10 countries with best pension systems and where India stands

Pension systems around the world are facing additional pressures in 2020. The widespread economic impact of COVID-19 is creating very real problems for retirees, both in the near-term as also in the future.

Combined with increasing life expectancies and rising pressure on public resources to support the health and welfare of older citizens, COVID-19 has the potential to exacerbate retirement insecurity globally.

Despite the challenges, ensuring a sustainable system is more important than ever. It is critical that policy-makers and governments reflect on the strengths and weaknesses of their systems to ensure stronger long-term outcomes for the retirees of the future.

Mercer’s 12th edition of the Global Pension Index report benchmarks each retirement income system using more than 50 indicators and covers almost two-thirds of the world's population. The Mercer CFA Global Pension Index uses three sub-indices - adequacy, sustainability, and integrity to measure each retirement income system against more than 50 indicators.

This report uses a wide variety of data sources drawing on publicly available data, wherever possible.

So, how does the India system compare on a global scale? What are the measures that can be taken to improve pension standards in each country? Take a look...

Rating system

Grade A - Index Value above 80 - represents a first class and robust retirement income system that delivers good benefits, is sustainable and has a high level of integrity.

Grade B+ & B - Index Value between 75-80 & 65 to 75 respectively - represents a system that has a sound structure, with many good features, but has some areas for improvement, that differentiates it from an A grade system.

Grade C+ & C - Index Value between 60-65 & 50 to 60 respectively -A system that has good features but has major risks and/or shortcomings that should be addressed. Without these improvements its efficacy and/or long-term sustainability can be questioned.

Top 10 best countries, and India’s position

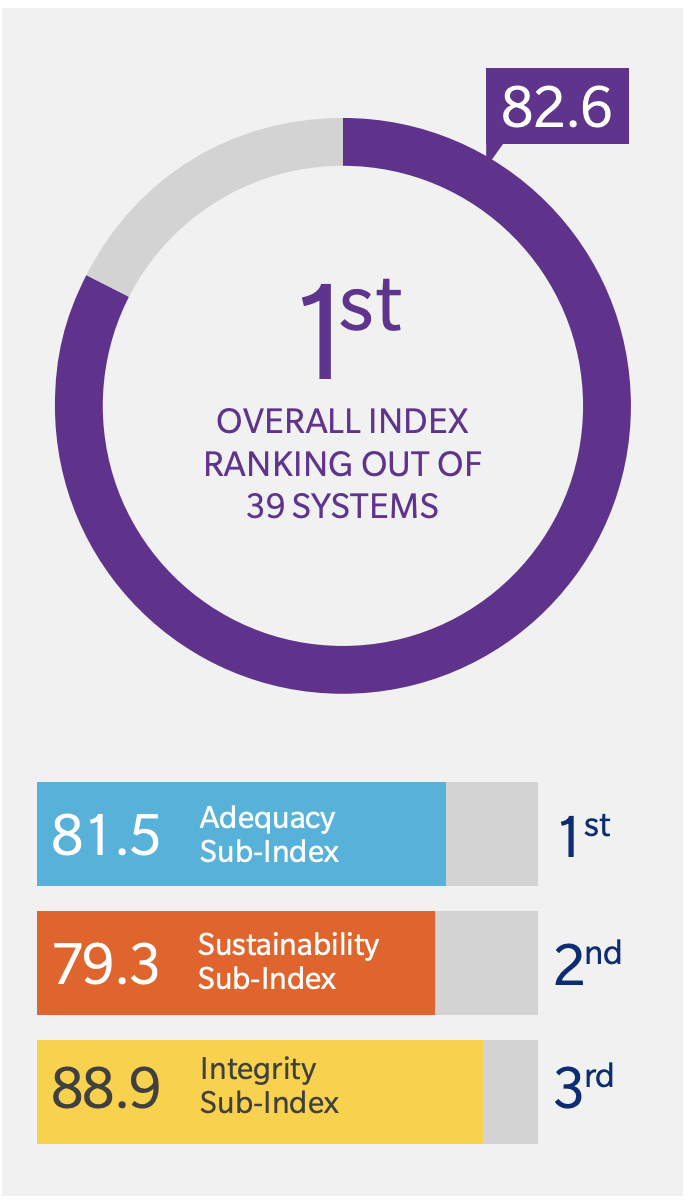

1 . The Netherlands

The retirement income system in The Netherlands comprises flat-rate public pension and a quasi-mandatory earnings-related occupational pension linked to industrial agreements. Most employees belong to these occupational schemes which are industry-wide defined benefit plans with the earnings measure based on lifetime average earnings.

The overall index-value for the Dutch system could be increased by:

Increasing the level of household saving and reducing the level of household debt.

Increasing the labour force participation rate at older ages as life-expectancies rise.

The Dutch index-value increased from 81.0% in 2019 to 82.6% in 2020 primarily due to an increase in the minimum pension and the net replacement rate published by the OECD.

Although The Netherlands has retained a high ranking this year, it is noted that their system is currently undergoing significant reform. However, it needs to be recognised that this system will continue to provide very good benefits, has excellent pension coverage in the private sector, has a significant level of assets set aside for the future and receives high scores in every sub-index.

2 . Denmark

Denmark’s retirement income system comprises a public basic pension scheme. A means tested supplementary pension benefit. A fully funded defined pension scheme and mandatory occupational schemes.

The overall index value for the Danish system could be increased by:

Raising the level of household saving and educing household debt.

Introducing arrangements to protect the interests of both parties in a divorce.

Providing greater transparency of pension plans through annual public reports.

The Danish index value increased from 80.3% in 2019 to 81.4% in 2020 with small increases in each sub-index.

3 . Israel

Israel’s retirement income system comprises of a universal state pension and private pensions with compulsory employer and employee contributions. In most cases annuities are paid from the private pension system.

The overall index-value for the Israeli system could be increased by:

Increasing the level of assets held in private pension arrangements

Lowering the reliance on the public system

Reducing government debt as a percentage of GDP

Introducing protection for members of private pension plans in the event of mismanagement or fraud.

The Israeli index-value for 2020 is 74.7%.

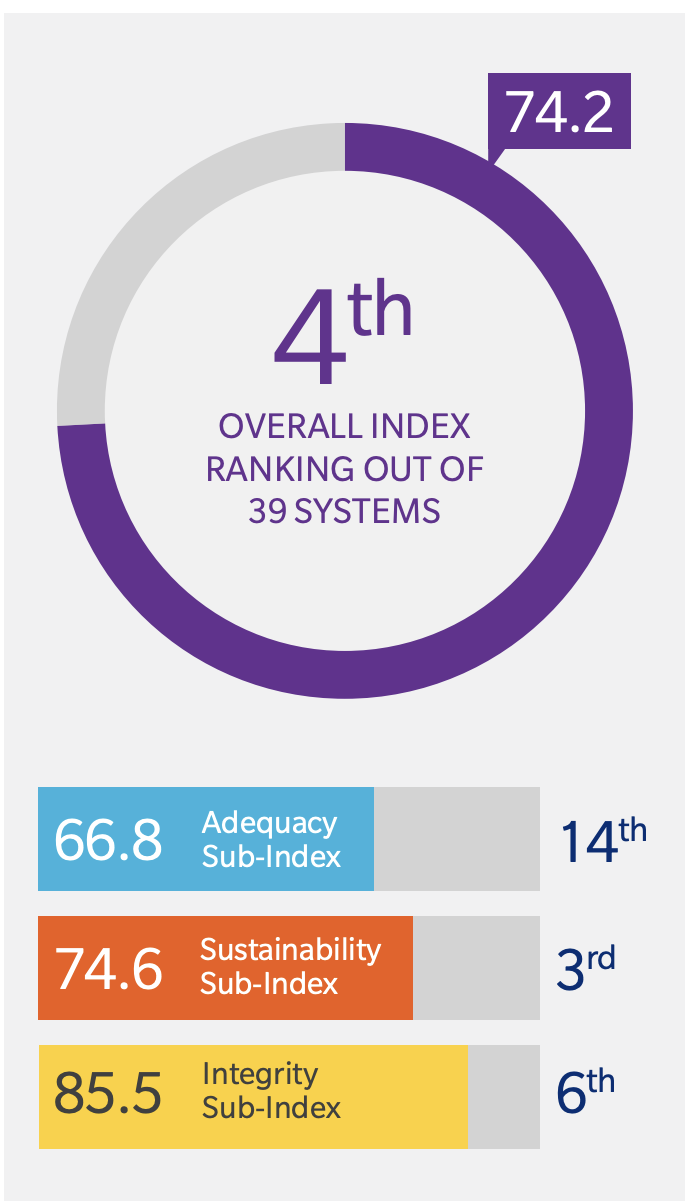

4 . Australia

Australia’s retirement income system comprises a means tested age pension (paid from general government revenue); a mandatory employer contribution paid into private sector arrangements (mainly DC plans); and additional voluntary contributions from employers, employees, or the self employed, paid into private sector plans.

The overall index system for the Australian system could be increased by:

Moderating the assets test on the means tested age pension to increase the net replacement rate for average income earners.

Raising the level of household saving and reducing the level of household debt.

Introducing the requirement that part of the retirement benefit must be taken as an income stream.

Increasing the labour force participation rate at older ages as life expectancies rise

Introducing the mechanism to increase the pension age as life expectancy continues to increase

The Australian index value decreased from 75.3 per cent in 2019 to 74.2 percent in 2020 primarily due to a reduction in the net replacement rates published by the OECD.

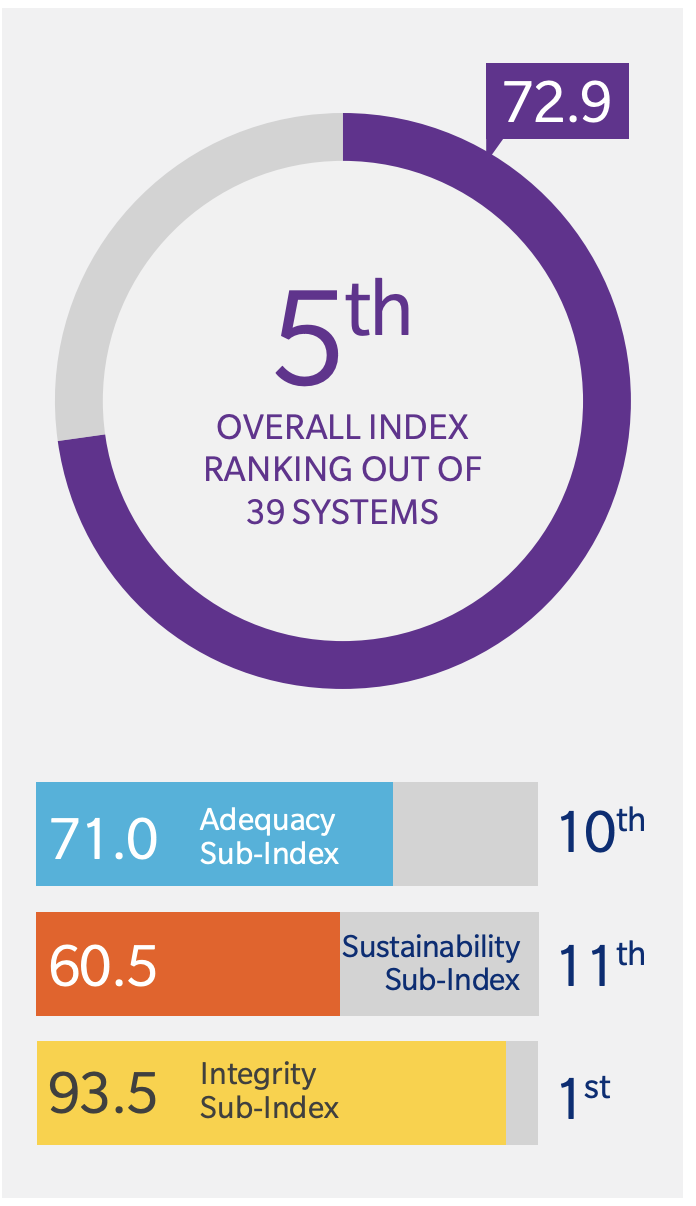

5 . Finland

Finland’s retirement income system consists of a basic state pension, which is pension income-tested and a range of statutory earnings related schemes.

The overall index value for the Finnish system could be increased by:

Raising the level of household saving and reducing household debt.

Continuing to raise the level of mandatory contributions that are set aside for the future.

Introducing arrangements to protect the pension interests of both parties in a divorce.

Increasing the labour force participation rate at older ages as life expectancies rise.

The Finnish index-value decreased from 73.6% in 2019 ton 72.9% in 2020 primarily due to a reduction in the minimum pension as reported by the OECD.

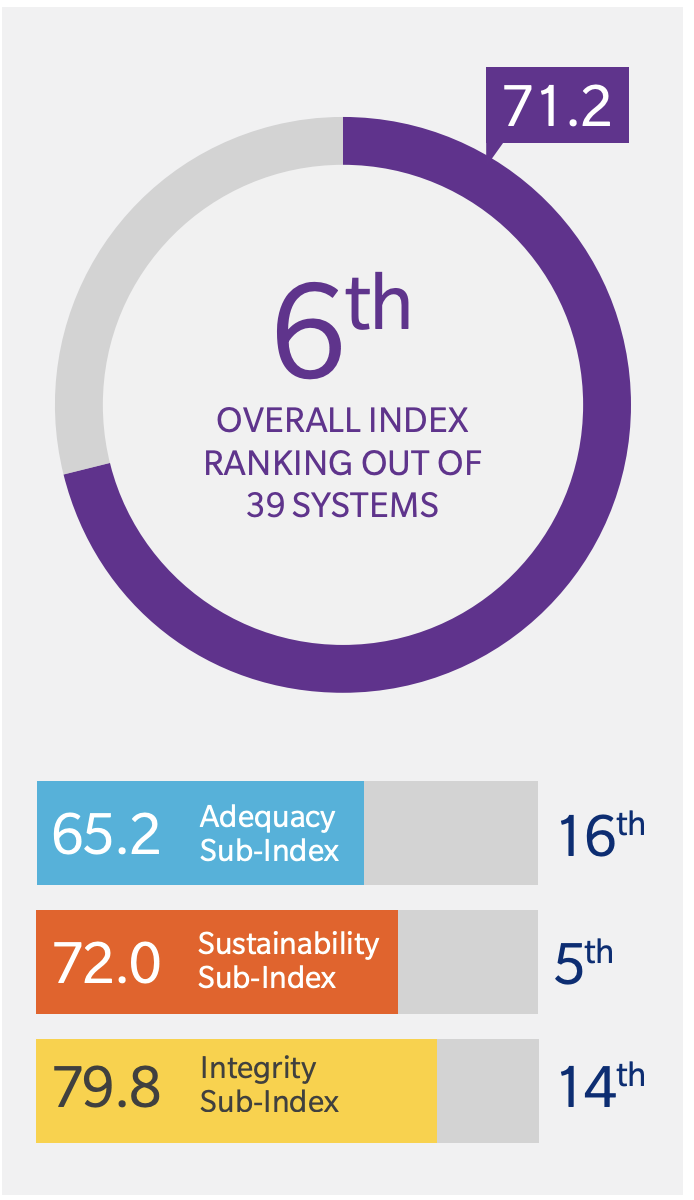

6 . Sweden

Sweden’s national retirement income system was reformed in 1999. The system is an earnings related system with notional accounts. The overall system is in transition from a pay-as-you-go system to a funded approach.

There is also an income-tested top-up benefit which provides a minimum guarantee pension. Occupational pension schemes also have broad coverage.

The overall index value for the Swedish system could be increased by:

Further increasing the state pension age to better reflect increasing life expectancy.

Ensuring that all employees could make contributions into employer sponsored plans.

Reintroducing tax incentives for individual contributions.

Introducing arrangements to protect all the pension interests of both parties in a divorce.

The Swedish index value deceased from 72.3% in 2019 to 71.2% in 2020 due to reductions in the minimum pension and the net replacement rates published by the OECD.

7 . Singapore

Singapore’s retirement income system is based on the Central Provident Fund (CPF) which covers all employed Singaporean residents. Under the CPF, some benefits are available to be withdrawn at any time for specified medical and housing expenses with other benefits preserved for retirement. A prescribed minimum amount is required to be drawn down at retirement age in the form of a lifetime income stream (Through CPF Life). The Singapore government has implemented changes to CPF in 2016 which include providing minimum pension top-up amounts for the poorest individuals, more flexibility in drawing down retirement pension amounts and increases to certain contribution rates and interest guarantees.

The overall index value for the Singaporean system could be increased by:

Reducing the barriers to establishing tax-approved group corporate retirement plans.

Opening CPF to non-residents (who comprise a significant percentage of the labour force)

Increasing the age at which CPF members can access some of their savings before age 65.

The Singaporean index value increased slightly from 70.8% in 2019 to 71.2% in 2020 due to small increases in all sub-indices.

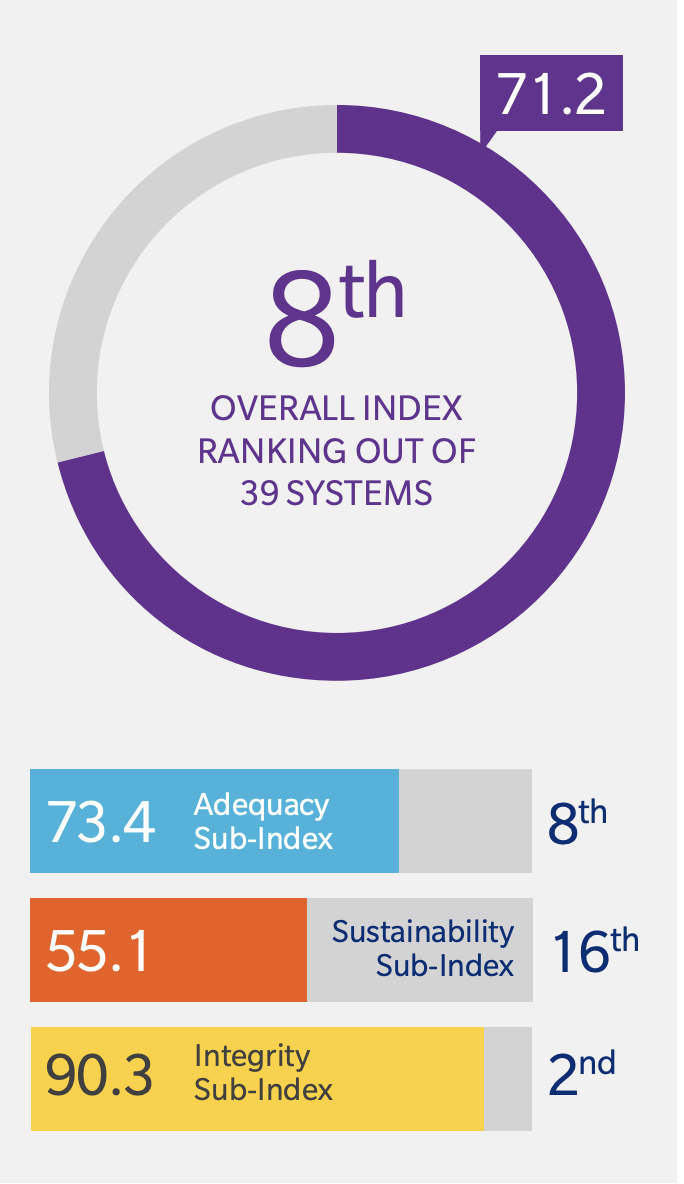

8 . Norway

Norway’s retirement income system comprises an earnings-related social security pension with a minimum pension level, and mandatory occupational pension plans. There are also many voluntary arrangements to provide additional benefits.

The overall index-value for the Norwegian system could be increased by:

Raising the level of household saving and reducing the level of household debt.

Increasing the level of mandatory contributions into the defined contribution plans thereby raising the level of pension assets.

Introducing the option of voluntary contributions with tax relief for members of defined contribution plans.

Introducing arrangements to protect all the pension interests of both parties in a divorce.

The Norwegian index-value remained unchanged at 71.2% from 2019 to 2020 although there were small movements in each sub-index.

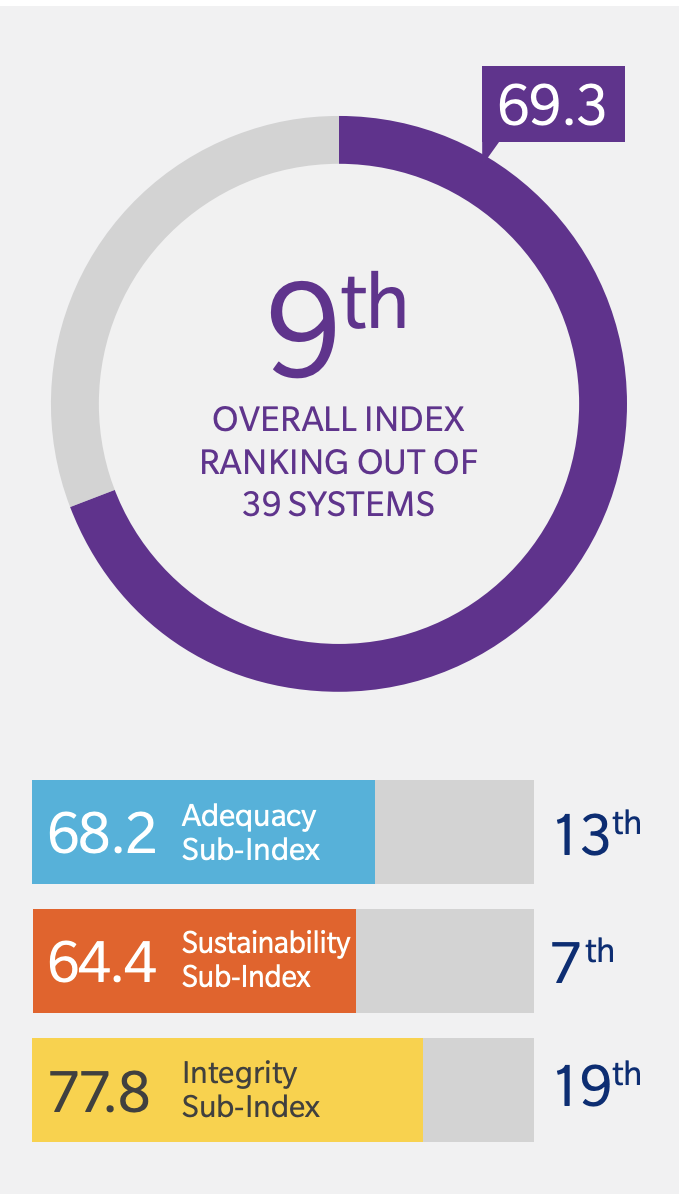

9 . Canada

Canada’s retirement income system comprises a universal flat rate pension supported by a means tested income supplement; an earnings related pension based on revalued lifetime earning. Voluntary occupational pension schemes (many of which are defined benefit schemes) and voluntary individual savings plans.

The overall index value for the Canadian system could be increased by:

Increasing the coverage of employees in occupational pension schemes to the development of an attractive product for those without an employer-sponsored scheme.

Increasing the level of house-hold savings and reducing the level of household debt.

Reducing government debt as a percentage of GDP

Increasing the labour-force participation rate at olde ages as life expectancies rise

The Canadian index value increased slightly from 69.2% in 2019 to 69.3% in 2020, due to several improvements in sustainability sub-index which were largely decreased by the adequacy sub-index with reductions in the net-replacement rates published by the OECD.

10 . New Zealand

New Zealand’s retirement income system comprises a universal public pension, voluntary private pensions and the KiwiSaver direct contribution retirement savings schemes. KiwiSaver is a voluntary scheme with contributions from the government, employers, and members. New employees who are not already members of KiwiSaver are automatically enrolled by their employer and can remain in KiwiSaver unless they elect to opt out within a limited time of joining. KiwiSaver allows all members once they’ve been a member for 12 months to take a break from saving.

The overall index value for the New Zealand system could be increased by:

Increasing the level of KiwiSaver contributions

Raising the level of household savings and reducing the level of household debt

Introducing a requirement that part of the retirement benefit must be taken as an income stream

Continuing to expand the coverage of KiwiSaver thereby raising level of pension assets

The New Zealand index value decreased from 70.1% in 2019 to 68.3% in 2020 primarily due to reductions in the net replacement rates published by the OECD.

34 . India

India’s retirement income system comprises an earnings-related employee pension scheme, a defined contribution employee provident fund, and supplementary employer managed pension, schemes that are largely defined contribution in nature.

Government schemes have been launched as part of universal social security program aimed at benefitting the unorganised sector. The EPFO’s scheme continues to be the primary one for the organised sector. The National Pension System is gradually gaining popularity.

The overall index value for the Indian system could be increased by:

Introducing a minimum level of support for the poorest aged individuals.

Increasing coverage of pension arrangements for the unorganised working class.

Introducing a minimum access age so that it is clear that benefits are preserved for retirement purposes.

Improving the regulatory requirements for the private pension system.

Increasing the level of contributions in statutory pension schemes.

The Indian index-value decreased slightly from 45.8% in 2019 to 45.7% in 2020. The increase in the integrity sub-index due to some regulations was offset by the small falls in both the adequacy and the sustainability sub-indices.