Election 2020 'has enormous implications for student loan debt'

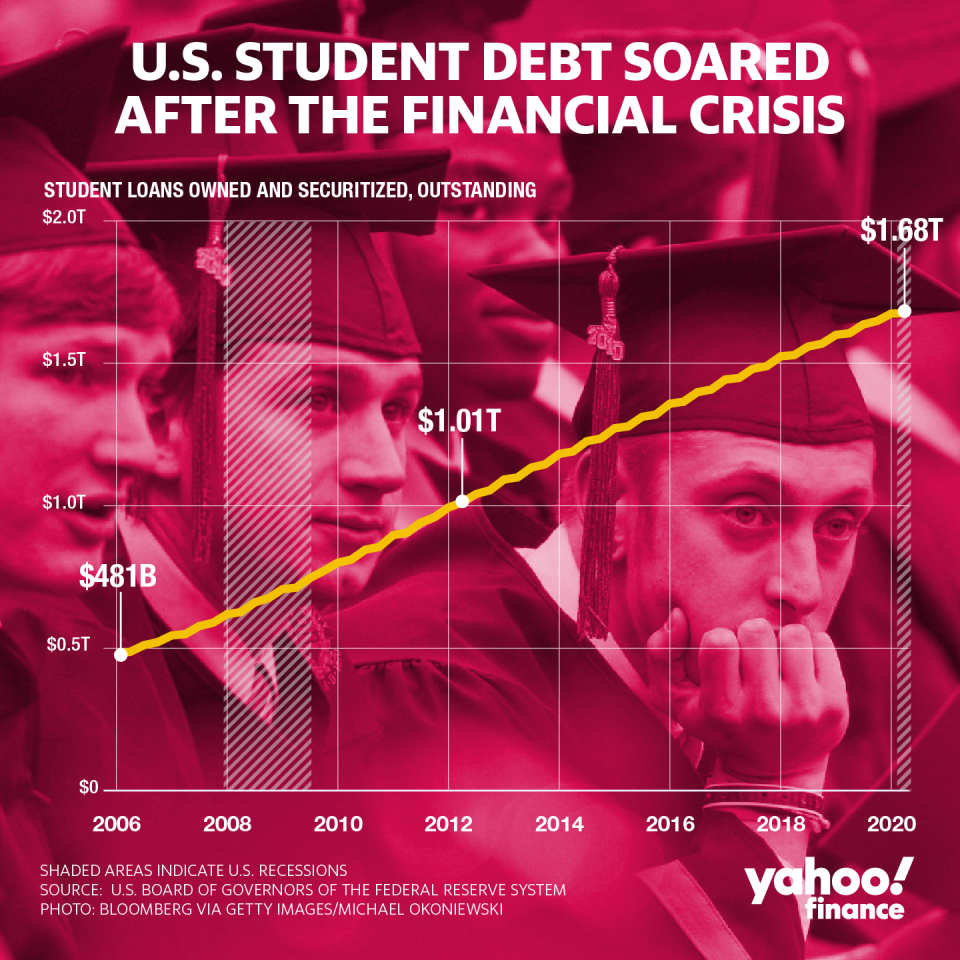

As millions of Americans cast their votes on Tuesday — after more than 100 million voted already — the stakes are high for more than 40 million Americans holding student loans.

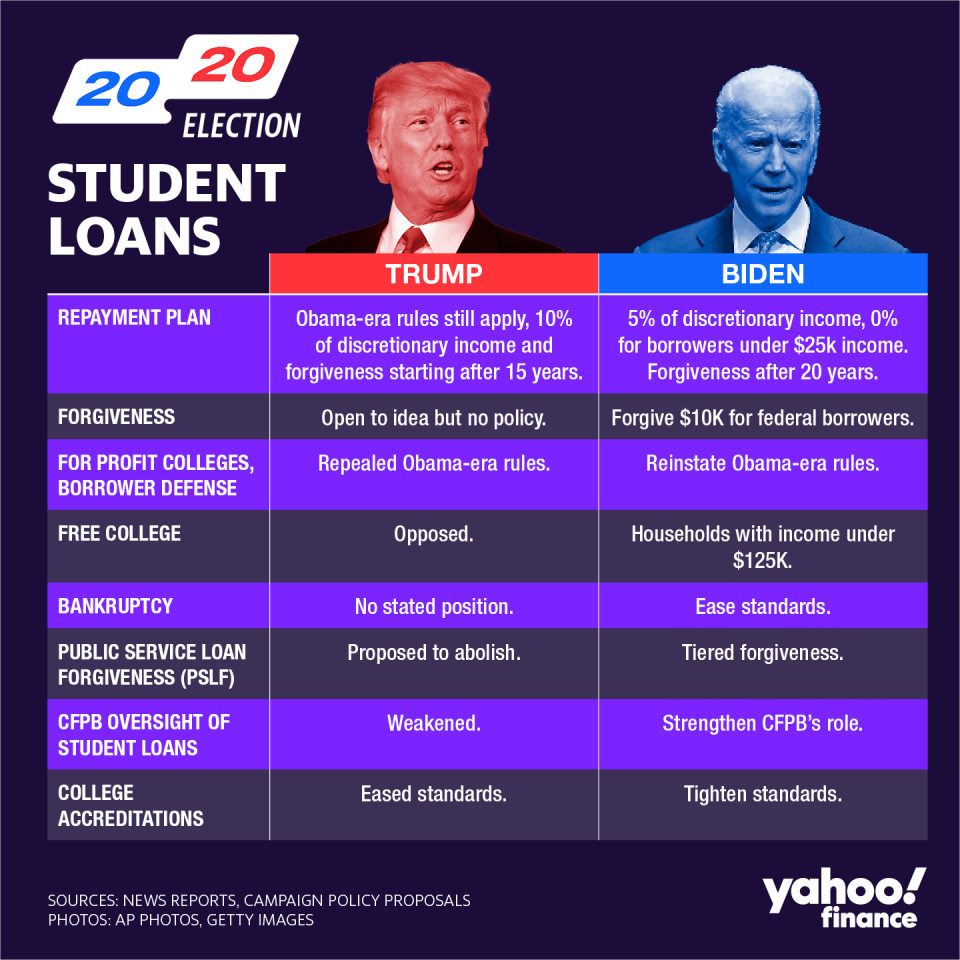

“This election has enormous implications for student loan debt,” Debbie Cochrane, executive vice president at the The Institute of College Access and Success, told Yahoo Finance Live (video above). “The two candidates that are on the ballot… have very different versions of college costs, college affordability, and student loan debt.”

President Donald Trump’s first term was “really focused a lot on regulation” and “not necessarily investing more in public higher education or financial aid,” she explained, adding that “a lot of those efforts have been about unleashing the for-profit college” industry.

A Biden administration, which has a “very ambitious agenda,” she continued, could overturn many of those policies while also making college much more affordable to all students — especially those who come from lower-income families.

For-profits’ performance during pandemic is ‘not surprising’

No matter how the election shakes out, the pandemic and resulting recession have led to for-profit colleges registering an uptick in enrollments in the fall.

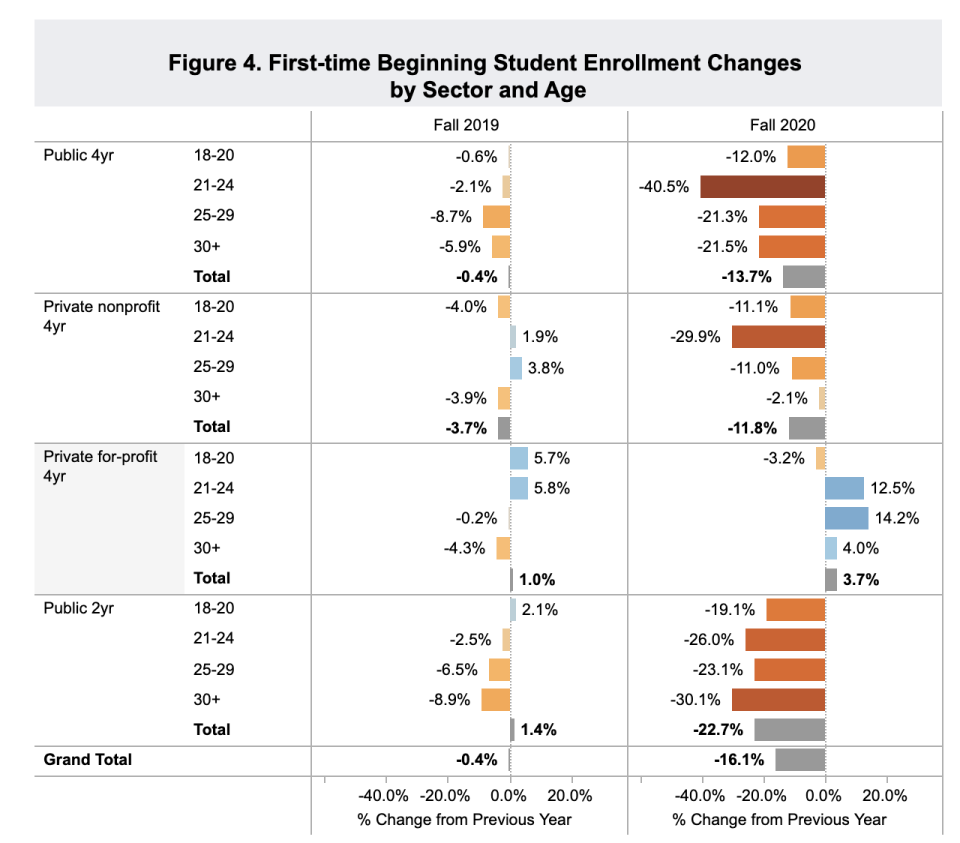

According to the National Student Clearinghouse Research Center, for-profit colleges saw an increase in undergraduate enrollments this fall by 3% while community colleges saw a 9.4% decline. For-profit colleges also saw a 9.3% increase in graduate enrollment while public four-year-colleges saw a 4% increase in graduate students.

Looking at the first-time student numbers, the difference is stark: While public four-year colleges saw a decline of roughly 13.7% for all age groups — the most pronounced being those between 21 and 24 — for-profit schools saw an increase in enrollment of 3.7%. Students from the 21 to 29 age groups constituted the biggest increases.

“We have seen a massive expansion in for-profit college enrollment, and we have seen the subsequent harm it caused,” Stephanie Cellini, professor of public policy and economics at George Washington University, noted in an article for the Brookings Institution think tank. “The difference this time is that we have the evidence to predict what will happen.”

And given the likelihood of Democrats bringing back Obama-era policies to curb predatory behavior — or even going further and enacting more guard rails — the current situation is “is a very sensitive time for the for-profit college industry,” Cochrane added, noting that the problems that have been festering in for-profit industry during the Trump administration schools are likely to “grow exponentially.”

‘All hope is not lost’

The first thing the presidential winner should do, Cochrane stressed, was to extend the payment pause that President Trump announced first in March.

The interest-free pause on all student loans — which was extended until the end of this year — “should be extended and applied to all, not just federal student loan borrowers,” Cochrane said.

“If student loan payments resume on January 1, repayment will compound the difficulty created by unprecedented labor shocks and ongoing economic hardship,” 77 organizations — from the American Federation of Teachers to the NAACP — stated in a recent letter to Education Secretary Betsy DeVos. “If the cliff isn’t resolved, borrowers will find it harder than ever to make ends meet as they are thrown back into repayment or forced collections while the economy continues to suffer.”

In any case, there is a clear opportunity for more borrowers to get on an income-driven repayment plan and pay back the debt at an affordable rate.

“All hope is not lost if people still can’t afford their student loan debt, but they need to get back into that rhythm” of paying back their student loans, Cochrane added.

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

New Jersey AG files suit accusing student loan giant Navient of 'unconscionable' practices

Trump v. Biden: Here's what's at stake for student loan borrowers

'The federal government is AWOL’ on student loan protections, California attorney general says

Warren and Schumer urge student debt cancellation of up to $50,000 for all federal borrowers

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.