The CRA 'picks on people who can't defend themselves,' says single mother battling agency

Tears well up in Karli Baxter's eyes as she recounts her recent experience with the Canada Revenue Agency.

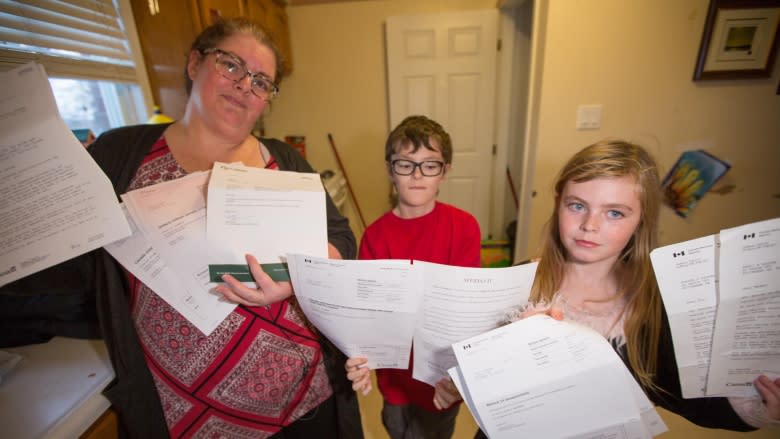

The single mother of two from Kitchener, Ont., is fighting the agency's demand that she pay $20,000 in back payments — for child benefits and tax credits — after a CRA review rejected her claim that she has been separated from her husband since 2015.

Baxter is just one of nearly 100 people who reached out to CBC News after it profiled another single mother from Saskatchewan who has spent the last six months battling the CRA over own her marital status and child benefits.

"This is very scary, especially at this time of the year. I struggled to even get my daughter a snow suit this year," Baxter told CBC News. "Christmas has been impacted. My kids are not getting anywhere near what I would like to do. I've tried to explain it to them and they've been pretty cool, but it still hurts."

Many of the other single parents who contacted CBC described a similar experience. They say they notified the CRA of a separation from their spouse and their benefits came as expected — until a couple years or more later, when the agency decided to conduct a review of their situation.

That review requires proof the separation is real, such as utility bills with separate addresses or letters attesting to the claim from people in authority, such as a doctor or member of the clergy. They say getting those documents can be a challenge if, for example, they moved in with parents or friends initially, or if they did not broadly advertise the breakdown of their marriage.

Even if the documents can be obtained, many of the parents who contacted CBC told stories of sending in requested documents only to have them rejected as insufficient.

When the CRA rejects a parent's declaration, the agency will then count both parents' incomes when calculating benefits and tax credits. That can lead to reduced benefits and a bill demanding back payments. Similarly, if a parent has trouble proving sole custody of a child, that too can impact benefits and tax credits.

A systemic problem

It turns out that the challenge to prove they are separated or have custody of their children is a systemic problem for single parents, according to the recently tabled annual report of the Taxpayers' Ombudsman, a government-funded office that operates at arms length to the CRA and promotes accountability to the public.

"The Canada Child Benefit complaints is always in our top five," said Taxpayers' Ombudsman Sherra Profit. "It's such a vital benefit to many Canadians who rely on it to feed their children, to pay their rent … so it's very serious for a lot of these families."

Complaints to the ombudsman's office resulted in 1,490 files being opened in the 2016–2017 fiscal year and another 880 files being opened in the first six months of this fiscal year.

Baxter said she submitted hydro, credit card and insurance documents as well as a sworn affidavit, but was told It wasn't enough.

"If I can't get them to accept the documents that I do have, that I legitimately separated from my husband when I say I did...I don't have $20,000 [to pay the CRA back]. I don't even know where I would begin," said Baxter.

Ashley Read got a letter from the CRA, not just years after her separation, but after she had legally divorced.

The agency demanded proof that the Regina mom was separated between 2014 and 2015. But because it was an amicable split, Read says she does not have a big paper trail of legal documents.

She submitted separation documents and a car insurance policy, but that too was insufficient for the CRA. Her benefits were stopped for a while and her last tax refund was clawed back.

She tried working it out with the CRA.

"I called numerous times and got through one time to one person and she was extremely rude and condescending to me," said Read. "I was in tears on the phone because I was so confused as to what else I could do to prove, because it was true and they didn't believe me."

'We're single parents and that's hard enough'

Kamal Khera, Parliamentary secretary to the Minister of National Revenue, said the Liberal government inherited a broken, underfunded system.

"First of all, I understand the challenges, especially around this time of year, that some Canadians are going through, and it is completely unacceptable," she told CBC News. "What I can say is that we as the government are working extremely hard to … make improvements to the system."

For Karli Baxter those improvements are not coming soon enough.

"I was a little bit shocked and disgusted that there are that many people going through this," she said, referring to the number of people who contacted CBC with similar issues. "I mean, we're single parents and that's hard enough."