Bitcoin price – live: BTC surges to new five-month high, as Elon Musk spurs on dogecoin

The price of bitcoin has risen to a new five-month high on Thursday, building on massive gains made since the start of October.

The rally was spurred on by positive news in the crypto space, pushing BTC up by more than a third since the start of the month.

Other leading cryptocurrencies have also seen significant price rises, with Ethereum (ether), Binance Coin, Cardano (ada) and Ripple (XRP) all increasing in value by between 4-6 per cent over the last 24 hours.

Dogecoin also shot up by nearly 10 per cent after Elon Musk once again tweeted his support for it. These price increases have pushed the overall crypto market cap above $2.37 trillion, overtaking the world’s most valuable company.

The recent surge has reinforced the beliefs of some crypto analysts, who predicted earlier this year that new record highs would be seen before the end of 2021.

We’ll have all the latest news, analysis and expert price predictions right here.

Read More

Key points

Crypto market value overtakes Apple

Bitcoin advocates share ‘best trading strategy'

Dogecoin price spikes after Elon Musk tweets

15:04 , Anthony Cuthbertson

Elon Musk has once again sent the price of dogecoin soaring after trading tweets with the cryptocurrency’s founder, Billy Markus.

The meme-inspired crypto shot up nearly 10 per cent after Musk replied with the ‘100’ emoji after Markus tweeted, “if you don’t run a dogecoin node, you are satan”.

The centibillionaire also posted a crying face emoji to a meme posted by Markus, inspired by hit Netflix show Squid Game.

🤣

— Elon Musk (@elonmusk) October 14, 2021

As the richest person in the world, Musk revealed earlier this year that beyond Tesla stock and his share of ownership in SpaceX, cryptocurrency is the only thing of significant value that he owns.

The only ones he has admitted to personally owning are bitcoin, Ethereum (ether) and, you guessed it, dogecoin.

How bitcoin and crypto market stack up

13:28 , Anthony Cuthbertson

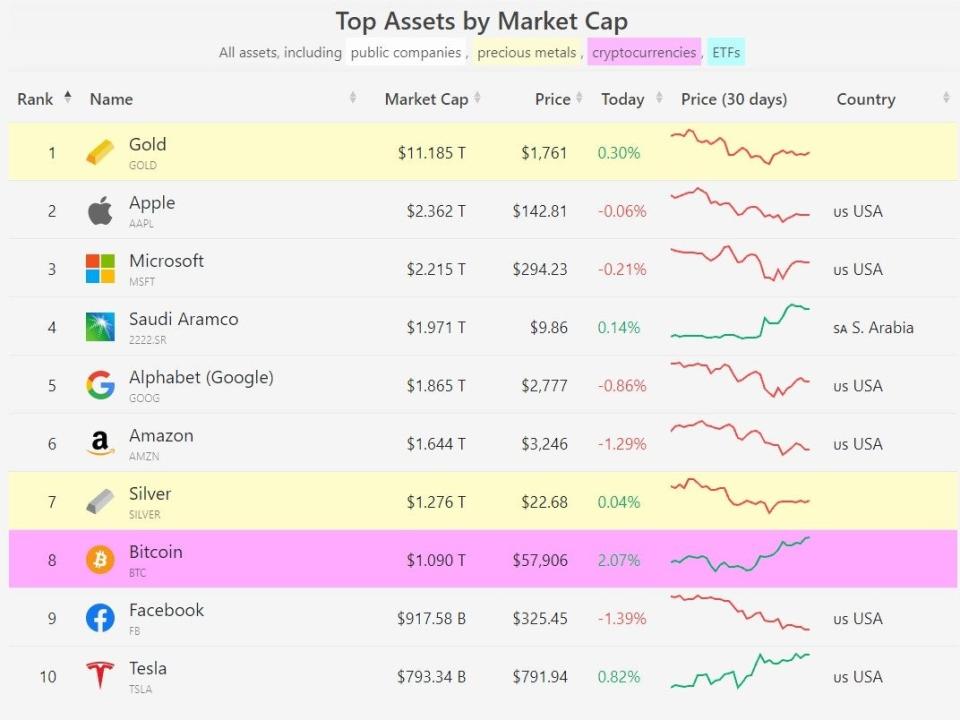

After overtaking the market value of Apple today, we put this chart together to see how the cryptocurrency market stacks up against the top 10 leading assets.

Accounting for nearly half of the global crypto market cap, bitcoin ranks above Facebook, Tesla and Berkshire Hathaway in the top 10.

No included on this chart are precious metals, but if they were gold would be way out in front with a market cap of more than $11 trillion. Silver would also rank 7th on the list, just ahead of bitcoin with a market cap of $1.31 trillion.

Crypto market value overtakes Apple

12:01 , Anthony Cuthbertson

The cryptocurrency market is now worth more than the world’s most valuable company.

Bitcoin’s price surge, combined with gains from Ethereum (ether), Cardano (ada) and Ripple (XRP) over the last few hours has pushed the overall crypto market cap up by 5 per cent.

This puts it at $2.37 trillion - roughly $40 billion more than Apple.

Bitcoin alone is now closing in on the market cap of silver, with analysts making comparisons to the astonishing price increase that it experienced in 2013.

You can read the full story here.

Bitcoin price rally sees crypto market overtake world’s most valuable company

Bitcoin price shoots up as ‘institutional investors return'

08:51 , Anthony Cuthbertson

Bitcoin is once again on the ascendency, hitting a fresh five-month high on Thursday morning after a brief moment of price consolidation in the middle of the week.

The overall crypto market has also shot up, with an increase in value of around 5 per cent since this time yesterday. That equates to more than $100 billion.

We’ve heard from the UK head of the Luno cryptocurrency exchange this morning, who offers his thoughts on why bitcoin and other leading cryptocurrencies are surging.

The rising expectations for a bitcoin ETF shown by rising open interest, and growing basis premiums for CME’s futures may be a cause of the bullish momentum. CME’s share of the global open interest in the bitcoin futures also reached 17 per cent this week – the highest level recorded since February 2021 suggesting institutional traders have returned to bitcoin.

Sam Kopelman, Luno

Bitcoin price slides but Binance Coin skyrockets

Wednesday 13 October 2021 11:24 , Anthony Cuthbertson

The price of bitcoin has now slipped below $55,000, though other leading cryptocurrencies are seeing a major resurgence.

Binance Coin is now up more than 16 per cent since this time yesterday, while Polkadot and Uniswap are both up by more than 7 per cent.

The latest gains have pushed Binance Coin’s price above $450 – less than $200 away from its all-time high – and means its market cap is now close to $80 billion.

The reason for the price surge appears to be the introduction of a $1 billion fund that Binance claims will be “the biggest growth fund in the history or crypto”.

US overtakes China for bitcoin mining

Wednesday 13 October 2021 09:51 , Anthony Cuthbertson

For the first time ever, the US has overtaken China to become the top destination for bitcoin miners.

New data from the Cambridge Centre for Alternative Finance shows that one third of bitcoin’s hashrate is now in the US, following a 428 per cent increase since September 2020.

The shift comes after China’s massive crackdown on mining operations in the country, which wiped out roughly half of all bitcoin miners.

Cheap energy and vast renewable power sources has made the US an attractive destination for miners, though it still doesn’t command the same dominance in the sector as China once did. Analysts see the spreading out of market share as a major positive for bitcoin and should ultimately reduce big price fluctuations as no single country can have a significant impact on the sector through introducing new legislation.

Bitcoin advocates share long-term trading strategy

Wednesday 13 October 2021 07:15 , Anthony Cuthbertson

Two of the most high-profile bitcoin advocates have offered their advice on cryptocurrency trading.

MicroStrategy CEO Michael Saylor, who has ploughed billions of the company’s cash reserves into bitcoin, and Binance CEO Changpeng Zhao (CZ) have both said they do not look at short-term price swings.

Instead, CZ advises to “focus on the long term”, while Saylor says “the best strategy is to buy bitcoin and wait”. It seems to have worked for him so far, with MicroStrategy more than doubling the $3.16 billion that it has invested into bitcoin.

Trading #Bitcoin is like trading Apple, Amazon, Google, or Facebook a decade ago. The more you obsess over timing the market, the more mistakes you make. They were all technology networks that were dominant & destined to grow. The best strategy is to buy bitcoin and wait. https://t.co/D3XiQ2B71R

— Michael Saylor⚡️ (@saylor) October 12, 2021

Altcoins surge as bitcoin price stalls

Wednesday 13 October 2021 06:55 , Anthony Cuthbertson

Bitcoin’s steady price gains since the start of the week appear to be on hold, as it remains below $56,000 on Wednesday morning.

Making up for the lack of movement are several leading cryptocurrencies that have surged in price overnight.

Binance Coin is up 8 per cent, while Solana and Polkadot are both up by around 3 per cent. Bitcoin’s slight dip in price, combined with these altcoin gains, mean the overall crypto market has moved by less than a third of a per cent since this time yesterday.

Bitcoin price dips but remains up by 10%

Tuesday 12 October 2021 19:11 , Anthony Cuthbertson

The price of bitcoin has dipped slightly over the last few hours, falling from above $57,000 to below $56,000.

Despite the losses, BTC remains up by more than 10 per cent week-on-week, and remains within a relatively tight trading window that has proved remarkably stable since the sudden surge at the start of October. Bitcoin’s market cap also remains above $1 trillion, though the overall crypto market cap has fallen by just over 2 per cent to $2.29 trillion over the last 24 hours.

Here’s how the price chart looks for the last seven days, courtesy of CoinMarketCap.

Bitcoin price actually benefits from Chinese crackdown, expert claims

Tuesday 12 October 2021 13:27 , Anthony Cuthbertson

After bitcoin hit an all-time high of just above $64,000 in mid April, the cryptocurrency suffered one of the most devastating price crashes in its history that took it below $30,000.

One of the leading causes was China’s crackdown on cryptocurrency, which forced miners - which made up more than 70 per cent of the network - to close operations and move out of the country. But while this had a negative impact on bitcoin’s price in the short term, some crypto experts believe it will actually be beneficial in the long run.

“Periodic ‘shock-tests’ seem to only make bitcoin grow stronger,” Paolo Ardoino, chief technology officer of the exchange Bitfinex, tells The Independent.

“The hashrate is recovering to reach a near all-time high in the wake of the China ban... We see the king of crypto is once again showing its resilience. In the case of any ban or restrictions on bitcoin, there will always be someone left to fill the void. We expect to see others step up as China’s power diminishes. This is a true testament to the far reach and resilience of the industry.”

Five countries will accept bitcoin as legal tender in 2022, crypto boss predicts

Tuesday 12 October 2021 11:27 , Anthony Cuthbertson

Following El Salvador’s pioneering Bitcoin Law, which made the cryptocurrency legal tender in the Central American country last month, there has been a lot of speculation over which countries might follow suit.

A bold new prediction has just come from Alex Hoeptner, the CEO of cryptocurrency exchange Bitmex, who believes that at least five countries will adopt bitcoin by the end of next year.

Hoeptner says “all of them will be developing countries,” citing remittance fees, inflation and politics as the three main factors driving the adoption.

“Over the next year, and as El Salvador works out the kinks in its rollout, savvy politicians will be thinking of how they can take a similar path, and how it might benefit both them and their constituents,” he said. “What El Salvador did is take the first leap of faith, making similar moves by other countries much easier to consider.”

JPMorgan’s Jamie Dimon says bitcoin is ‘worthless’, exposing stark lack of knowledge

Tuesday 12 October 2021 09:57 , Anthony Cuthbertson

JPMorgan CEO Jamie Dimon has said he believes bitcoin is “worthless”, while also revealing that his clients disagree.

He said that JPMorgan will provide customers “as-clean-as-possible access” to bitcoin, saying that his personal opinion on the world’s most valuable cryptocurrency is irrelevant when there is such strong demand for it.

It is not the first time the controversial CEO has spoken out against bitcoin, though his latest comments have revealed a fundamental misunderstanding about the cryptocurrency. He questioned whether bitcoin’s fixed supply - no more than 21 million coins will ever exist - will magically increase in the future, asking: “How do you know it ends at 21 million? You all read the algorithms? You guys all believe that? I don’t know, I’ve always been a skeptic of stuff like that?”

If he bothered to “read the algorithms” himself, he would realise that it is just five lines of code that limit bitcoin’s supply.

Five lines of code that results in 21m #Bitcoin pic.twitter.com/Isx8CTYMe0

— Bitcoin (@Bitcoin) October 12, 2021

Bitcoin ETF speculation pushing price up?

Tuesday 12 October 2021 09:31 , Anthony Cuthbertson

Widely reported speculation that the US Securities and Exchange Commission (SEC) is interested in four separate bitcoin exchange-traded funds (ETF) is being cited as one of the driving factors behind the cryptocurrency’s astonishing price rise since the start of October.

We’ve heard from Konstantin Anissimov, executive director of the crypto exchange CEX.IO, who says the rumours are just one of several factors pushing bitcoin’s price higher.

Here’s what he had to say:

There are a few reasons why bitcoin is currently experiencing a bullish surge.October has been a good month for crypto investors. El Salvador’s move to adopt bitcoin as legal tender has been seen in a positive light.El Salvador’s President, Nayib Bukele announced that they will use surplus funds from The Bitcoin Trust to build a veterinary hospital. The use of bitcoin for such a noble cause has surely played a role in public approval and a gain in price.Another reason for Bitcoin’s increase in value is JPMorgan’s recent note to investors - it said that the prized crypto asset seems to be a better hedge against inflation than gold. I believe the latest bitcoin rally is a direct result of inflation concerns and investors are using the cryptocurrency as a hedge against it. The US’s positive stance on cryptocurrencies in recent weeks is another contributing factor.The public sentiment is bullish at the moment and there appear to be no roadblocks in the near future. 2021 has been a topsy-turvy year for cryptocurrencies as is usually the case – we could be in for a good end to the year!

Konstantin Anissimov, CEX.IO

Mystery whale buys $1.6 billion of bitcoin

Tuesday 12 October 2021 07:58 , Anthony Cuthbertson

A mysterious investor, or group of investors, has placed an order to buy $1.6 billion worth of bitcoin on a cryptocurrency exchange.

Such a large volume trade has inevitably contributed to bitcoin’s price surge, pushing it above $57,000 for the first time since May.

Ki Young, a crypto analyst and CEO of on-chain data firm CryptoQuant, speculated that traders may be taking on large positions ahead of a rumoured approval by the US Securities and Exchange Commission of a futures-based bitcoin exchange-traded fund (ETF). This kind of announcement would be huge for bitcoin, and would almost certainly lead to fresh new price highs.

Bitcoin price closing in on ATH as crypto market closes in on Apple

Tuesday 12 October 2021 07:51 , Anthony Cuthbertson

Bitcoin has risen by nearly a third in value since the start of the month, with the price gains pushing the overall crypto market cap above the value of tech giants like Amazon, Alphabet (Google) and Microsoft.

The cryptocurrency market is currently worth $2.32 trillion, meaning only Apple is worth more at $2.36 trillion.

The market value of bitcoin alone is more than $1 trillion, meaning one more price rally could push it above silver. Some analysts and investors, such as MicroStrategy’s Michael Saylor, believe the world’s most valuable cryptocurrency will one day “flip” gold, due to its inbuilt scarcity. That would put the price of a single bitcoin at around half a million dollars.

Hello and welcome...

Tuesday 12 October 2021 07:35 , Anthony Cuthbertson

to The Independent’s live coverage of the crypto market. With another bull run seemingly underway, we’ll have all the latest news, updates and analysis throughout the week for bitcoin, Ethereum (ether) and other leading cryptocurrencies.

We’ll also be bringing you expert price predictions, as well as seeking to answer the question of whether we really are set to see a new all-time high for bitcoin within the next 10 weeks. It’s currently less than $7,000 away from hitting a new record, with its notorious volatility meaning such a jump could be achieved in just a few hours - though such a significant price move could also go the other way.