UK electric vehicle company Arrival set for $5.4bn Nasdaq listing

A British startup building electric vans and buses has announced plans to go public in New York through a deal with a so-called “blank cheque” company on the Nasdaq (^IXIC).

Arrival said on Wednesday it had reached a deal to merge with CIIG Merger Corp. (CIIC), one of the many “special purpose acquisition companies” — or SPACs — that have proliferated in the US over the last 12 months. SPACs are shell companies, also known as “blank cheque” companies, that are capitalised and looking for deals to acquire businesses as a means to help them go public.

Arrival will be valued at $5.4bn (£4bn) once the transaction closes, the company said in a statement. The startup will raise $660m through the deal. CIIG has tapped investors Fidelity, Wellington, and BNP Paribas (BNP.PA) for an additional $400m to help fund the transaction.

READ MORE: UK plans to ban new petrol and diesel vehicles by 2030

Founded in 2015, Arrival builds electric vehicles from the ground up rather than re-engineering existing buses and vans to fit electric engines. The company has designed its own sustainable and cheap material to construct vehicles from and does so in “micro-factories” that can be set up cheaply in cities around the world.

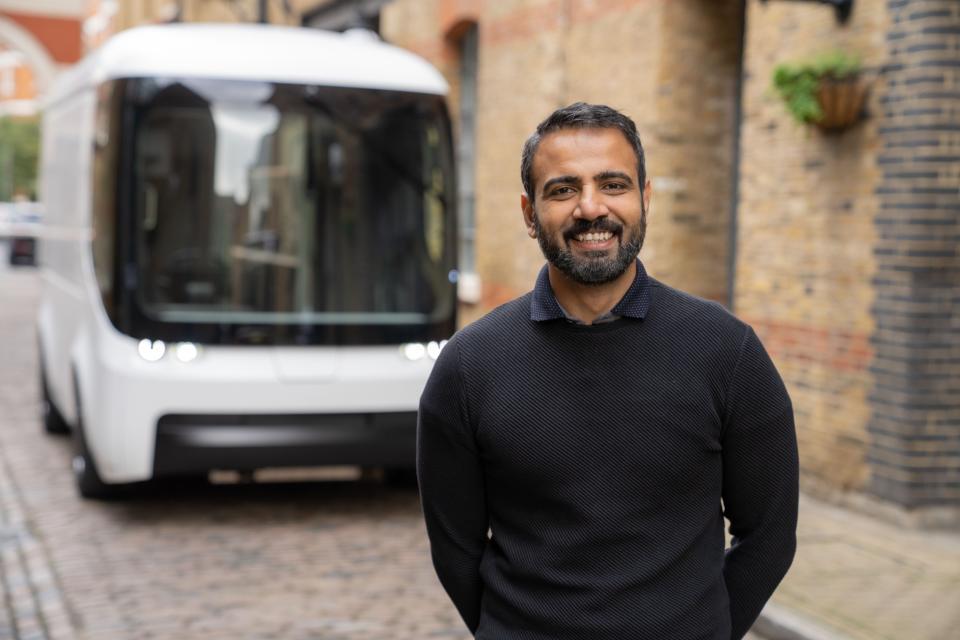

“We envision any large city that will have urban transportation... We can have a factory there,” Avinash Rugoobur, Arrival’s president and chief strategy officer, told Yahoo Finance UK. “That’s a real change in the way the industry operates.

“In the automotive industry, you normally have to build hundreds of thousands of vehicles to be able to have any decent margins on the product. We’re able to create micro-factories that are around 20,000 square meters and capex (capital expenditure) of under $50m. One micro-factory can produce 10,000 vans or 1,000 buses.”

Rugoobur is a veteran of the automotive industry with an engineering background. He helped GM (GM) buy self-driving car startup Cruise in 2016 and became the division’s chief of strategy. Other members of the Arrival executive team are veterans of the auto and telecoms industry.

Arrival’s vehicles are currently being tested on the roads in the UK but the company plans to start commercial production next year.

“Our technology is mature and we’re at the stage now where we’re looking to start production in 2021,” Rugoobur said.

Funds gained through the SPAC transaction will be used to scale up production, with plans to open three to four micro-factories a year.

READ MORE: Germany to extend grants on e-cars until 2025

Arrival already has a facility in Bicester, England, and has announced plans to build another in Rock Hill, South Carolina.

UPS (UPS) is an “anchor customer” and has signed a deal to buy up to 10,000 of Arrival’s vans when commercial production begins. UPS has been working with Arrival since 2016 and is also an investor.

Rugoobur said Arrival is in “late stage sales discussions with a variety of different players both for our bus and van.” He said the company was getting a lot of interest from “e-commerce players and logistics players” and said the pitch was a “no-brainer” given Arrival’s vehicles are a similar price to diesel vans and cheaper to run. Arrival has signed contracts worth $1.2bn for its vehicles so far.

Arrival has raised over $200m from investors to date, from backers including BlackRock (BLK), Hyundai (005380.KS), and Kia.

Rugoobur said the SPAC deal came about after conversations with management at CIIG, which listed on the Nasdaq in November 2019.

“When we started talking to CIIG, we found in them a partner that was looking to be part of the mission... and they also provide things that aid and help Arrival grow,” Rugoobur said. “We’ve got the technology... they’ve got the experience on public and private companies and on brand building.”

CIIG’s chairman and chief executive Peter Cuneo will become non-executive chairman of Arrival after the transaction closes. Cuneo is a turnaround specialist who previously ran Black & Decker, Remington, and Marvel Comics, reviving its fortunes in the 2000s before its sale to Disney (DIS).

London-based Arrival’s decision to list in New York is a blow for the UK, which has long struggled to retain home-grown technology businesses once they reach stock market size.

READ MORE: Bolt plans Europe expansion with e-scooter and e-bikes push in 100 cities

Tech businesses typically get a warmer reception in the US, with higher valuations. Rugoobur said this influenced the decision but was not a “driving factor.”

“The understanding of the future of EVs in the US is really strong,” he said. “A lot of investors have already recognised that that is the shift. There’s no going back — we’re passed that point.”

Rugoobur said Arrival was committed to the UK, where it employs 1,300 people, despite the listing.

“UK, we’re still headquartered here, we still have huge growth potential here, we’re still hiring here, and we have massive opportunities, but our partner was in the US and it made sense also to get a strong foothold in the US and grow our base and revenue opportunity there as well,” he said.

The deal with CIIG is expected to complete in the first quarter of 2021. Arrival will trade under the ticker ARVL.

WATCH: What does a Joe Biden presidency mean for the global economy?