Analog Devices (ADI) Q1 Earnings Beat, Revenues Down Y/Y

Analog Devices Inc. ADI reported first-quarter fiscal 2020 adjusted earnings of $1.03 per share, beating the Zacks Consensus Estimate by 3%. However, the bottom line decreased 22.6% year over year and 13.4% sequentially.

Revenues of $1.304 billion surpassed the Zacks Consensus Estimate of $1.301 billion. However, the top line declined 15% year over year and 9.6% from the fiscal fourth quarter.

This downside can be attributed to weak performance of the company in all the end-markets served. Moreover, the top line was negatively impacted by macroeconomic headwinds.

Nevertheless, Analog Devices’ deepening focus on efficient capital deployment and executing customer-centric approach remains a positive. Additionally, the company expects stabilization in the end-market demand in second-quarter fiscal 2020.

Revenues by End Markets

Industrial: The company generated revenues of $744.1 million (accounting for 52% of total revenues), which was flat year over year.

Communications: Revenues from this market came in at $260.1 million (18% of revenues), decreasing 19% year over year.

Automotive: Revenues from this market came in at $226.1 million (16% of revenues), down 8% from the year-ago quarter.

Consumer: This market generated revenues of $212.8 million (15% of revenues), reflecting a decline of 7% on a year-over-year basis.

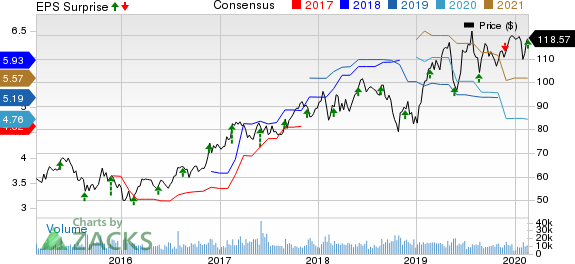

Analog Devices, Inc. Price, Consensus and EPS Surprise

Analog Devices, Inc. price-consensus-eps-surprise-chart | Analog Devices, Inc. Quote

Operating Details

Non-GAAP gross margin contracted 180 basis points (bps) on a year-over-year basis to 68.5%.

As a percentage of revenues, adjusted operating expenses were 31.6%, expanding 250 bps from the year-ago quarter.

Non-GAAP operating margin contracted 430 bps on a year-over-year basis to 36.9% during the reported quarter.

Balance Sheet & Cash Flow

As of Feb 1, 2020, cash and cash equivalents were $654.4 million, up from $648.3 million as of Nov 2, 2019.

Long-term debt was approximately $4.7 billion, down from $5.2 billion in the prior quarter.

Net cash provided by operations was $349.6 million in the fiscal first quarter, down from $658 million in the prior quarter.

The company generated $294.8 million of free cash flow during the fiscal first quarter.

Additionally, Analog Devices returned $300 million to shareholders through dividends and share repurchases in the reported quarter.

Guidance

For second-quarter fiscal 2020, Analog Devices expects revenues to be $1.35 billion (+/- $50 million). The Zacks Consensus Estimate for the same is pegged at $1.38 billion.

Outbreak of coronavirus remains a concern for the company.

Non-GAAP earnings are expected to be $1.10 (+/- $0.08) per share. The consensus mark for the same is pegged at $1.13 per share.

The company anticipates non-GAAP operating margins to be approximately 37.5% (+/- 100 bps).

Zacks Rank & Key Picks

Analog Devices currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are Itron, Inc. ITRI, NetEase, Inc. NTES and Five9, Inc. FIVN. All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth rate for Itron, NetEase and Five9 is currently pegged at 25%, 41.99% and 10%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Itron, Inc. (ITRI) : Free Stock Analysis Report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Five9, Inc. (FIVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research