Did Changing Sentiment Drive Ocean Line Port Development's (HKG:8502) Share Price Down By 15%?

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Ocean Line Port Development Limited (HKG:8502) share price is down 15% in the last year. That contrasts poorly with the market return of 6.1%. Ocean Line Port Development hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time.

See our latest analysis for Ocean Line Port Development

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

The last year saw Ocean Line Port Development's EPS really take off. We don't think the growth guide to the sustainable growth rate in this case, but we do think this sort of increase is impressive. As a result, we're surprised to see the weak share price. Some different data might shed some more light on the situation.

Ocean Line Port Development managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

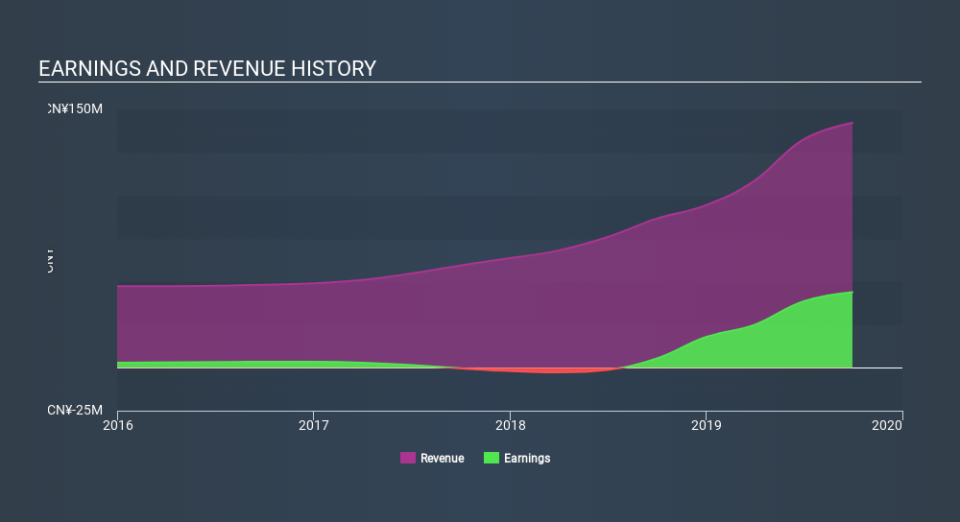

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Given that the market gained 6.1% in the last year, Ocean Line Port Development shareholders might be miffed that they lost 15%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 7.0%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Ocean Line Port Development that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.