CBC News poll: Albertans were hurting financially even before COVID-19

Editor's note: CBC News commissioned this public opinion research before concerns about the COVID-19 pandemic mounted. About half of the total survey of 1,200 respondents was conducted before stock markets and oil prices plunged (March 2-8). The other half of the interviews took place after this economic shock (March 9-18). Growing concerns about the pandemic continue to shape public attitudes. As with all polls, this one is a snapshot in time. CBC News — and the public opinion experts consulted on this survey research — believe the data offers some valuable insights into Albertans' attitudes about the economy and politics just at the moment when COVID-19 changed everything.

This is the second article to come out of this research. Read the previous article here:

Mass layoffs, closed offices, shuttered shops, plunging oil prices and the need for the federal and provincial governments to implement aggressive supports for businesses and individuals — COVID-19 has sparked mass economic upheaval.

But even before all that, Albertans were hurting financially.

Janet Brown Opinion Research, on behalf of CBC News, was polling Albertans just as the economic reality of the coronavirus was becoming apparent.

It's an interesting snapshot in time of how people in our province were feeling.

And, when it comes to their finances, many were already feeling worried, even before the worst of the pandemic had hit.

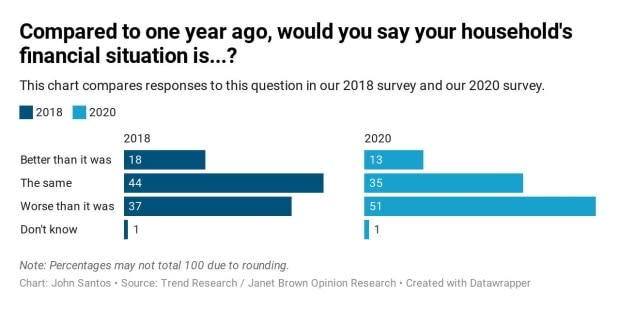

The poll found 51 per cent of people believed their household's financial situation was worse now than it was last year, while 35 per cent felt things were about the same. Just 13 per cent said their finances had improved.

Back in 2018, we asked the same question. At that time, 37 per cent of Albertans had said their financial situation had worsened, while 44 per cent said it was about the same and 18 per cent said things had improved.

Compare the two polls, taken two years apart, and you see a 14-percentage point increase in the proportion of people who feel their finances are worsening.

These personal finance findings mirror the concerns Albertans have for the wider provincial economy, which also showed increased pessimism.

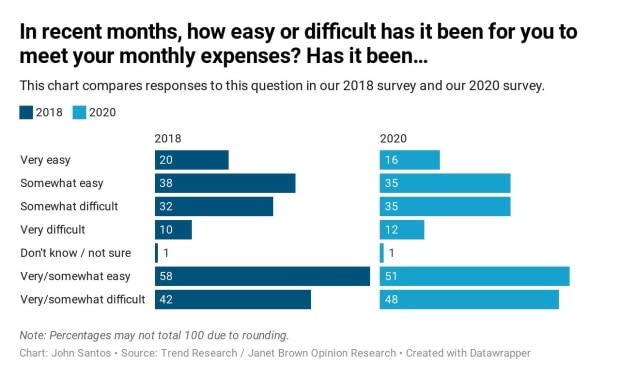

The new survey results also show that people in this province are finding it harder to pay their bills, with 48 per cent of Albertans saying it is either very or somewhat difficult to meet their monthly expenses.

This is an increase of six percentage points from the 2018 survey.

Those numbers are disquieting to see in a province that is used to leading the country in wage earnings. The pain, however, is not being felt evenly across Alberta.

The biggest differences

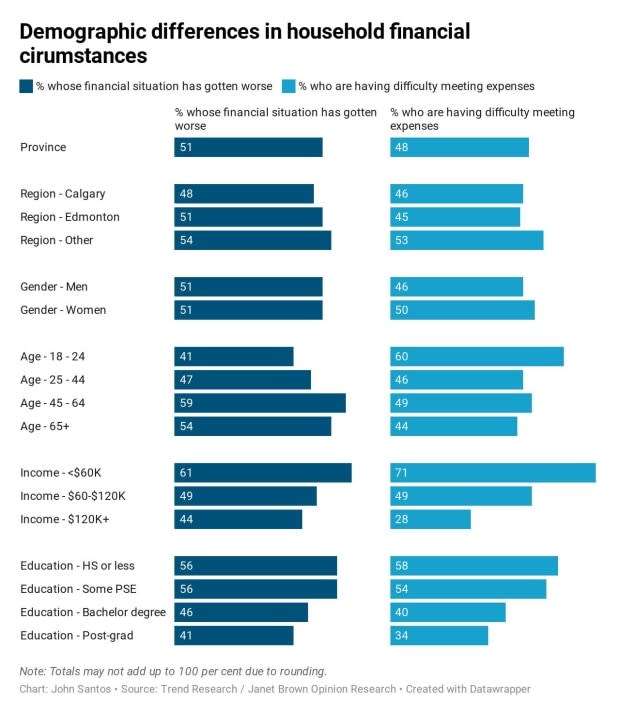

In the chart below, you'll see only very slight regional differences. Albertans living outside the two major cities are just a little more likely to say they are worse off and having more difficulty with their expenses than people in Calgary and Edmonton.

There is also only a slight gender gap, when it comes to expenses.

But it is in age, income, and education where the differences are most stark.

Of those whose household income is less than $60,000 a year, 61 per cent say their financial situation has gotten worse over the past year.

For those with household incomes of $120,000 or more, only 44 per cent say it's gotten worse.

That's a 17-point difference.

This gap jumps to 43 points when you look at the proportions of those same two groups who say they are having difficulty meeting their monthly expenses (71 per cent of households making less than $60,000, versus 28 per cent of those making $120,000 or more).

In terms of education, there is a big gap in financial concerns between those with and without a university degree.

Fifty-six per cent of those without a university degree (people holding either a high school diploma or less, or only some post-secondary education), say their financial situation has worsened.

Compare that to 46 per cent of those with a bachelor's degree and 41 per cent of those with a graduate or professional degree.

The patterns are also complex when it comes to age.

Trouble for both seniors and younger Albertans

Older Albertans are more likely to say their financial situation has gotten worse than younger Albertans — 59 per cent of those aged 45 to 64, and 54 per cent of seniors. Compare this with only 41 per cent of those aged 18 to 24.

However, college-age Albertans are more likely than any other age group to say they are having trouble meeting their monthly expenses.

Sixty per cent of those aged 18 to 24 are having difficulty getting through the month. Compare that to 46 per cent of those aged 25 to 44. It's 49 per cent for those aged 45 to 64. For seniors, it's 44 per cent.

This difference could be explained by life-cycle effects.

College-aged Albertans are either in school or just starting their careers. They do not have much purchasing power or savings to begin with, and one cannot lose what one doesn't have. That also means they have fewer financial resources to fall back on when they lose their job or cannot find a job — a familiar refrain in Alberta over the last few months.

Conversely, even if older Albertans are earning less, or have lost value in their investment portfolios, they likely have more savings that can shore up lost income, at least for now.

Personal financial future

The poll also asked Albertans how they expect their household financial situation to change over the next year.

Forty per cent expect it to get worse. Thirty-seven per cent expect it to stay the same, and twenty per cent actually expect it to get better.

Remember, this is data from early to mid-March, before social distancing, before restaurants and bars started closing their doors, and before the oil patch began laying off workers.

It was already a pretty bleak picture — the proportion who have negative expectations now (40 per cent) is almost twice the proportion that had negative expectations in 2018 (22 per cent).

It has been two weeks since Albertans answered our questions.

Since then, the global economy has received an epic shock, oil prices have dropped to historic lows, and over two million Canadians have applied for employment insurance.

We expect the answers to these questions will continue to change as the economic repercussions of COVID-19 on businesses and individuals evolve. We will explore that in follow-up research we plan on conducting in the coming months.

Methodology:

CBC News' random survey of 1,200 Albertans was conducted using a hybrid method between March 2 and March 18, 2020 by Edmonton-based Trend Research under the direction of Janet Brown Opinion Research. The sample is representative along regional, age, and gender factors. The margin of error is +/-2.8 percentage points, 19 times out of 20. For subsets, the margin of error is larger.

The survey used a hybrid methodology that involved contacting survey respondents by telephone and giving them the option of completing the survey at that time, at another more convenient time, or receiving an email link and completing the survey online. Trend Research contacted people using a random list of numbers, consisting of half land lines and half cellphone numbers. Telephone numbers were dialled up to five times at five different times of day before another telephone number was added to the sample. The response rate among valid numbers (i.e. residential and personal) was 13.2 per cent.