Envision Solar International, Inc. (NASDAQ:EVSI) Analysts Are Cutting Their Estimates: Here's What You Need To Know

Envision Solar International, Inc. (NASDAQ:EVSI) just released its latest full-year report and things are not looking great. It was not a great statutory result, with revenues coming in 21% lower than the analysts predicted. Unsurprisingly, earnings also fell seriously short of forecasts, turning into a per-share loss of US$0.88. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Envision Solar International after the latest results.

View our latest analysis for Envision Solar International

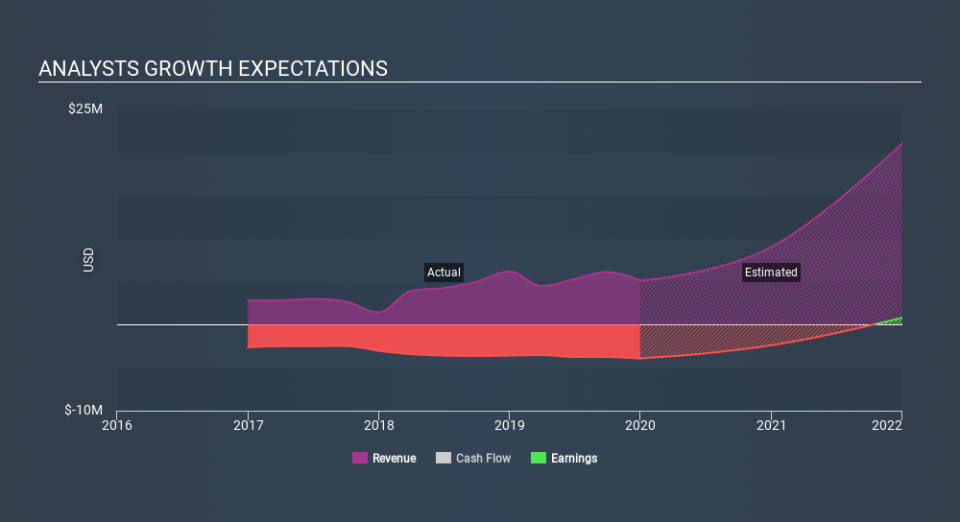

Taking into account the latest results, the most recent consensus for Envision Solar International from two analysts is for revenues of US$9.00m in 2020 which, if met, would be a major 76% increase on its sales over the past 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 50% to US$0.44. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$11.9m and losses of US$0.35 per share in 2020. There's been a definite change in sentiment in this update, with the analysts administering a notable cut to next year's revenue estimates, while at the same time increasing their loss per share forecasts.

The analysts lifted their price target 33% to US$12.00, implicitly signalling that lower earnings per share are not expected to have a longer-term impact on the stock's value.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Envision Solar International's past performance and to peers in the same industry. It's clear from the latest estimates that Envision Solar International's rate of growth is expected to accelerate meaningfully, with the forecast 76% revenue growth noticeably faster than its historical growth of 29%p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.9% next year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Envision Solar International to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2021, which can be seen for free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Envision Solar International (at least 2 which are significant) , and understanding them should be part of your investment process.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.