Why the Fed's new Beige Book survey is good for mortgage rates

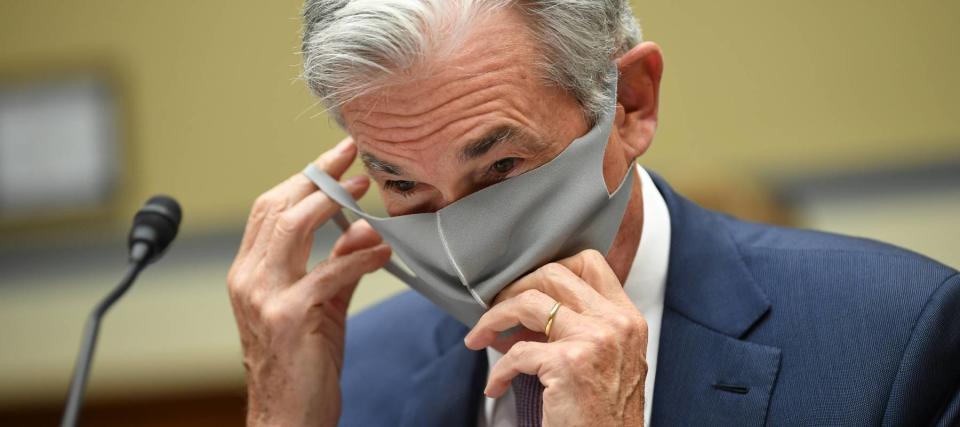

Chairman Jerome Powell and the other officials at the Federal Reserve say in a new report that the U.S. economy is growing at just a "slight to modest" pace with some industries doing better than others. Hiring is still slow, prices are rising modestly, and COVID-19 is raising costs for companies.

The "Beige Book" survey of economic conditions around the U.S. will be up for discussion when Fed officials sit down for their next policy meeting on Nov. 4 and 5. And, the report seems promising for homebuyers and homeowners.

That's because there's nothing to suggest the Fed will veer from its current plan of keeping interest rates at next to nothing until 2024.

That policy has helped create the climate for today's lowest-ever mortgage rates — which have been one of the bright spots for the economy, the Beige Book suggests.

Fed not likely to be 'thinking about thinking about raising rates'

The book doesn't point to changes in the Federal Reserve's stance, which Chairman Jerome Powell described this way at a June news conference: "We're not even thinking about thinking about raising rates."

The Fed chopped a key interest down close to zero in March as the coronavirus started beating up on the economy, and a forecast from last month's Fed meeting indicated a rate hike won't come before 2024.

The central bankers aren't likely to move off that course, because the Beige Book says the economic recovery has been uneven: "Changes in activity varied greatly by sector."

Manufacturing is coming back at a "moderate pace," retail sales are leveling off, tourism is seeing a little bit of improvement, but restaurants are worried that cooler weather will hurt business by limiting outdoor dining, according to the report.

While most of the Fed's regional banks say employment is increasing, the growth in hiring remains slow, and employers continue to report new furloughs and layoffs.

How is this all good for mortgage rates?

While there's no direct connection between the benchmark interest rate the Fed controls and the rates on home loans, the central bank has an influence on mortgage rates. It's unlikely they'll take off as long as the Fed is holding its rate down.

Since the central bank slashed its "federal funds rate" to the bone in March, home lending rates have hit new all-time lows 10 times, says mortgage company Freddie Mac, which has been tracking mortgage rates for nearly half a century.

Average 30-year mortgage rates for buying homes and refinancing have been below 3% for much of this year, and if you shop around you might now find rates as low as the neighborhood of 2.5%.

Those ultra-low rates have been good for the economy, the Beige Book suggests.

The Federal Reserve Bank of San Francisco reports lending activity has been picking up, with sources saying "the bulk of demand was for home mortgages and refinancing as households took advantage of low interest rates."

What can homeowners and homebuyers expect?

The Beige Book doesn't show any immediate threats to today's amazingly low rates on home loans, but a new fee could push refinance rates higher later this fall.

To beat the fee, borrowers should be shopping around for low rates on new and refinance mortgages now.

Rates spiked in mid-August when Freddie Mac and Fannie Mae — government-sponsored mortgage giants that buy most U.S. home loans from lenders — made the surprise announcement that a 0.5% fee would be applied to refi loans starting Sept. 1.

After an uproar, a federal regulator pushed the launch to Dec. 1. But already, some lenders have been passing the fee along to consumers in the form of higher mortgage rates.

To find the best rates available in your area and for a person with your credit score, gather quotes from at least five lenders and compare them side by side.

Keep those comparison shopping skills in your back pocket for when it's time to buy or renew your homeowners insurance, so you'll feel confident you're getting the right coverage at the right price.