Did You Manage To Avoid Pacific Online's (HKG:543) Painful 64% Share Price Drop?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Pacific Online Limited (HKG:543), since the last five years saw the share price fall 64%. Furthermore, it's down 25% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 15% decline in the broader market, throughout the period.

View our latest analysis for Pacific Online

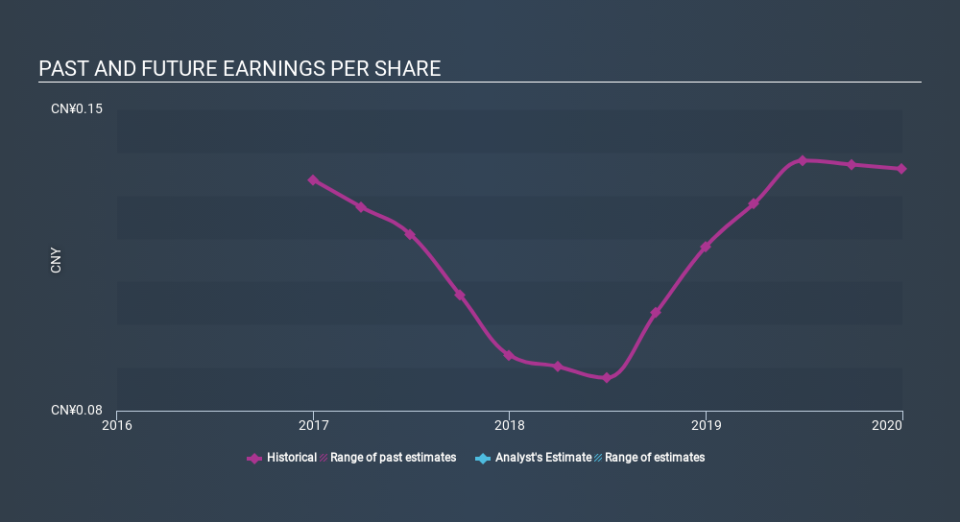

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined, Pacific Online's earnings per share (EPS) dropped by 7.4% each year. This reduction in EPS is less than the 18% annual reduction in the share price. So it seems the market was too confident about the business, in the past. The low P/E ratio of 8.81 further reflects this reticence.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on Pacific Online's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Pacific Online the TSR over the last 5 years was -47%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While it's certainly disappointing to see that Pacific Online shares lost 12% throughout the year, that wasn't as bad as the market loss of 18%. Given the total loss of 12% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Pacific Online (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

Pacific Online is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.