Did You Manage To Avoid United States Antimony's (NYSEMKT:UAMY) 43% Share Price Drop?

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term United States Antimony Corporation (NYSEMKT:UAMY) shareholders for doubting their decision to hold, with the stock down 43% over a half decade. And we doubt long term believers are the only worried holders, since the stock price has declined 42% over the last twelve months. Furthermore, it's down 24% in about a quarter. That's not much fun for holders.

View our latest analysis for United States Antimony

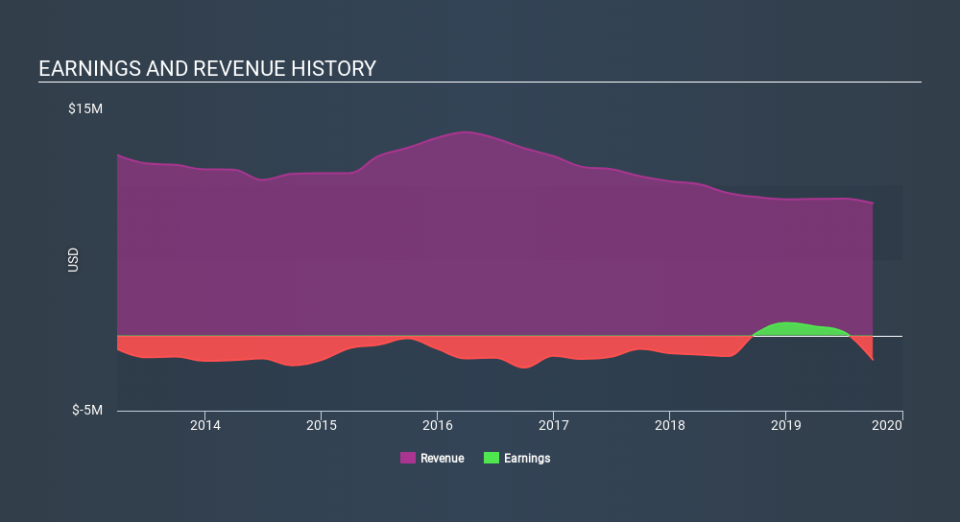

Because United States Antimony made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years United States Antimony saw its revenue shrink by 6.4% per year. That's not what investors generally want to see. The share price decline at a rate of 11% per year is disappointing. But it doesn't surprise given the falling revenue. Without profits, its hard to see how shareholders win if the revenue keeps falling.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on United States Antimony's earnings, revenue and cash flow.

A Different Perspective

Investors in United States Antimony had a tough year, with a total loss of 42%, against a market gain of about 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand United States Antimony better, we need to consider many other factors. For instance, we've identified 4 warning signs for United States Antimony (1 is potentially serious) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.