Alberta Ballet trying to recover from financial misstep

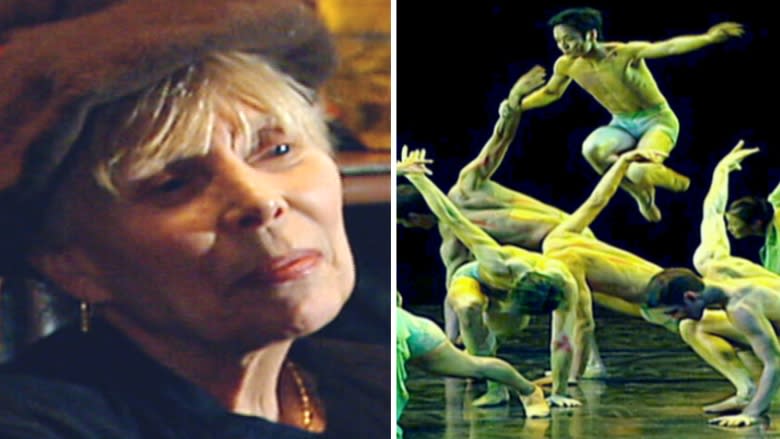

Alberta Ballet is struggling to recover from a financial stumble that started three years ago with a canceled Joni Mitchell ballet.

Since then the company has slid into a substantial deficit, been forced to borrow to cover shortfalls and is now pre-spending a rising proportion of money raised against future productions before it ever mounts those performances.

It's a problem that has led to staff cuts, fewer dancers on shorter contracts and a big fundraising campaign.

The ballet ran an accumulated deficit in 2014-15 of close to half a million dollars on a budget of about $14 million.

The larger worry though is the so-called pre-spend, in which a portion of the coming year's subscriptions are used to cover the current year's spending. In 2014-2015, the pre-spend hit $2.9-million.

Pre-spending next year's revenues

Chris George, the company's executive director, said he can't yet give a figure for the pre-spend in the last financial year that ended June 30.

But he said the company borrowed to cover a shortfall through the year — with a bank line of credit and a loan from the Alberta Foundation for the Arts — and paid the debt back before year end with revenue raised primarily through subscription sales for the 2016-17 season.

"The ideal model is that you don't spend any of that deferred revenue that comes in until the actual season," George told CBC News.

Pre-spending is not unusual in the ballet world, but George confirmed the size of that spending at Alberta Ballet is now uncomfortably high, particularly in a recession, where he says both donations from individuals and corporate sponsorship revenue are falling.

So too are annual ticket subscriptions, he expects, though individual ticket sales are still projected to strengthen.

Financial slip

In previous years, Alberta's booming economy and rising revenue from other sources have helped shield against gaping deficits, but that tide has now decisively turned.

George says he has been wrestling with the problem since he took the reins late last year as interim executive director. He took the role permanently just a few months ago.

The difficulties began in 2013.

On the heels of a series of successful pop productions the ballet was working for a second time with singer Joni Mitchell, working to stage a production based on her love songs.

But the result was a meditation on loss.

$1M loss in ticket sales

Martin Bragg, executive director of the company at the time, recalls that Mitchell wouldn't whittle her songbook below 46 songs, which was too large for a single ballet.

The planned production was cancelled and ticket sales reimbursed.

"That left a Joni Mitchell shaped hole [in finances]" Bragg says.

"I'd say that cost us about a million dollars ... in single ticket sales that were budgeted for but were then lost."

That year the pre-spend jumped to $3.1 million from $1.6 million the year before.

It hasn't recovered since.

Rising costs

The loss of the Mitchell production coincided with rising costs elsewhere in the company.

Historically the ballet employed dancers on 36-week contracts.

In the 2013-14 season, the company expanded that to 42 weeks.

Bragg says the move was aimed at showcasing Alberta Ballet's own dancers — rather than those brought in with guest productions — and attracting the best talent.

But it was also a expensive departure from the norm for the company.

Bragg resigned last summer and moved on to a job as senior vice president at Arts Consulting Group in Calgary. He says his resignation was not tied to the organization's financial difficulties.

Staff changes

"I'd been there five years. It was time," Bragg said.

Former ballet chair Dawn McDonald also presided over the period of deteriorating finances. She resigned the volunteer post in April.

McDonald declined an interview request.

Larry Clausen replaced her.

He's a brand and crisis communications expert with Cohn & Wolfe and has a decades-long association with the ballet.

The recession

The ballet was slow to pare costs in the face of losses but it had plenty of company in failing to anticipate the looming recession and how deeply it would bite.

The 2014-2015 season was characterized by an oil price rout. Alberta-based companies cut expectations and slashed staff and other expenses.

By early 2015, a range of arts organizations were feeling the pinch.

Roughly half the ballet's budget is based on donations and sponsorship by individuals and corporations.

The company lost several of its corporate sponsors and, George says, more significantly is that donations across the board have fallen heavily — though he couldn't say by how much.

The turnaround

Last October as it became clear that escalating costs would find no counterbalance in rising revenue Alberta Ballet hired turnaround consultants Finley & Associates.

They are the same group that helped revive the bankrupt Calgary Philharmonic Orchestra more than a decade ago.

Early this year it cut administrative staff in marketing and fundraising. In other areas, including the box office, it's outsourcing to the Arts Commons.

They are a group of mostly performing arts organizations that share back office expenses.

Attrition among dancers — including the retirement of lead dancer Yukichi Hattori — means the company will be reduced to 26 dancers and two apprentices in the upcoming season.

That's down from 31 dancers last season and labour contracts are back down to 36 weeks in the upcoming season.

Recapitalization campaign

On the revenue side the company launched a recapitalization campaign aiming to raise $1 million this year.

Money, George says, that would go directly toward reducing pre-spending.

It's an audacious effort even as giving overall is falling. George says the campaign has entailed very personal requests, "meeting long-time supporters for dinner, if that's what's required, it's been very individual."

He says it's already raised $420,000 though that will be offset by consultant fees.

It's also meant preliminary work to develop a new home for both the company and its school will have to stay on the back burner and wait for better times.