New Brunswick car insurance quotes can differ by more than $5,000

A controversial graph, issued by former Alberta premier and current opposition leader Rachel Notley, that showed New Brunswick with some of the highest car insurance rates in Canada is proving to be mostly erroneous, but it does hint at excessive costs that lurk in waiting for New Brunswick drivers who don't look hard for deals on their premiums.

In a tweet earlier this month meant to criticize car insurance prices in Alberta, Notley included a graph purporting to show the "median car insurance premiums" in each province.

In New Brunswick, the chart listed median prices to be $2,187 in 2022, 75 per cent higher than the lowest prices listed as belonging to Saskatchewan's public insurance system and worse than rates in four other provinces.

"This isn't right," Notley wrote about the rates in Alberta, which topped the list with the highest prices. "Why should it cost you more here than anywhere else in Canada?"

However, the chart was wrong on several points, including about New Brunswick where figures show auto insurance premiums are actually lower than four of the five provinces the graph claimed had better rates than New Brunswick, including Saskatchewan.

Those errors appear to have originated in a misreading of a report commissioned by the publicly owned Insurance Corporation of British Columbia and issued last October by the consulting firm Ernst & Young.

Canada's private insurance companies, which provide car insurance in six provinces, including Atlantic Canada, Ontario and Alberta, have attacked that report as inaccurate and designed to exaggerate the benefits of public insurance.

"Not surprisingly, the 'report' favours public over private insurance models," said Brett Weltman in an email to CBC News last week.

Weltman is the manager of media relations for the Insurance Bureau of Canada.

In the disputed study, Ernst & Young constructed 30 distinct driver profiles of men and women that included high and low risk drivers and those who are young, middle aged and older. Vehicles in the 30 case studies included new and used cars and trucks and, in three cases, motorcycles.

Ernst &Young then obtained insurance quotes for each customer profile in each province.

In New Brunswick, problems arose when only two and sometimes even one insurance quote was gathered for each customer profile in the four communities of Moncton, Saint John, Fredericton and Miramichi.

Insurance companies routinely quote prices to New Brunswick consumers that are among the worst in Canada and without a comprehensive search for the best price through multiple quotes, it is often difficult for New Brunswick drivers to find one that is reasonable.

In one profile in Moncton, Ernst & Young obtained two quotes for a 22-year-old to insure a two-door 2008 Honda Civic EX-L coupe. One came in at $2,968 and one for $4,134.

The quote from Saskatchewan's public insurer, SGI, was $1,471.

Ernst & Young did not disclose where its two quotes were from, but last Friday CBC News ran a similar search for a 24-year-old driver in Moncton to insure the same 2008 Honda Civic from the online site surex.com.

The quotes were $5,300 apart.

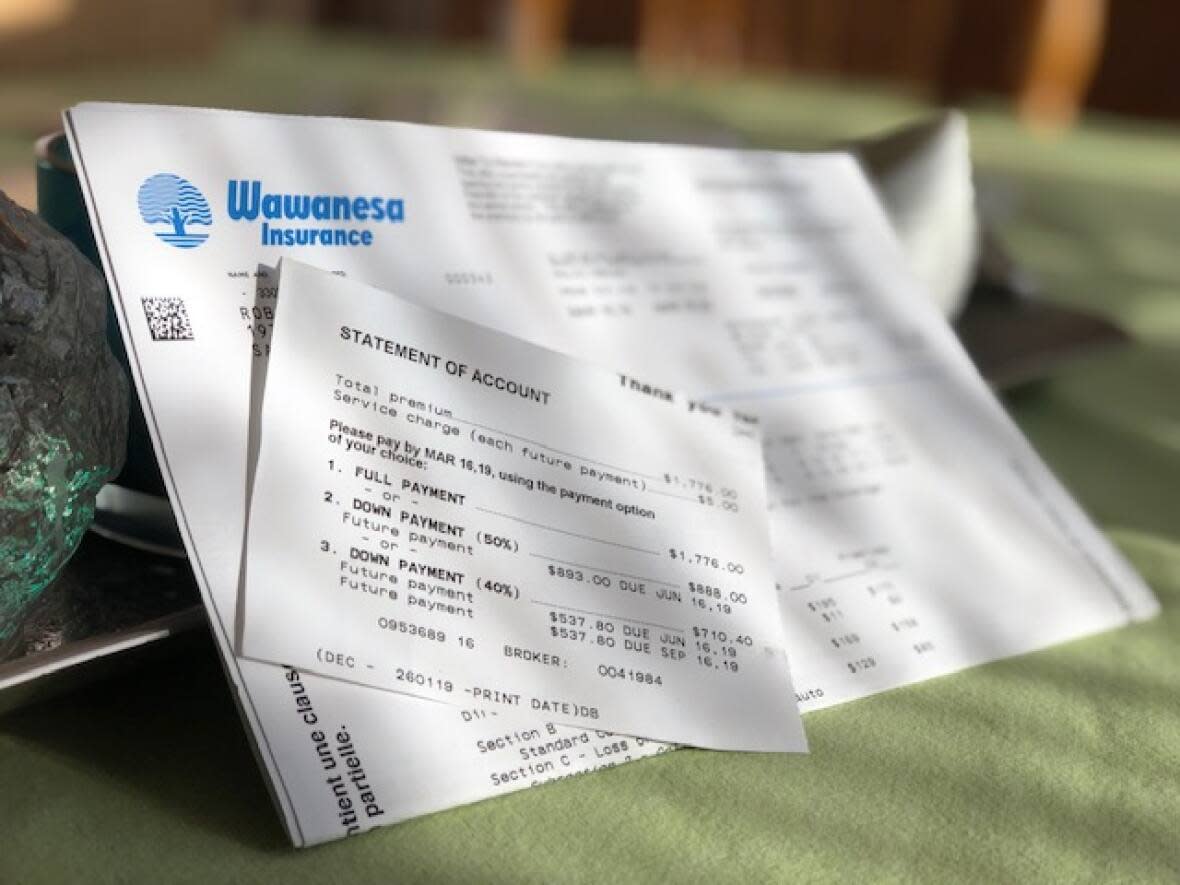

Eight offers came in, ranging from $1,597 from Economical Insurance to $6,898 from Wawanesa. Without finding the rate at Economical, the next best price available was $2,961.

Surex handles only a portion of the companies offering insurance in New Brunswick, and even the insurance industry acknowledges that consumers are likely to get stuck with high prices if they don't hunt for the best price.

Weltman said getting just one or two quotes online in a New Brunswick market, as Ernst & Young did, would almost certainly result in inflated premiums.

"The New Brunswick quotes were generated through an online quoting portal," said Weltman.

"Ernst & Young did not give licensed insurance brokers the opportunity to shop the market and present additional, more affordable quotes."

Ernst & Young did not create a "median car insurance premium" from the 30 customer profiles in its study, and it is not clear where the $2,187 median premium listed in Notley's graph originated.

However, according to the latest data published by the General Insurance Statistical Agency, insurance companies collected an average premium of $1,064 per insured passenger car in New Brunswick in 2021. It was the second lowest, behind Prince Edward Island, and about half the amount quoted in the graph one year later.

But that number also includes drivers who pay more than they would if they looked harder for a better deal.

"We recommend that drivers review their policy, shop around and ask their insurance representatives what they can do to help reduce their rates," wrote Weltman.