Did You Manage To Avoid Pak Wing Group (Holdings)'s (HKG:8316) 97% Share Price Wipe Out?

As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Pak Wing Group (Holdings) Limited (HKG:8316) investors who have held the stock for three years as it declined a whopping 97%. That would certainly shake our confidence in the decision to own the stock. And the ride hasn't got any smoother in recent times over the last year, with the price 86% lower in that time. Shareholders have had an even rougher run lately, with the share price down 43% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 17% in the same timeframe.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Pak Wing Group (Holdings)

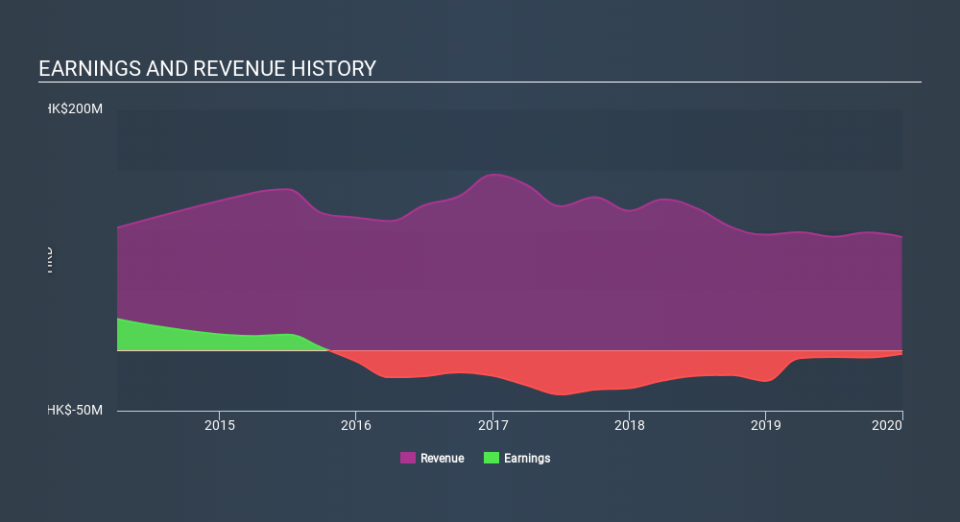

Given that Pak Wing Group (Holdings) didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Pak Wing Group (Holdings) saw its revenue shrink by 15% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 70%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Pak Wing Group (Holdings)'s earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pak Wing Group (Holdings) shareholders are down 86% for the year, falling short of the market return. The market shed around 20%, no doubt weighing on the stock price. The three-year loss of 70% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Pak Wing Group (Holdings) has 5 warning signs (and 3 which make us uncomfortable) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.