Century Aluminum (CENX) Q3 Earnings and Sales Beat Estimates

Century Aluminum Company CENX reported a net loss of $58.2 million or 65 cents per share in third-quarter 2020, wider than a net loss of $20.7 million or 23 cents per share in the year-ago quarter. The bottom line in the reported quarter was affected by $6.2 million of exceptional items.

Barring one-time items, adjusted loss was 67 cents per share, narrower than the Zacks Consensus Estimate of a loss of 69 cents.

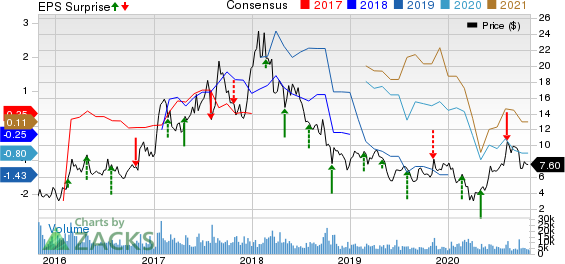

Century Aluminum Company Price, Consensus and EPS Surprise

Century Aluminum Company price-consensus-eps-surprise-chart | Century Aluminum Company Quote

Revenues and Shipments

The company generated net sales of $392.9 million in the third quarter, down around 10% year over year. The figure, however, surpassed the Zacks Consensus Estimate of $370.4 million.

Shipments of primary aluminum were 203,022 tons, up around 2% year over year.

Financials

At the end of the quarter, the company had cash and cash equivalents of $81.4 million, up more than three fold year over year.

Net cash provided by operating activities was $33.3 million for the nine months ended Sep 30, 2020.

Outlook

Century Aluminum stated that the industry in the United States and Europe continues to recover. Moreover, the company is seeing an improvement in order rates and its customers are showing increasing confidence regarding the remainder of 2020 as well as 2021. While metal price has strengthened, it continues to be impacted by the volatility affecting all risk assets, the company noted.

Price Performance

Century Aluminum’s shares rose 20.2% in the past year against the industry’s 8% decline.

Zacks Rank & Key Picks

Century Aluminum currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks worth considering in the basic materials space include Agnico Eagle Mines Limited AEM, Barrick Gold Corporation GOLD and B2Gold Corp. BTG.

Agnico Eagle has a projected earnings growth rate of 102.1% for the current year. The company’s shares have gained around 28% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Barrick Gold has an expected earnings growth rate of 100% for the current year. The company’s shares have surged around 51% in the past year. It currently carries a Zacks Rank #2 (Buy).

B2Gold has a projected earnings growth rate of 250% for the current year. The company’s shares have shot up roughly 77% in a year. It currently carries a Zacks Rank #2.

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

B2Gold Corp (BTG) : Free Stock Analysis Report

Century Aluminum Company (CENX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research