Downturn pushes debt-burdened to seek help with financial woes

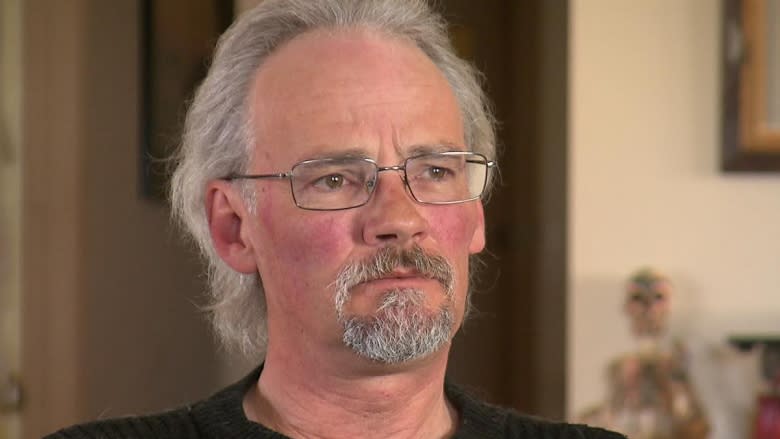

Randy Rigel remembers the good times fondly. Working in the Alberta oilpatch he earned $140,000 per year, and could afford lots of toys, like his prized cobalt-blue customized Harley-Davidson and the vintage Camaro he's restoring.

"You could cover everything, whatever you wanted, just kind of go in debt, get your credit built back up and everything was fine," he says. "Until, well, it just ended."

The end came for Rigel, as it did for thousands of others, in January, when plunging oil prices led to layoffs.

Rigel lost his job at a Grande Prairie pipeline company. At the time, he was trying to buy a house and had discovered some long-forgotten debt on his credit report. With no income and bills to pay, he decided he needed help.

According to Canada's superintendent of bankruptcy, 54,640 Canadians sought formal help dealing with debt in the past year using means other than bankruptcy, an increase of 7.9 per cent from January 2014.

In Alberta, which enjoyed the economic windfall of high oil prices until early autumn, the figures are even more pronounced. The number of consumers seeking the federal agency's help with their debts totalled 4,484, a spike of 25.3 per cent from 2014.

And the figures only capture those going through a formal process known as a consumer proposal, where a bankruptcy trustee works with creditors to reduce total debt, extend the time to pay off their bills, or both.

Credit counsellors busier

The figures don't include those who use the less formal approach of working with a credit counseling agency. Those organizations are private businesses and do not report the total number of people seeking help. However, credit counsellors are reporting a dramatic increase in business, particularly in Alberta.

Consolidated Credit Counseling is reporting a 38 per cent increase in clients from Alberta, comparing February 2015 with the same month last year.

Company spokesman Jacob MacDonald said high rates of household debt are driving Canadians to seek help.

"It's incredibly easy for things to go off the rails," he said. "It all comes down to the variance between what's coming in and what's going out, and if there's not a lot of space there, it's like cruising down the highways at high speeds, the slightest bump could throw you in the ditch."

According to the credit agency Equifax Canada, Albertans hold the highest levels of non-mortgage debt in Canada. Calgary is No. 1 at $28,263, with Edmonton not far behind at $26,305.

Household debt highest in Alberta

A recent report by the Bank of Montreal shows average household debt including mortgages is $124,838 in Alberta. That's much higher than the $99,835 owed by B.C. residents and the $67,507 of average debt held by Ontario residents.

While more Canadians are reaching for help with their debts, fewer are opting to solve their problems through bankruptcy. Total bankruptcies in Canada were down 5.9 per cent in January 2015. MacDonald says that's reflected in the type of client his company is seeing.

"They're not looking to go bankrupt or to speak to a trustee. These are people who can service their debts, they can make the minimum payments, but with interest as high as it is you might be paying 19 per cent on your credit card, you'll never get ahead, you'll never get out of that hole."

Another indicator that many Albertans are falling on hard times is the growing workload of bailiffs in the province.

The seizure of vehicles for unpaid bills is a financial barometer that foretells changes in economic conditions.

"Whenever there is a downturn in the economy, the vehicle recovery is the first one to jump up," said Steven Low of Consolidated Civil Enforcement.

"That's because when people come on hard times, the vehicle payment is usually one of the first things to stop."

Low reports the number of vehicles seized by Consolidated (which is not associated with the credit counseling service) is up 20 per cent from one year ago, at close to 10,000.

Low said that's the highest number since the recession of 2009. Seizures of homes and property will likely come later, as they require court procedures before bailiffs can act.

"We're busy, we get through it. We have hired some new people," said Low.

"We recognize that increasing work for us … means there's been a personal financial setback for somebody, so we don't gloat in it and we take every care we can to be sensitive to the predicament of the debtor."

Compared to many, Rigel is in pretty good shape. After a couple of months of searching, he found a new job, which pays about half of what he used to make.

Still, that will be enough to pay off his outstanding bills and leave him debt free within a few months. He said he'll never again be seduced by the big money paid by the petroleum industry.

"No, I'll never go back again. I mean after all those years going in and then you get whacked … what's the point."