Got prepaid credit cards for Christmas? Here's why you should use them up fast

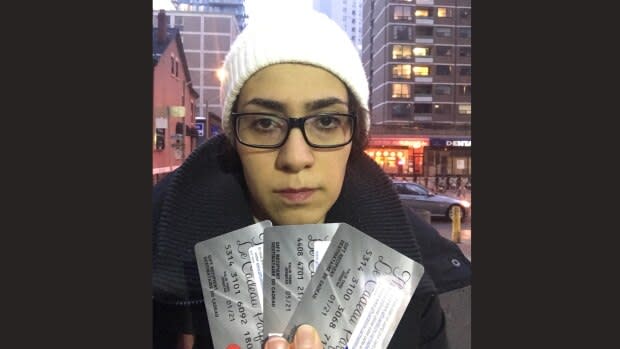

A Toronto woman is warning people who may have received prepaid credit cards for Christmas to use them immediately.

Even though they're called "The Perfect Gift" on the packaging, Najme Farahani says the cards don't live up to their name after she discovered her own cards were left without a balance due to monthly fees.

"The way the system works just didn't seem nice. It's very hostile," she said. But the company that distributes the cards has told CBC News it is following federal rules and is transparent about the fees that are charged.

Farahani received several cards as gifts for her baby shower in March 2018. She said she did not feel the need to spend them right away, especially as the expiry date was years away.

She decided to use them in December, but discovered their initial worth of $175 went down to virtually nothing.

"I was very angry," she said.

To her surprise, there is a monthly fee of $3 deducted from each of the cards after one year. Cards like hers usually charge other fees that eat away at the balance, as well.

'How much profit is enough?'

"I knew it wasn't the biggest thing in the world but couldn't understand," she said.

"How much profit is enough?"

After several calls to Peoples Trust, the trust company that offers the cards, Farahani was able to recoup $49.

But she gave up on the rest because she had already spent a lot of time on the phone with the company's customer service representatives.

She says she's going public with her story to warn other cardholders to spend the balances on their cards quickly.

That's also the advice of Ken Whitehurst, executive director of the Consumers Council of Canada.

'A badly regulated area'

"A lot of these programs are designed to extract value at your expense," he said. "The longer you let it sit around, the more the costs run up."

Whitehurst says there's "no reason" that should be happening.

"It's a badly regulated area."

While gift cards are regulated by the province and companies aren't allowed to charge fees or implement an expiry date, prepaid credit cards are under federal jurisdiction.

Federal rules stipulate only that the financial institutions that issue the cards must state the monthly fees on the card and can't start charging them until a year after they're purchased, as in Farahani's case.

Blackhawk Network Canada, which distributes the Perfect Gift Visa cards on behalf of Peoples Trust, told CBC News in a emailed statement the monthly fees "support the program operations."

The statement goes on to say the "Perfect Gift Visa Prepaid Cards issued by Peoples Trust Company comply with the Federal Prepaid Payment Products regulations that have been in place since 2014."

The company makes "every effort to make any usage details (including fees and expiry) as clear as possible to consumers," the email continues.

"With proper disclosure, monthly maintenance fees can be assessed on a card starting 12 months after purchase and every month thereafter as long as a positive balance remains on the card."