A Fresh Bout of Italian Political Risk Puts Investors on Edge

(Bloomberg) -- The prospect of a comeback for the populist Italian firebrand Matteo Salvini was hanging over markets on Wednesday after a key political rival stepped down, raising the chances of an early election that could pave the way for him to pursue his euroskeptic agenda.

The resignation of Luigi Di Maio as leader of the Five Star Movement has unsettled investors wary of another standoff between Italy and the European Union. Bonds fell as much as eight basis points on fears about the government’s stability but then recovered as the fragile coalition held together.

For now investors see a weaker government whose key members are compelled to cling to power and avoid a snap election that they would be likely to lose.

“Our economists’ base case is that the coalition government survives through 2020,” George Cole, managing director at Goldman Sachs International in London, said in a client note. He expects the Italian bond yield premium to narrow against Spanish and Portuguese peers as data stabilizes and the European Central Bank continues to snap up assets in the region.

Bank stocks in the country bore the brunt of selling, and the FTSE Italia All-Share Banks Index dropped 1.6% as of 3.39 p.m. in London.

The key focus now will be local elections this weekend: Gains for the League party could send the spread between benchmark Italian bonds and their German peers to beyond 200 basis points, predicts Peter McCallum, rates strategist at Mizuho International Plc in London. The gap is steady at 162 basis points.

“Even a benign election result at the weekend would likely still leave an uncertain political situation,” McCallum said.

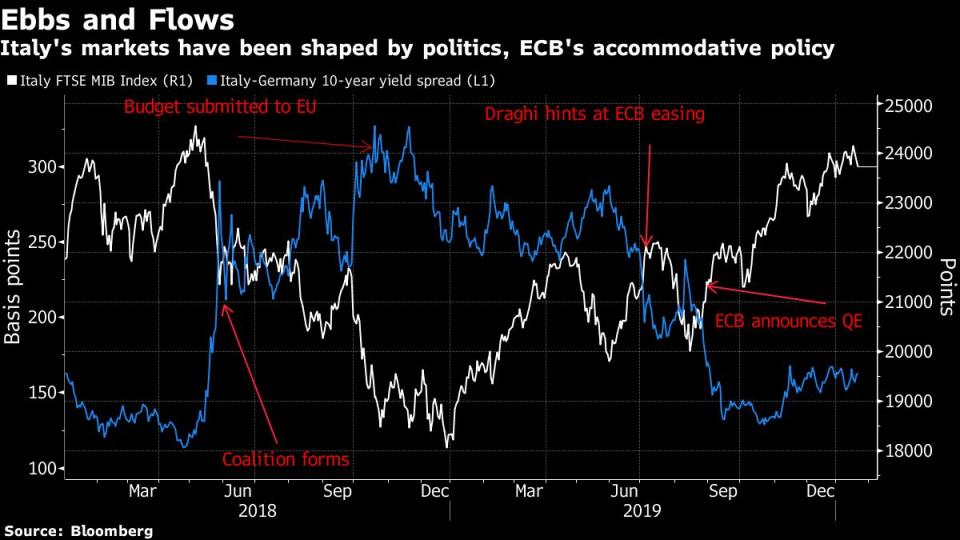

The developments threaten to add pressure to the nation’s bonds, which have been drifting lower in recent months after a stellar run in 2019. The yield on the benchmark posted the biggest annual drop in five years as the ECB, a key buyer of Italian debt, resumed its stimulus measures.

Despite the apprehension there are some who think the market could live with a Salvini government. A general election campaign would likely herald higher volatility and wider spreads, but these could re-tighten even if Salvini wins, according to Antoine Bouvet, a senior rates strategist at ING Groep NV in London.

“Historically the League has been seen as a more pro-business party,” he said. “Some of their planned tax cuts would threaten the deficit but it could also boost growth. Once the election is out of the way, with presumably a League victory, I think markets will come to terms with a Salvini-led government.”

Here’s what other strategists are saying:

MUFG Bank Ltd. (League government could be negative for the euro)

Lee Hardman, currency strategist.

“It is a more euro-negative threat with respect to the Italian government’s commitment to at least bring public finances in line with euro-zone ideals. If the League were to take over, then at face value there is more risk of confrontation between the EU and the Italian government further down the line, and that is something that could be destabilizing and euro negative. At this stage it is all ifs, buts and maybes.”

Societe Generale SA (Politics for now will have little impact on credit)

Juan Valencia, credit strategist.

“If BTPs really underperform, some Italian credit would widen in sympathy. For the overall market, it won’t matter much, unless things deteriorate badly. There is big demand for credit and people keep buying.”“If you start seeing weakness in BTPs, then the banks are going to come under pressure and some corporates but I would see this as a temporary setback, probably an opportunity to buy.”

Rabobank (Sell-off is a buying opportunity)

Lyn Graham-Taylor, senior rates strategist.

“I would fade today’s sell-off” as the Democratic Party and Five Star are lagging in the polls and have little incentive to call a snap election.

Colombo Wealth SA (League win in Sunday’s elections could create opportunities)

Alberto Tocchio, chief investment officer.

“Of course it could create some unwanted political instability in Italy and Europe and to me the best trade is to go long the widening of the BTP-bund spread.”“If there is an over-reaction on Monday with a substantial sell-off of Italian equities, it could be a nice entry opportunity in a unloved market with some decent stocks that are offering an high dividend yield.”

ING Bank NV (Spreads could tighten on a Salvini government)

Antoine Bouvet, rates strategist.

“There is a more technical reason why spreads will re-tighten even if Salvini is elected: investors cannot stay underweight/short Italian bonds for too long. They offer a much better carry than other government bonds and represent too large a portion of the market for investors to ignore them.”

(Adds comment from Goldman Sachs in fourth paragraph and new chart.)

--With assistance from Anooja Debnath, Tasos Vossos and Ksenia Galouchko.

To contact the reporters on this story: William Shaw in London at wshaw20@bloomberg.net;James Hirai in London at jhirai3@bloomberg.net

To contact the editors responsible for this story: Dana El Baltaji at delbaltaji@bloomberg.net, Cecile Gutscher, Sam Potter

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.