Estate agent Countrywide slumps on fundraising proposal as losses mount

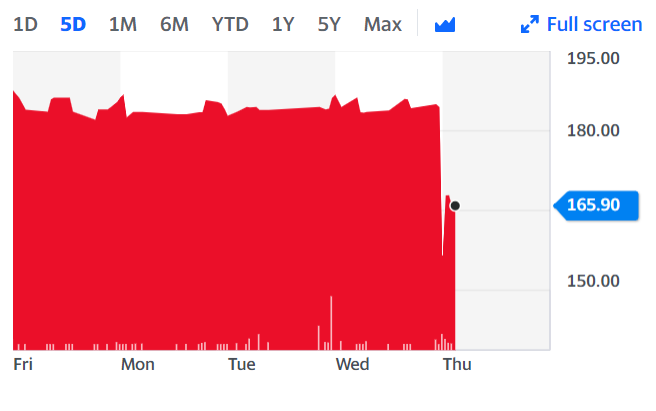

Countrywide (CWD.L) shares fell in early trading in London as it announced a fundraising proposal to support the beleaguered business.

The estate agent’s stock was down as much as 12% following the announcement that it was planning a £90m ($120.06m) capital raise.

Watch: What is inflation?

It will be underwritten by Alchemy, a private equity investor and current shareholder in Countrywide as well as a new £75m term loan facility with existing lenders, which will be repayable four years after it is firmly put in place.

“The term loan and a portion of the proceeds from the capital raise will be used to repay the [company’s] existing indebtedness,” said Countrywide in a trading statement on Thursday.

The additional investment from recapitalisation is conditional upon consent from a meeting of Countrywide’s shareholders that will be held shortly. Proceeds of the investment will be used to pay off some of its existing debts, which currently stand at £91.9m.

The business’s income was “significantly reduced” by COVID-19, but management said it moved quickly to mitigate the risk, including reducing salaries and accessing various government schemes.

READ MORE: West End landlord Shaftesbury asks shareholders for £300m

“The Group continued to make good operational progress in the execution of its turnaround plan and entered the year anticipating that the increase in activity in the UK property market following the decisive election victory in December 2019 would be sustained, and the Group saw the benefit of this in the first twelve weeks of 2020,” the company said.

“However, following the COVID-19 pandemic and the resulting impact on GDP and unemployment, the Group revised its cashflow projections looking forward and this has resulted in further impairment charges since those taken at the full year.”

After assessing the business’s trading and cash flow forecasts against the available financing facilities and covenants available, the board decided action needed to be taken to address the capital structure or the business would face further indebtedness by 2021.

WATCH: What is a budget deficit and why does it matter?