Budget 2017: Liberals spend on training and innovation while holding line on most taxes

The Liberal government has delivered a budget designed to brace Canadians for a fast-changing global economy and empower women in the workforce, while taking a wait-and-see approach to sweeping changes south of the border.

Budget 2017, titled Building a Strong Middle Class, offers targeted investments to tackle what it calls the "challenge of change." It offers little new spending, but fleshes out details on where dollars earmarked in last fall's economic update will be spent.

The budget delivers $1.18 billion this year on skills and innovation, nearly half of which has already been announced.

Other targeted programs for new investment range from child care and social housing to training for jobless youth, Indigenous people and other Canadians to adapt to the transforming economy.

But some of that money will not begin to flow for years down the road.

"We will continue to invest in our people, our communities, and our economy while maximizing every dollar and ensuring it is well spent," Finance Minister Bill Morneau said in the House of Commons.

His budget speech was delayed more than 30 minutes because of filibustering by the Conservatives over proposed changes to parliamentary procedures.

The female-friendly plan includes measures to support female entrepreneurs, expanded eligibility for tax credits for fertility treatments and new flexibility for Canadians to spread out parental leave from the current 12 months to 18 with reduced payments.

Transit tax credit scrapped

The spending plan also includes some smaller revenue grabs, including a new tax on ride-sharing services like Uber, cancellation of the Canada Savings Bond and new taxes on tobacco products and alcohol. A non-refundable transit tax credit brought in by the previous Conservative government has also been scrapped.

But former Saskatchewan finance minister Janice MacKinnon said the 278-page budget document delays much-needed measures for keeping businesses, jobs and opportunities in Canada in the wake of the election of U.S. President Donald Trump.

"I see this budget as a bit of a pause. It's a pause in the spending, from the big spending last time to virtually no new spending this time, and also a pause because of what is happening in the United States," said MacKinnon.

"Donald Trump is there and his message is clear: he's going to help the middle class by reducing taxes, reducing regulations, not proceeding with helping the environment, and we're going in the opposite direction."

Infrastructure details

The budget provides more details about the government's previously announced $81.2-billion infrastructure plan, including $11 billion for affordable housing over 11 years and $7 billion over 10 years to create new child-care spaces.

Some of the other key budget details:

- $3.4 billion over five years in areas of critical need for Indigenous people, including infrastructure, health and education.

- $8.5 billion in capital spending for the military bumped nearly two decades down the road.

- $28.5-billion deficit projected for the 2017-18 year, compared with $23 billion this year — both higher than projected in the fall.

- The return of an annual $3-billion "risk adjustment" padding to the deficit.

The budget offers no timeframe of when the government will balance the books.

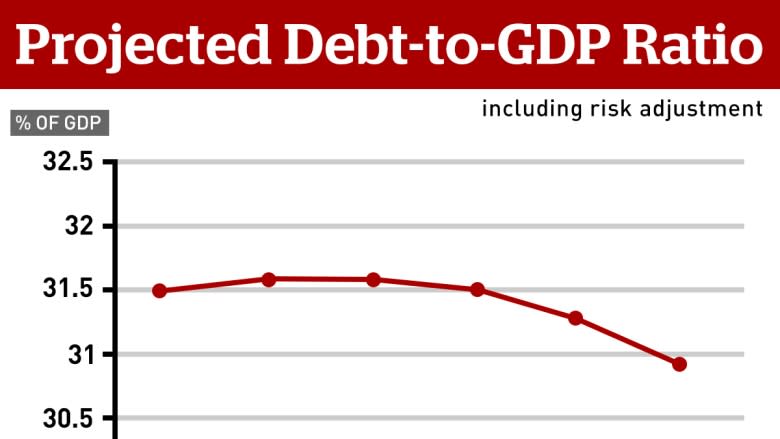

The budget predicts the economy will grow slightly this year, keeping the ratio of federal debt to GDP fairly flat for the next five years, at 31.6 per cent in this year compared with 31.5 per cent last year.

Sprinkled through the budget are other spending initiatives, some of which draw on previously announced allocations:

- $691.3 million over five years to expand the caregiver benefit for Canadians supporting critically ill and injured family members.

- $395.5 million over three years to expand the youth employment strategy.

- $279.8 million over five years for the temporary foreign workers program.

- $57.8 million for mental health for federal inmates.

- $50 million over two years for teaching initiatives to help children learn to code.

- $27.5 million for programs to help newcomers get foreign credentials recognized.

Morneau said in his speech in the Commons that consumer spending is up since the government introduced the Canada child benefit, and the economy has seen the largest seven months of job gains Canada has seen in a decade.

"These are good, early signs of a plan that is working," he said.

'Nickel and diming' Canadians

Interim Conservative Leader Rona Ambrose slammed the budget for "nickel and diming Canadians to death" through rescinded credits, new taxes and user fees. She accused government of being out of step with the needs of ordinary Canadians, putting the interests of venture capitalists ahead of family farmers, oil drillers and salon workers.

"If you're a guy who takes the bus to work and back, or to university and back and when you get home you like to have a beer, well both of those things are going to cost you more," she said.

Ambrose said the budget also misses an opportunity to take steps to combat Trump's "aggressive" move to cut taxes for individuals and businesses.

The government had floated several trial balloons in the run-up to the budget, including proposals to tax capital gains and privatize federally owned airports, which were left out of the budget.

NDP Leader Tom Mulcair said if the government had closed a stock option tax loophole it could have netted $720 million that could have helped children living on First Nations reserves.

He also criticized the government or delaying the roll-out of new money for critical programs.

"There is not one penny for child care next year," he said. "The lack of affordable quality child care is one of the things that affects women negatively in terms of their economic livelihood. It's a shame the Liberals have not made that a priority despite all their promises."

Innovation spending

The budget creates Innovation Canada, with $950 million over five years to support innovators and build hubs for innovation known as "super-clusters."

Avery Shenfeld, chief economist at the CIBC, said government can only do so much to prepare for the digital economy; education systems and the private sector must do the heavy lifting.

Shenfeld said it's positive that the government is recognizing the nature of work is changing, but whether the measures to spur innovation announced today will have a positive impact is to be determined.

"These are always experiments, because it's like every government introduces new skills training programs and we have to wait and see how they work," he said.

"But at least they're not creating big boondoggles where corporations apply for money … thinking that is going to push innovation. Clearly people who can fill these jobs is a big part of it."