Is Acushnet Holdings' (NYSE:GOLF) Share Price Gain Of 120% Well Earned?

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Acushnet Holdings Corp. (NYSE:GOLF) share price has flown 120% in the last three years. How nice for those who held the stock! On top of that, the share price is up 28% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 18% in 90 days).

See our latest analysis for Acushnet Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last three years, Acushnet Holdings failed to grow earnings per share, which fell 11% (annualized).

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Therefore, we think it's worth considering other metrics as well.

Languishing at just 1.8%, we doubt the dividend is doing much to prop up the share price. Do you think that shareholders are buying for the 1.5% per annum revenue growth trend? We don't. So truth be told we can't see an easy explanation for the share price action, but perhaps you can...

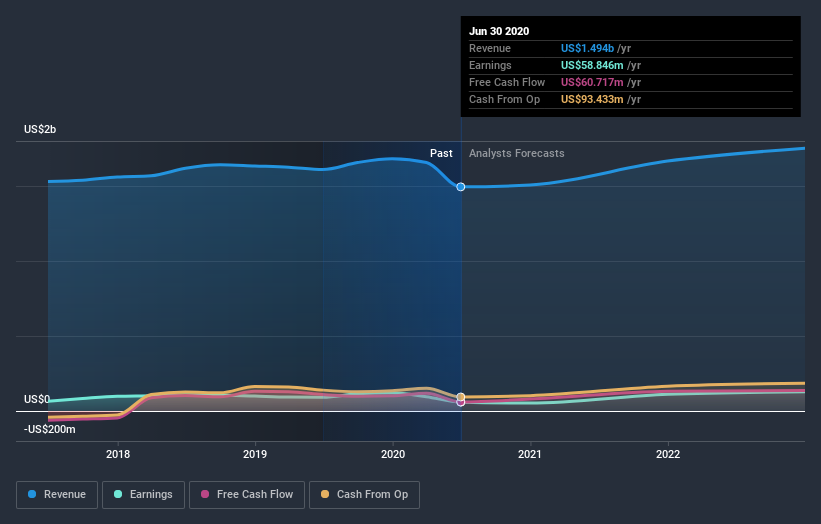

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Acushnet Holdings is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Acushnet Holdings in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Acushnet Holdings' TSR for the last 3 years was 136%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Acushnet Holdings shareholders have gained 43% (in total) over the last year. And yes, that does include the dividend. That's better than the annualized TSR of 33% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Acushnet Holdings (1 shouldn't be ignored) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.