Former Domino’s Pizza CEO Joins Forces With Restaurant Brands. Is the Stock Set to Skyrocket?

Written by Motley Fool Staff at The Motley Fool Canada

Restaurant Brands International (TSX:QSR) — parent company of Burger King, Popeyes Louisiana Kitchen, Tim Hortons, and Firehouse Subs — has hired Patrick Doyle as executive chairman. Doyle is a legend for restaurant investors because he helmed the ship at Domino’s Pizza (NYSE:DPZ) as it sailed to a greater than 2,200% gain in just eight years.

In the past month alone, QSR stock has risen almost 11%. Will the good times keep rolling? Here’s what Restaurant Brands investors need to know.

First, the market-crushing pizza stock

When Doyle took over in March 2010, Domino’s was in the dumps. The business was ok — full-year revenue for 2009 only fell 1% from 2008. But the product was bad. So Doyle had the company redo its pizza recipe and launched an ad campaign admitting to its previous culinary shortcomings.

The result: Consumers absolutely loved Domino’s 2.0. In the first quarter of 2010, same-store sales (SSS) surged 14.3% in response to the better pizza — a gain that Doyle called “unprecedented.” For the year, same-store sales were up almost 10%. Domino’s new pizza continued driving that growth every quarter for the next decade.

Same-store sales growth was (and is) key for Domino’s for two reasons. First, restaurant companies typically have thin profit margins, but these can increase dramatically with greater sales volume. Consider that Domino’s is roughly 98% operated by franchisees. By increasing restaurant-level profitability through same-store sales growth, franchisees are kept happy. Moreover, franchisees are more motivated to open new locations.

When Doyle came in as Domino’s CEO, the company had fewer than 500 company-owned locations but had about 9,000 total locations around the world. Today, Domino’s still has fewer than 500 company-owned stores. But it’s closing in on 20,000 locations worldwide — all of the growth has come from franchisees.

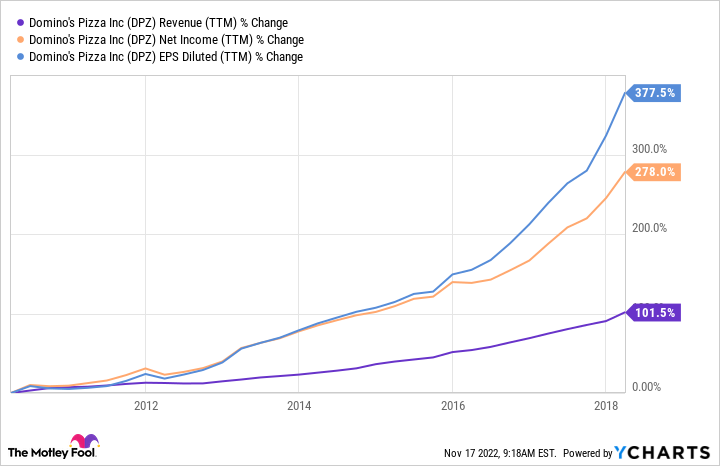

From March 2010 through June 2018, Domino’s revenue only roughly doubled — franchised locations don’t add much to the franchiser’s top line. But franchise fees are higher margin than restaurant sales. Unsurprisingly, Domino’s net income nearly quadrupled over this time span. And earnings per share (EPS) jumped even higher because Domino’s was repurchasing shares.

DPZ Revenue (TTM) data by YCharts

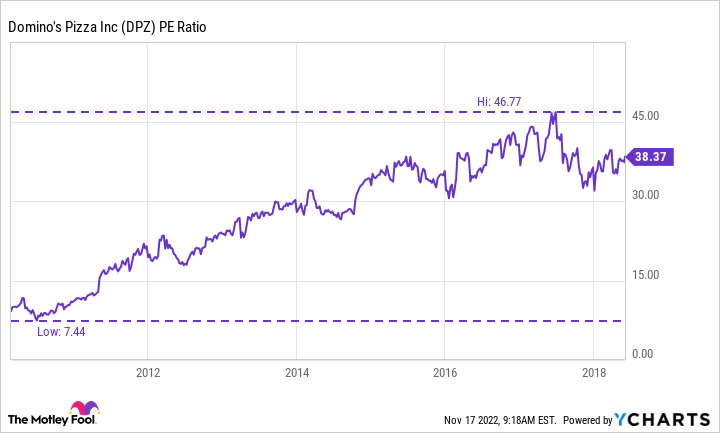

Finally, Domino’s Pizza stock also succeeded under Doyle because investors believed again. The stock traded at a price-to-earnings (P/E) ratio of about 10 at the start of 2010 — very inexpensive. By the time Doyle left, it traded closer to a P/E of 40.

DPZ PE Ratio data by YCharts

Is Restaurant Brands stock a buy?

In Restaurant Brands’ press release announcing his hire as executive chairman, Doyle said, “I am confident we can create one of the most compelling growth stories in the industry.” And Doyle’s money is where his mouth is. His compensation is tied to the stock price. And he personally invested $30 million with a five-year committed hold period.

However, for those hoping for greater than 2,000% gains in Restaurant Brands stock — like Domino’s — there’s an important caveat. Restaurant Brands is in better shape and has a better valuation than Domino’s in 2010. The company’s revenue, net income, and EPS are all up over the past five years. And the stock trades at a P/E ratio of almost 22 — a slight premium to the market’s average.

Therefore, some of the possible Domino’s-esque catalysts are off the table for Restaurant Brands stock. That said, it can still generate positive returns for shareholders. Here’s how.

Burger King is already quite large with over 19,400 worldwide locations. However, Tim Hortons, Popeyes, and Firehouse still have room to expand with only 5,400, 3,900, and 1,200 locations, respectively. Moreover, management says it would like to acquire another restaurant chain as well, which would provide another expansion opportunity.

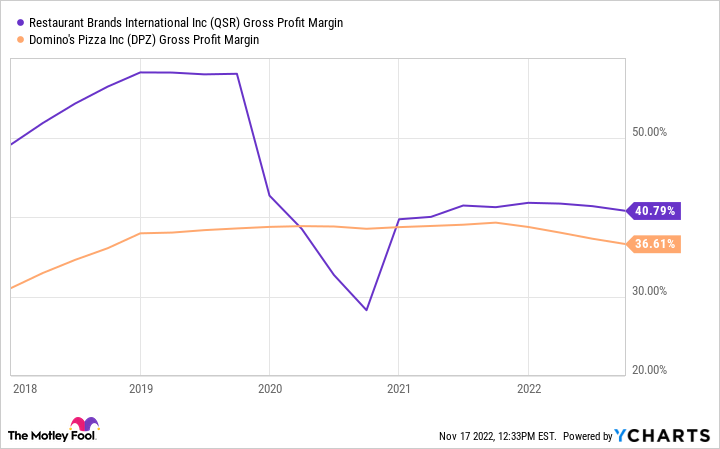

Opening new restaurants will grow Restaurant Brands’ revenue. However, net income probably won’t grow at a much greater pace than revenue, unlike Domino’s. Back in 2010, Domino’s gross margin was low and able to expand with higher revenue. By contrast, Burger King’s margin is better, as seen below. Moreover, a big hindrance to margin expansion is Tim Hortons’ supply chain logistics, which are mostly company-owned.

QSR Gross Profit Margin data by YCharts

Doyle is a proven operator, and Restaurant Brands is lucky to have him. But this isn’t the turnaround opportunity that Domino’s was. The company’s revenue and earnings will likely rise, but probably not at a spectacular pace. Share repurchases and its high-yield dividend (currently 3.3%) should further boost shareholder returns, possibly even making this a market-beater over the long term. But my guess is that returns for Restaurant Brands will be more in line with the market average.

The post Former Domino’s Pizza CEO Joins Forces With Restaurant Brands. Is the Stock Set to Skyrocket? appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Restaurant Brands International?

Before you consider Restaurant Brands International, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in November 2022 ... and Restaurant Brands International wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 15 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 11/4/22

More reading

4 TSX Dividend Stocks Offering Big Income in a Bearish Market

Just Released: The 5 Best Stocks to Buy in November 2022 [PREMIUM PICKS]

The 3 Best Dividend Stocks to Buy in November 2022 [PREMIUM PICKS]

The Motley Fool recommends Domino's Pizza and Restaurant Brands International. The Motley Fool has a disclosure policy.

2022