Coinbase is getting ready to expand its cryptocurrency offering after a new acquisition

Cryptocurrency exchange Coinbase is looking to circumvent regulatory hurdles and add new coins to its portfolio with the acquisition of Paradex, a service which allows users to trade cryptocurrencies without relying on a trusted third party.

Paradex, which launched in beta in January 2018, is a so-called relayer built on top of the 0x platform. This means it provides users with a way to trade ERC20 tokens — a large ecosystem of cryptocurrencies built on top of Ethereum — directly from their digital wallets.

SEE ALSO: For cryptocurrency to go mainstream, it needs tools like these

This is an important move for Coinbase, which is the top U.S. cryptocurrency exchange with more than 20 million customer accounts and $20 billion in crypto-assets. The exchange currently lists only four cryptocurrencies: Bitcoin, Ethereum, Litecoin and Bitcoin Cash. Despite customer demand for more (there are thousands of cryptocurrencies out there, 23 of them with a market cap of over $1 billion), Coinbase has been wary of adding new coins due to regulatory pressure from the SEC, which (possibly) sees many of these as unregulated and unregistered securities.

According to Coinbase CEO Asiff Hirji, who spoke on CNBC's "Fast Money" Wednesday, the company sees Paradex as a "bulletin board" and not an exchange, which should make it an acceptable addition to Coinbase's portfolio in the eyes of the regulators.

But make no mistake, Paradex will effectively allow Coinbase users to trade in hundreds of new cryptocurrencies, which is a huge step for the company. We'll have to wait until launch to see how exactly Coinbase will integrate Paradex's current product into its service.

Paradex will be integrated into Coinbase Pro, which is a rebrand of GDAX, the company's trading platform aimed at advanced users. But there's a caveat: It will initially only be available to international accounts and not U.S. users. The company plans to start offering the product to U.S. users "as soon as we can," according to Hirji.

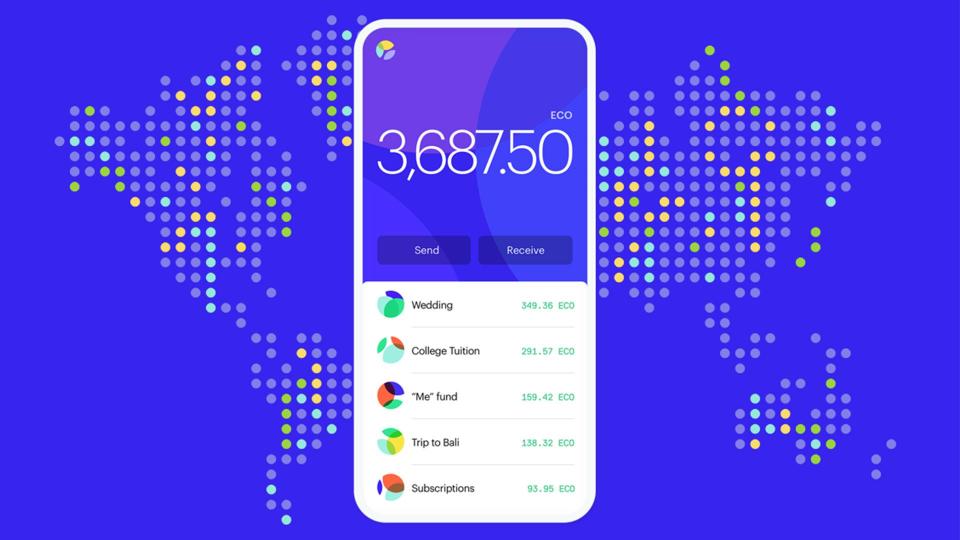

Besides Paradex, Coinbase Pro will also offer a simplified user experience, improved charts and a new portfolio view called "My Wallets," which will give users a consolidated look into their orders and balances.

Paradex is temporarily unavailable following the acquisition.

"In our next steps together, we’ll continue to build out the existing Paradex roadmap and continue to explore the world of decentralization and the amazing opportunities at hand," Paradex wrote in a notice on its site.

The financial terms of the deal were not disclosed.

Coinbase's annoucement come days after the company launched four new major products aimed at institutional investors. In March, Coinbase announced it would launch an index fund for cryptocurrencies.

Disclosure: The author of this text owns, or has recently owned, a number of cryptocurrencies, including BTC, ETH and ZRX.

WATCH: 'Uber' co-founder Garrett Camp is creating a new cryptocurrency