Garmin (GRMN) Q3 Earnings & Sales Beat Estimates, Up Y/Y

Garmin Ltd. GRMN has reported third-quarter 2020 pro-forma earnings of $1.58 per share, beating the Zacks Consensus Estimate by 56.4%. Moreover, the bottom line improved 24.4% on a year-over-year basis and 73.6% sequentially.

Net sales were $1.11 billion, which surpassed the Zacks Consensus Estimate of $907.4 million. Further, the figure increased 19% from the year-ago quarter and 27.5% sequentially.

Top-line growth was driven by strong performance delivered by the company’s marine, outdoor and fitness segments. Moreover, increasing demand for active lifestyle products remained a major positive.

However, sluggishness in its auto and aviation segments was concerning.

Nevertheless, Garmin’s strong focus on continued innovation, diversification and market expansion to explore opportunities across all business segments remains a major positive. Further, its strong product lines are expected to aid its performance in the current quarter.

Segmental Details

Outdoor (30.2% of net sales): The segment generated sales of $334.84 million during the reported quarter, improving 30% year over year. The year-over-year increase was primarily driven by robust demand for Garmin’s adventure watches.

Fitness (29.6%): This segment generated sales of $328.45 million, which increased 35% from the year-ago quarter. This can be primarily attributed to its well-performing advanced wearables and cycling products.

Aviation (13.6%): The segment generated sales of $151.11 million, declining 19% on a year-over-year basis. This was due to sluggish contributions from ADS-B products. Also, weak shipments to OEM customers remained a headwind.

Marine (14.9%): Garmin generated sales of $165.44 million from this segment, increasing 54% on a year-over-year basis. The company witnessed solid momentum across chartplotters during the reported quarter, which, in turn, drove the segment’s revenues.

Auto (11.7%): This segment generated sales of $129.36 million, down 6% from the prior-year quarter. The decline was primarily due to softness in the personal navigation device market. Nevertheless, Garmin witnessed strengthening momentum across specialty categories and new OEM programs.

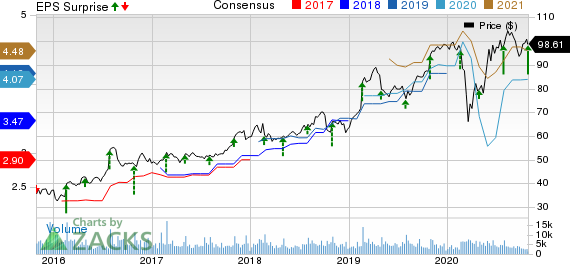

Garmin Ltd. Price, Consensus and EPS Surprise

Garmin Ltd. price-consensus-eps-surprise-chart | Garmin Ltd. Quote

Revenues by Geography

Americas: Garmin generated sales of $521.87 million from this region during the reported quarter (47% of net sales), up 19% year over year.

EMEA: This region generated sales of $407.86 million in the third quarter (36.8%), up 19% on a year-over-year basis.

APAC: The company generated sales of $179.47 million from this region (16.2%), improving 19% from the year-ago quarter.

Operating Results

In the third quarter, gross margin was 60.2%, which contracted 50 basis points (bps) from the year-ago period.

The company’s operating expenses of $350.9 million were up 14.7% from the prior-year quarter.However, as a percentage of revenues, the figure contracted 110 bps year over year to 31.6%.

Operating margin of 28.6% in the reported quarter expanded 60 bps year over year.

Balance Sheet & Cash Flow

As of Sep 26, 2020, cash, cash equivalents and marketable securities came in at $1.65 billion, lower than $1.74 billion as of Jun 30, 2020.

In the third quarter, inventories were $821.4 million compared with $813.2 million in the second quarter. We note that the company had no long-term debt in the reported quarter.

Further, it generated $274.3 million of cash from operations during the reported quarter compared with$199.2 million in the previous quarter.

Further, the companygenerated free cash flow of $235.5 million.

Further, Garmin paid out dividends worth $117 million to shareholders in the third quarter.

2020 Guidance

The company projects net sales at $4 billion, which is expected to be driven by growth in marine, outdoor and fitness segments. Notably, year-over-year growth in these segments is projected at 25%, 15% and 20%, respectively.

Garmin anticipates aviation and auto segments to exhibit year-over-year declines of 17% and 20%, respectively.

The Zacks Consensus Estimate for 2020 net sales is pegged at $3.73 billion.

Further, the company expects gross margin and operating margin of 59% and 24%, respectively.

Also, it projects pro-forma earnings at $4.70 per share. The consensus mark for 2020 earnings is pegged at $4.07 per share.

Zacks Rank & Stocks to Consider

Garmin currently carries a Zacks Rank #3 (Hold).

Some other top-ranked stocks in the broader technology sector are Fortinet FTNT, CDW Corporation CDW and Qorvo QRVO. All three companies carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth rate of Fortinet, CDW and Qorvo is pegged at 14%, 13.1% and 12.35%, respectively.

Zacks’ 2020 Election Stock Report:

In addition to the companies you learned about above, we invite you to learn more about profiting from the upcoming presidential election. Trillions of dollars will shift into new market sectors after the votes are tallied, and investors could see significant gains. This report reveals specific stocks that could soar: 6 if Trump wins, 6 if Biden wins.

Check out the 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research