Did The Underlying Business Drive Fulgent Genetics' (NASDAQ:FLGT) Lovely 937% Share Price Gain?

Fulgent Genetics, Inc. (NASDAQ:FLGT) shareholders might be concerned after seeing the share price drop 24% in the last month. But over three years the performance has been really wonderful. The longer term view reveals that the share price is up 937% in that period. As long term investors the recent fall doesn't detract all that much from the longer term story. Only time will tell if there is still too much optimism currently reflected in the share price.

Anyone who held for that rewarding ride would probably be keen to talk about it.

View our latest analysis for Fulgent Genetics

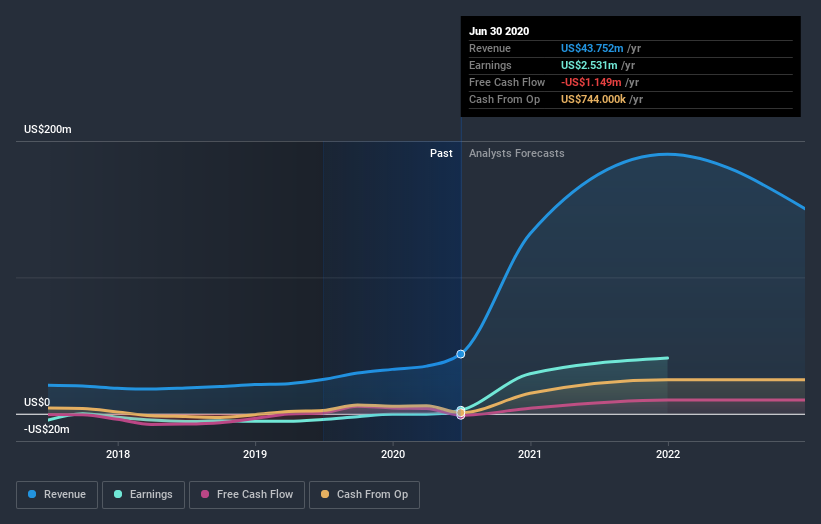

Given that Fulgent Genetics only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 3 years Fulgent Genetics saw its revenue grow at 28% per year. That's well above most pre-profit companies. And it's not just the revenue that is taking off. The share price is up 118% per year in that time. Despite the strong run, top performers like Fulgent Genetics have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think Fulgent Genetics will earn in the future (free profit forecasts).

A Different Perspective

Pleasingly, Fulgent Genetics' total shareholder return last year was 198%. That gain actually surpasses the 118% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. It's always interesting to track share price performance over the longer term. But to understand Fulgent Genetics better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Fulgent Genetics , and understanding them should be part of your investment process.

Of course Fulgent Genetics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.