GM thought it had a slam dunk deal with EV startup Nikola — but it may have underestimated the risk founder Trevor Milton posed to its future

REUTERS/Massimo Pinca

Just weeks after GM and Nikola established a strategic partnership, the deal has become embattled amid allegations of fraud against the electric truck startup.

The SEC and DOJ are investigating, and Nikola founder Trevor Milton stepped down as chairman this week. His replacement is Stephen Girsky, a GM veteran who formed the blank-check investment fund that merged with Nikola earlier this year, taking the automaker public.

GM has what looked like a risk-free deal to use Nikola vehicles as platforms for GM's new Ultium battery technology.

But GM's risk assessment might have underestimated Milton's entrepreneurial willingness to distort capabilities in the interest of creating a great story.

Once the details of General Motor's $2 billion deal with electric and fuel-cell vehicle startup Nikola came to light, it was clear that the largest US automaker wasn't taking any big risks.

GM's 11% equity stake in Nikola was wrapped up with a $700 million payment to GM, to effectively make it a contract manufacturer for Nikola's Badger pickup. The truck would be a showcase for GM's new Ultium battery technology, along with the electric Cadillac and Chevy models the automaker will roll out in the next few years.

Moreover, while the new pickup would be Nikola-badged, GM would get 80% of the emission credits associated with the vehicle (with an option on the rest), offsetting GM's portfolio of top-selling gas-powered pickups and SUVs.

So: GM was spending exactly nothing. It had a fresh place to showcase its new battery tech. And it would get the credits to make meeting regulatory demands easier.

The only meaningful risk in an otherwise slam dunk deal was reputational: What if Nikola founder and chairman Trevor Milton, an outspoken character, proved to be a liability?

He had, after all, spontaneously started fights with both Bloomberg and CNBC this year, attacking reporters and insisting that if he were punched, he would punch back.

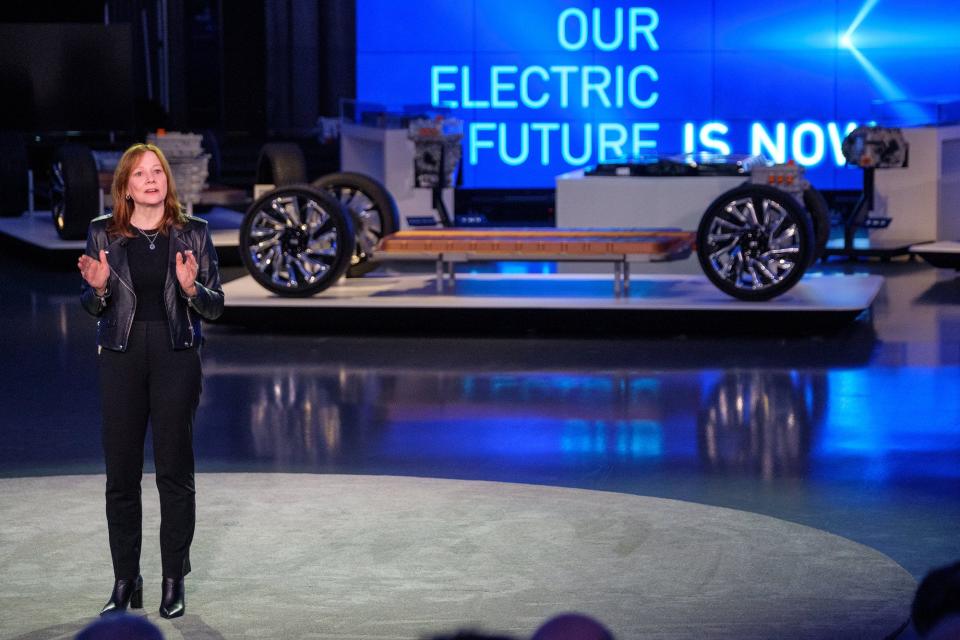

GM is a company that's happy to defend itself against media criticism, but it typically doesn't start fights, favoring a more diplomatic approach (in many ways, GM runs itself like a country, not a firm). But CEO Mary Barra seemed unconcerned. She joined Milton on a conference call with reporters when the Nikola deal was announced. After allegations of fraud emerged from a short-seller's damning report published just days after the deal was announced, she defended GM's due diligence to Wall Street.

And then everything got more complicated

GM

That was before Milton stepped down this week, with Stephen Girsky taking over as chairman. The former GM board member and executive created the blank-check fund, VectoIQ, that acquired Nikola earlier this year and took it public in a $3.3 billion reverse merger. The move generated a market capitalization that, at one frothy point, surpassed Ford's.

Nikola shares have slid more than 30% since Hindenburg Research, a firm run by Nate Anderson, released a report on September 10 alleging that Nikola is "an intricate fraud." Hindenburg also disclosed a short position on the stock. (GM stock declined as well, but not as much as Nikola's — cold comfort for a company whose shares have underperformed the markets since 2010.)

Anderson's report — "Nikola: How to Parlay An Ocean of Lies Into a Partnership With the Largest Auto OEM in America" — maintained among other things that Nikola had promoted proprietary technology that didn't exist, claimed it was on the verge of a battery breakthrough and a revolution in hydrogen production for fuel-cell purposes, and showcased a non-functional semi-truck prototype, a "pusher" in the parlance of the auto industry.

The SEC and the Department of Justice opened probes into Nikola's business, and GM's riskless deal, slated to close before the end of September, started to look a lot riskier than anyone had reckoned. But the big automaker, in a statement to Business Insider, affirmed its commitment to what it had previously termed a strategic partnership.

"We acknowledge Trevor Milton's departure from Nikola and the decision of the Nikola Board to move forward," the company said.

"We will work with Nikola to close the transaction we announced nearly two weeks ago to seize the growth opportunities in broader markets with our ... fuel cell and Ultium battery systems, and to engineer and build the Nikola Badger. Nikola, Honda and other companies who are looking to GM's technology as a platform for their products, represent just one part of our overall EV strategy. Our overall goal is to put everyone in an EV and accelerate adoption."

(GM's arrangement with Honda entails an investment in self-driving company Cruise, which GM acquired in 2016 and is now led by former GM President Dan Ammann, and a North American alliance to develop new vehicles.)

Milton had to go

Nikola

Still, what looked like a foolproof deal for GM had become anything but, as the media and Wall Street swarmed the Hindenburg news.

"It's clear Steve Girsky and Nikola were not prepared for serious public scrutiny, even if Girsky did have a full understanding of Nikola's capabilities before initiating the talks with GM," Karl Brauer, executive analyst at online auto resource iSeeCars.com, said in an email to Business Insider.

"Regardless of what Girsky and GM knew before the Hindenburg report, there's the appearance of Nikola misleading them. That doesn't negate the long-term potential of the partnership, but it undeniably damages the short-term image of both companies while putting more pressure on GM and Nikola to deliver something concrete as soon as possible."

The fastest way to take unexpected risk off the deal and assure investors that Nikola was being professionally managed was to sacrifice Milton, and the Nikola board did so in short order — though Milton's resignation was voluntary. According to an SEC filing, Milton also gave up all his performance-based equity and agreed to stay out of Nikola's business for three years. (He will remain available as a consultant through December.)

The flashy are falling

Getty

If you're keeping track, high-profile founders are struggling to retain their positions at high-profile companies, once those companies start moving toward going public. Travis Kalanick was forced out of Uber in 2017 as the ride-hailing company sought to reform a bare-knuckled, sexist culture, and Adam Neumann was deposed from WeWork prior to the commercial real-estate startup's IPO last year, when a bevy of questionable management details were revealed.

Milton now joins their ranks, and some of his controversies weren't even that controversial: The Hindenburg report alleged that Nikola's semi-trucks weren't ready for prime time when they were showcased for potential customers, something GM likely assessed as an opportunity to provide a startup with what it couldn't develop on its own, such as salable vehicles and viable drivetrains.

For GM, this is all more of a headache than a terminal illness. The company is still selling millions of gas-powered cars and trucks every year, and it should meet its 22-EVs-by-2023 goal should with its own vehicles.

But it is yet another instance of new-economy entrepreneurship, with all its positives and negatives — creating excitement and then colliding with the more mundane concerns of dealmaking with the old-economy players who want to join in, but who have to play by well-established rules.

The big question now is whether GM has stabilized the deal, or whether there's more trouble on the horizon.

Read the original article on Business Insider