COVID-19 isn't the biggest risk to the stock market, it's Trump vs. Biden: Goldman Sachs

COVID-19 is mostly a rearview mirror type of event at least when it comes to markets, suggests strategists at Goldman Sachs. The bigger threat to rallying stock markets right now: the upcoming presidential election.

“Perhaps the most significant risk and source of uncertainty is the U.S. election that is now just five months away,” said Goldman Sachs strategist David Kostin in a new note on Friday. The reason for Kostin’s cautiousness on the impact to markets from a contentious election is none other than possible changes to corporate tax rates.

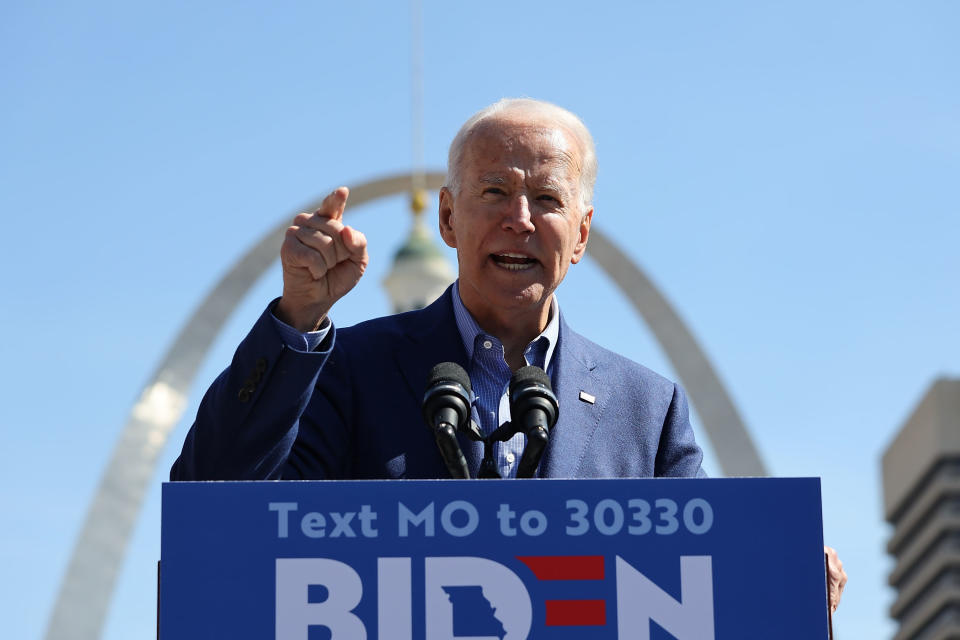

Under the Trump tax cuts, the corporate tax rate was lowered to 21% from 35%. It has since led to a boom in corporate profits, in large part because of aggressive stock buybacks but also because of the lowered rate itself and its effect on net profits. But Democratic presidential hopeful Joe Biden has said he would roll back part of the Trump corporate tax cuts to fund various social safety net programs, taking them up to around 27%.

By Kostin’s math, a higher corporate tax rate could hurt S&P 500 earnings estimates pretty drastically and perhaps equity values.

“If the tax law is reversed, it would translate into an 11% reduction in our 2021 EPS forecast (to $150 from $170, and buy-side consensus would fall to $133 from $150),” points out Kostin.

Other equities risks Kostin highlights include a slower pace of hiring post the worst of the pandemic and rising geopolitical tensions between the U.S. and China. Maneuvers by both countries in recent days — stemming from China’s tougher stance on Hong Kong — has shown to be a driver of lower stock prices. So, Kostin is right to present that as a key risk.

Overall, Kostin sees at least 5% upside potential to the S&P 500 this year to 3,200. Previously, his case was 3,000. Kostin’s worst-case scenario for the S&P 500 is 2,750, up from 2,400 in a prior estimate.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Read the latest financial and business news from Yahoo Finance

Levi's reports solid quarterly earnings, CEO says jeans maker will come out of coronavirus stronger

Yum! Brands CEO on how his 50,000 restaurants are doing amidst the coronavirus pandemic

Grubhub founder: our sign-ups are surging during the coronavirus

HP CEO: here’s how we are helping coronavirus relief efforts

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.