Crown Castle (CCI) Tops Q3 FFO Estimates, Provides '21 View

Crown Castle International Corp.’s CCI third-quarter 2020 adjusted funds from operations (AFFO) per share of $1.56 surpassed the Zacks Consensus Estimate of $1.55. Moreover, the figure was 6% higher than the prior-year quarter figure of 1.47.

Net revenues of $1.49 billion inched up 0.2% year over year in the reported quarter. However, the revenue figure narrowly missed the Zacks Consensus Estimate.

Growth in site-rental revenues aided top-line performance. However, services and other revenues were down during the quarter. The company also provided an outlook for 2021 and hiked quarterly dividends.

Quarter in Detail

Site-rental revenues were $1.3 billion, up 4% year over year. The $70 million in organic contribution to site rental revenues reflects 5.5% growth. However, services and other revenues plunged 25% year over year to $147 million.

Quarterly operating expenses declined 0.7% year over year to $1.05 billion. Moreover, operating income increased 2.6% year over year to $434 million. Quarterly adjusted EBITDA of $883 million marked 4% year-over-year growth.

The company reported capital expenditure of $377 million during the third quarter. This included $357 million of discretionary capital expenditure and $20 million of sustaining capital expenditure.

Balance Sheet

Crown Castle exited third-quarter 2020 with cash and cash equivalents of $242 million, up from the $196 million reported at the end of 2019.

Furthermore, as of Jun 30, 2020, the company generated $2.1 billion of net cash from operating activities compared with $1.9 billion reported in the year-ago period.

Also, debt and other long-term obligations aggregated $19.2 billion, up from $18 billion witnessed at the end of 2019.

Guidance

Crown Castle reduced its outlook for 2020 primarily due to the timing difference of its tower activity that has been postponed from the second half of 2020 to the first half of 2021. The company expects site-rental revenues of 5,307-$5,327 million as compared with $5,337-$5,382 million mentioned earlier. Adjusted EBITDA is projected at $3,409-$3,429 million as compared with the previously mentioned $3,479-$3,524 million. AFFO per share is anticipated to be $6.07-$6.11. The Zacks Consensus Estimate for the same is $6.04.

The company also provided guidance for 2021. The company expects site-rental revenues of 5,532-$5,577 million. Adjusted EBITDA is projected at $3,584-$3,629 million. AFFO per share is anticipated to be $6.64-$674. The Zacks Consensus Estimate for the same is pegged at $6.75.

Dividend Update

On Oct 21, Crown Castle announced an 11% sequential hike in the quarterly cash dividend to $1.33 per common share. The dividend will be paid out on Dec 31 to common stockholders of record as of the close of business on Dec 15, 2020.

Crown Castle currently carries a Zacks Rank of 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

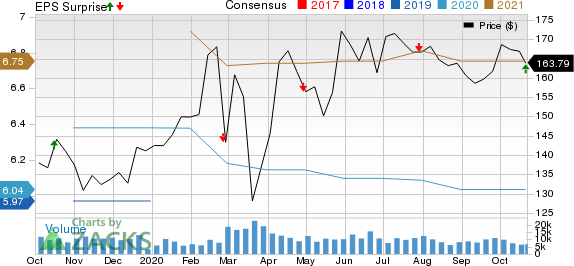

Crown Castle International Corporation Price, Consensus and EPS Surprise

Crown Castle International Corporation price-consensus-eps-surprise-chart | Crown Castle International Corporation Quote

We now look forward to the earnings releases of other REITs like Lexington Realty Trust LXP, National Storage Affiliates Trust NSA and Ventas, Inc. VTR. While Lexington Realty and National Storage Affiliates are slated to report third-quarter earnings on Nov 5, Ventas will release earnings on Nov 6.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Crown Castle International Corporation (CCI) : Free Stock Analysis Report

Ventas, Inc. (VTR) : Free Stock Analysis Report

Lexington Realty Trust (LXP) : Free Stock Analysis Report

National Storage Affiliates Trust (NSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research