If You Like EPS Growth Then Check Out Industrial and Commercial Bank of China (HKG:1398) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Industrial and Commercial Bank of China (HKG:1398), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Industrial and Commercial Bank of China

Industrial and Commercial Bank of China's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Over twelve months, Industrial and Commercial Bank of China increased its EPS from CN¥0.82 to CN¥0.86. That's a modest gain of 5.1%.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Industrial and Commercial Bank of China's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Industrial and Commercial Bank of China's EBIT margins were flat over the last year, revenue grew by a solid 5.6% to CN¥639b. That's a real positive.

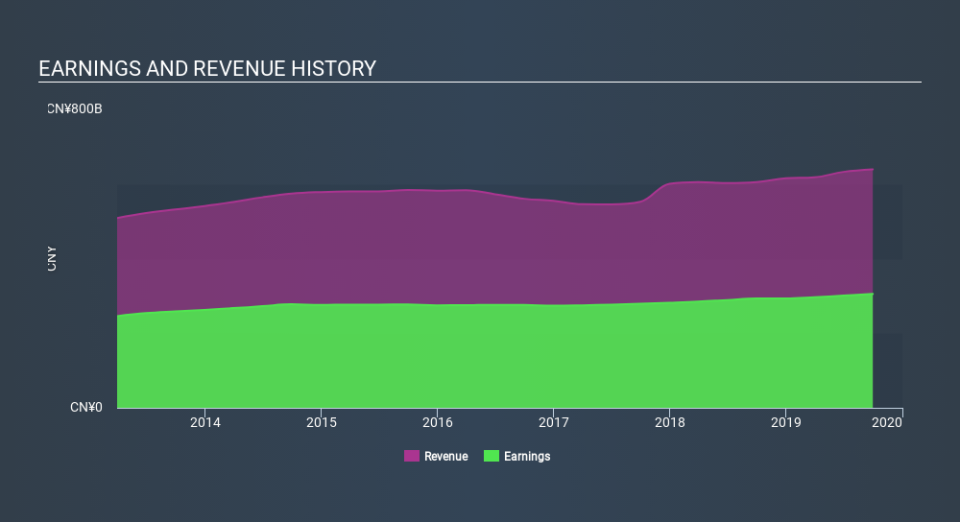

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Industrial and Commercial Bank of China.

Are Industrial and Commercial Bank of China Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalizations over CN¥55b, like Industrial and Commercial Bank of China, the median CEO pay is around CN¥7.9m.

The CEO of Industrial and Commercial Bank of China only received CN¥673k in total compensation for the year ending December 2018. That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Industrial and Commercial Bank of China Deserve A Spot On Your Watchlist?

As I already mentioned, Industrial and Commercial Bank of China is a growing business, which is what I like to see. Not only that, but the CEO is paid quite reasonably, which makes me feel more trusting of the board of directors. So I do think the stock deserves further research, if not instant addition to your watchlist. Of course, just because Industrial and Commercial Bank of China is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Although Industrial and Commercial Bank of China certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.