Did You Miss RPMGlobal Holdings's (ASX:RUL) 62% Share Price Gain?

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the RPMGlobal Holdings Limited (ASX:RUL) share price is up 62% in the last 5 years, clearly besting the market return of around 25% (ignoring dividends).

See our latest analysis for RPMGlobal Holdings

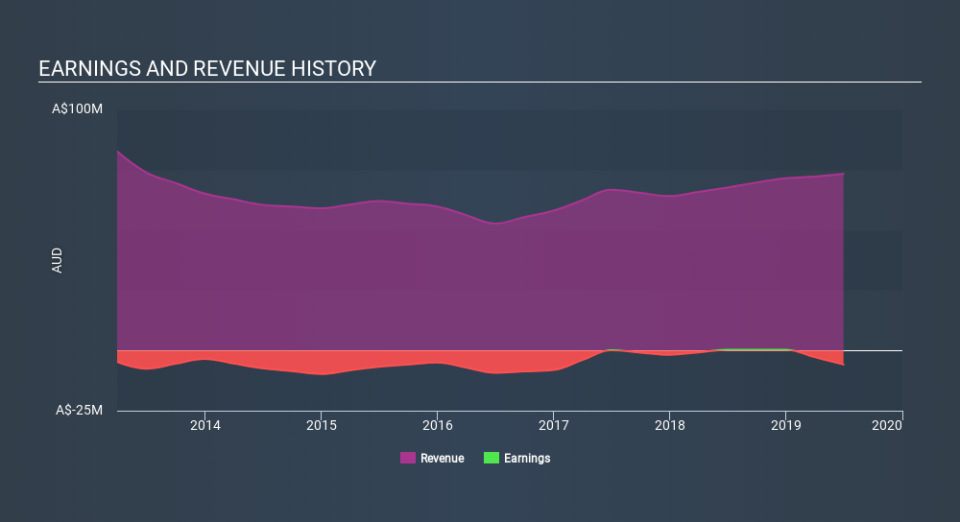

Because RPMGlobal Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years RPMGlobal Holdings saw its revenue grow at 4.5% per year. Put simply, that growth rate fails to impress. The modest growth is probably broadly reflected in the share price, which is up 10%, per year over 5 years. We'd be looking for the underlying business to grow revenue a bit faster.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at RPMGlobal Holdings's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that RPMGlobal Holdings shareholders have received a total shareholder return of 59% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 10% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand RPMGlobal Holdings better, we need to consider many other factors. Be aware that RPMGlobal Holdings is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.