The best Canadian cities for single people to buy a home

Today is National Single’s Awareness day — something of a celebration for people that dodged Cupid’s arrow on Valentine’s Day, the day before. In honour of the occasion, Zoocasa crunched the numbers and found the few remaining pockets of the country single people can afford to buy a home and still have money left over.

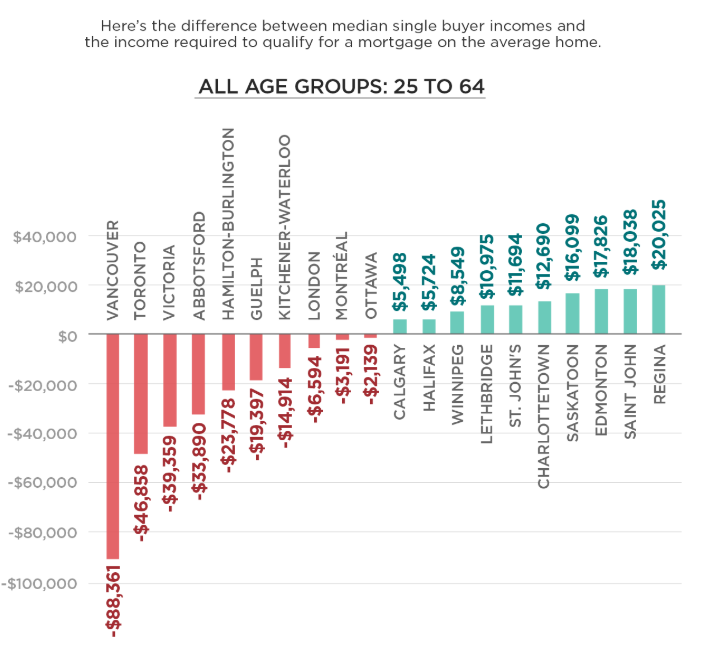

Zoocasa looked through prices and assumed the buyer would have enough saved up for a 20 per cent down payment and get a 30-year mortgage with a 3.29 per cent interest rate. The formula determines the minimum income required to qualify for a mortgage on the average home — which was then compared to the median income of people living alone.

Atlantic Canada and the Prairies came out on top as being the most affordable. Regina took the top spot out of 20 cities for affordability.

“There, a single buyer earning the median income of $58,823 would enjoy an income surplus of $20,025 on the average-priced home of $284,424”, says Penelope Graham.

“That’s followed by Saint John, where someone earning the median of $42,888 would see a surplus of $18,038 on a $181,576 home, and Edmonton, where earning $64,036 would net a $17,826 surplus on the average home price of $338,760,” says Graham.

Graham says Lethbridge, Winnipeg, and Halifax are also relatively affordable options.

Not surprisingly — British Columbia and Ontario’s Greater Golden Horseshoe area are the most out of reach.

“A buyer earning the median of $50,721 would fall a whopping $88,361 short on the average $1,019,600 for MLS listings in Vancouver,” says Graham.

“Toronto real estate listings are the second-least affordable with an average home price of $748,328; a buyer earning $55,221 would face an income gap of $46,858.”

Victoria is the third most unaffordable city for singles. Others in the category include Guelph, Kitchener-Waterloo, London, Montreal, and Ottawa.

Also not surprisingly — single millennials have the least purchasing power.

“Overall, single home buyers aged 35 – 44 purchasing a home in Regina enjoyed the greatest affordability of all, with an income surplus of $24,215. A millennial purchasing in Vancouver had the least, facing a gap of $92,774,” says Graham.

Download the Yahoo Finance app, available for Apple and Android.