Albemarle (ALB) Stock Up 25% in 3 Months: What's Driving It?

Albemarle Corporation’s ALB shares have popped 24.9% over the past three months. The company has also outperformed its industry’s rise of 19.1% to over the same time frame.

Albemarle, a Zacks Rank #3 (Hold) stock, has a market cap of roughly $10.1 billion and average volume of shares traded in the last three months is around 1,070.6K. The company has an expected long-term earnings per share growth rate of 8%, above the industry average of 7%.

Let’s delve deeper into the factors behind the stock’s price appreciation.

What’s Aiding ALB?

Albemarle is benefiting from its cost reduction and productivity improvement actions. Forecast-topping earnings performance in the second quarter of 2020 has also contributed to the gain in the company's shares. Its adjusted earnings for the second quarter of 86 cents per share topped the Zacks Consensus Estimate of 72 cents. While the company faced headwinds from weak lithium pricing and demand weakness due to the impacts of the coronavirus pandemic, it gained from its cost-saving and efficiency improvement initiatives in the quarter.

Notably, Albemarle beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters, the average being 9.7%.

The company is accelerating its $100 million cost-saving program. It expects to realize $50-$70 million of savings this year. The company is also implementing short-term cash management actions which is expected to deliver $25-$40 million of savings per quarter. Its cost actions are expected to support margins in 2020.

Albemarle is also strategically executing its projects aimed at boosting its global lithium derivative capacity. It remains focused on investing in high-return projects to drive productivity. The company is well placed to gain from long-term growth in the battery-grade lithium market.

Moreover, Albemarle remains committed to deliver incremental returns to its shareholders. The company's board, earlier this year, raised its quarterly dividend by 5% to 38.5 cents per share. The hike marked the 26th straight year of dividend increase by the company. Albemarle remains focused on maintaining its dividend payout. The company also remains committed to maintain adequate financial flexibility with ample liquidity.

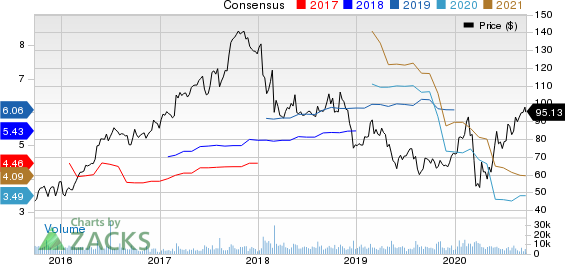

Albemarle Corporation Price and Consensus

Albemarle Corporation price-consensus-chart | Albemarle Corporation Quote

Stocks to Consider

Better-ranked stocks stocks worth considering in the basic materials space include AngloGold Ashanti Limited AU, Barrick Gold Corporation GOLD and Pretium Resources Inc. PVG.

AngloGold Ashanti has a projected earnings growth rate of 124.2% for the current year. The company’s shares have gained roughly 27% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Barrick Gold has a projected earnings growth rate of 80.4% for the current year. The company’s shares have rallied around 52% in a year. It currently has a Zacks Rank #2 (Buy).

Pretium Resources has an expected earnings growth rate of 20% for the current year. The company’s shares have gained around 7% in the past year. It currently carries a Zacks Rank #2.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pretium Resources, Inc. (PVG) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

AngloGold Ashanti Limited (AU) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research