A bitter brew: Aluminum can shortage, Trump tariff hit beer makers

New Brunswick beer makers large and small are feeling tapped out since the price for aluminum cans went up.

Two factors, blended together, have created price increases that directly target Canadian brewers.

Stephen Dixon, president of Grimross Brewing in Fredericton, says the mixture is a bitter drink to swallow.

"It's enough that it's painful," Dixon said by phone Wednesday.

First is the 10 per cent tariff on aluminum placed on Canadian exports to the U.S. by the Trump administration earlier this summer.

Canada has retaliated with a dollar-for-dollar counter tariff.

Second, a North American shortage of aluminum cans, which already existed, has jacked up the price further.

'More than a couple cents'

Overall, Dixon said, the tariff adds "more than a couple cents" to the cost of each of his beers — which adds up if you're canning about 30,000 beverages a month, as Grimross does.

The company buys and brings in cans by the truckload from a supplier, often 156,000 at a time, and the tariff is now approximately six per cent of the total cost, Dixon said.

But what's hurting more than the tariff is the can shortage.

"Every time we go without cans for a period of time, we're not putting beer in those cans, so we're not making money with those cans," Dixon said. "That's very significant for us."

Wes Ward of Graystone Brewing in Fredericton said his brewery only began canning its flagship Patagonia Pale Ale, earlier this month.

"I'm concerned," he said. "If it continues to increase, we're going to end up absorbing the cost to a certain extent before we pass it along to the consumer. For now we will not be passing it along."

'Perfect storm'

Both breweries' beer, in part, is canned by Craft Coast Canning, a company that serves many of the small and medium-sized breweries in New Brunswick, Nova Scotia and Prince Edward Island.

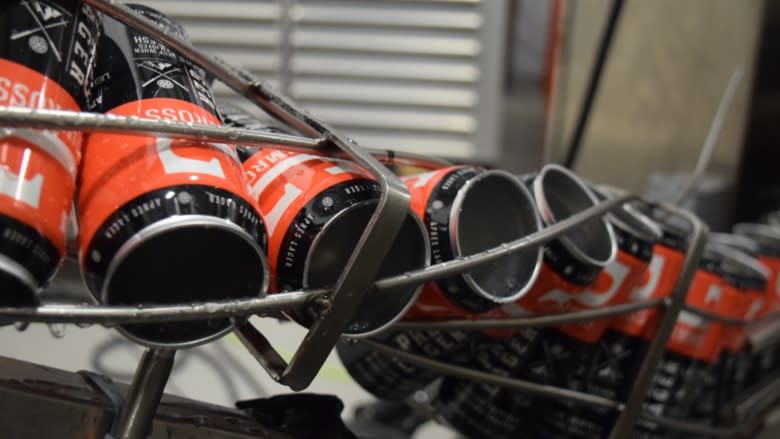

With its portable canning assembly line, it allowed Grimross to go from canning five beer a minute to 30.

Although Grimross supplies its own cans, Craft Coast also provides aluminum cans for some clients, using the clout of the micro breweries collectively to purchase in bulk.

"We distribute those prices down," said company co-founder Melinda Ponting-Moore.

She said even more factors are driving up the price of aluminum right now.

Depending on where the supplier is, the raw material could be slapped by the tariff when it's exported from Canada and dinged by the counter tariff as it's imported back into the country, said Ponting-Moore.

Likewise, changes to the courier system have caused delays to the already-limited and taxed cans coming in.

"It really is the perfect storm," she said.

Affects ability to grow

Her company hasn't been hit too hard financially, though. She said she's been able to secure prices for the orders it had in anticipation of a trade war.

But the perfect storm has hindered Craft Coast's ability to grow, "to take on new customers and to make deliveries outside of our current order when the tariffs came in."

The company has had to secure new suppliers to take on new clients.

"It's slowed us down for sure," said James Ponting, Craft Coast Canning's other founder and Melinda's husband.

"Prices are up and I expect what people are going to see in the liquor stores in the next three, six months is cans of beer will cost five cents more, 10 cents more."

Moosehead makes change

Grand Bay-Westfield resident Troy Sprague Hay was disappointed when he was told by a New Brunswick Liquor Corp. clerk last week the store was out of his beloved Moosehead Radler in the can.

He was told Moosehead would "focus their aluminum on other products," Sprague Hay said.

"This is the first time a Trump policy has affected me personally."

While Moosehead did not grant an interview, Bill Gallagher, Moosehead's director of procurement, did email a statement to CBC News.

"I can confirm that Moosehead's primary can supplier is experiencing a shortage of 355 millilitre aluminum cans — an issue that is impacting North American breweries big and small," he said.

"We are assessing our inventory daily and are working diligently to minimize any potential impact. We are hopeful that the situation will be resolved by the end of this month."

Craft Coast Canning and Grimross hope the can shortage — caused by a major supplier overselling by an estimated 500 million cans, Ponting-Moore said — is soon rectified.

Uncertain long-term effect

But the Craft Coast Canning founders said they're uncertain when or if the tariffs will let up.

Ponting said the marketplace doesn't have much stability and involves people buying units where they can for whatever price they can afford.

"We don't know what the implications will be in the long term," Ponting-Moore said.

"We have a sense this will likely affect all our future orders in some way. We just don't really know what that's going to be. This isn't really a high margin business."

Dixon said so far his company has been able to absorb any increases without passing them along to consumers.

Customers like Sprague Hay will have to enjoy a competitor's product until his summer drink of choice returns to store shelves.

"No marches on Washington for my Moosehead Radlers," he said.