Hampton banker made ‘highly unusual’ loan to Alex Murdaugh, documents show. Why?

A now-fired Hampton bank CEO, as financial representative for a teenager injured in an accident, inexplicably loaned Alex Murdaugh $40,000 from the teen’s settlement funds in 2011, court documents show.

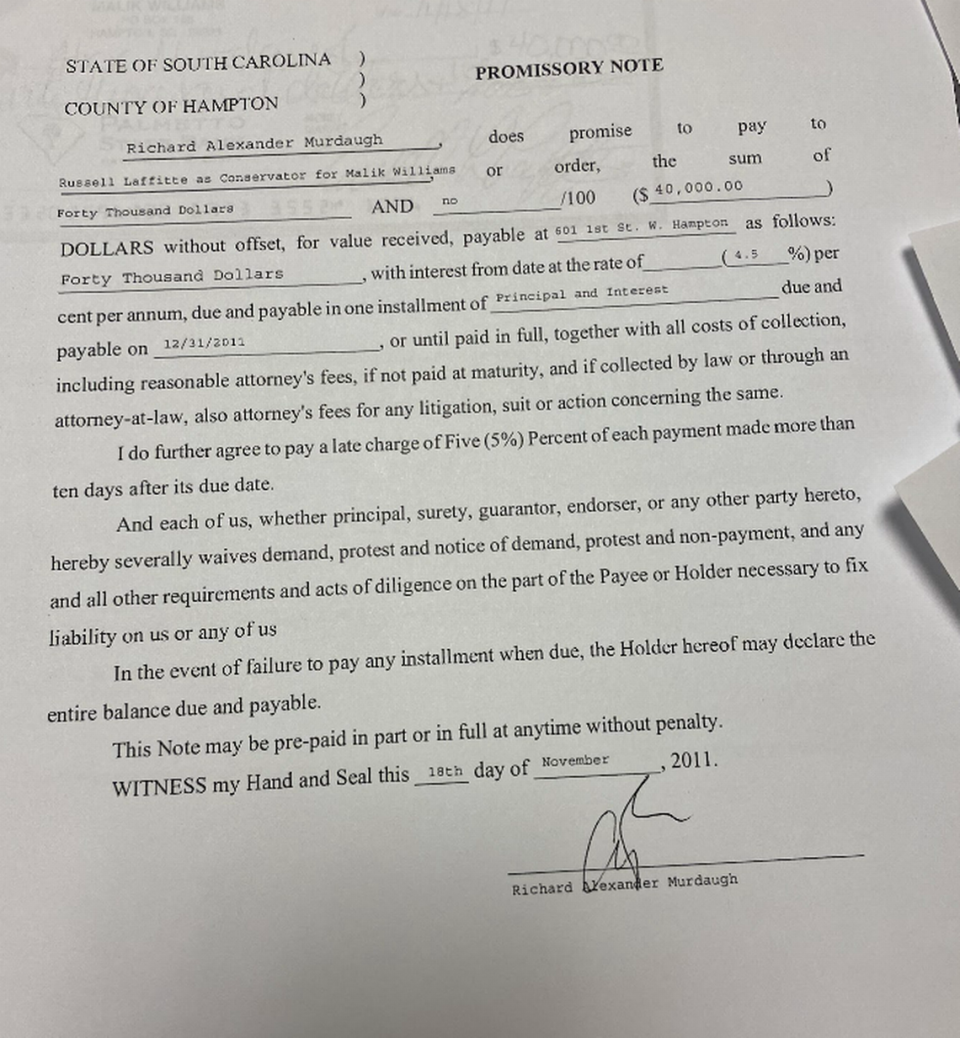

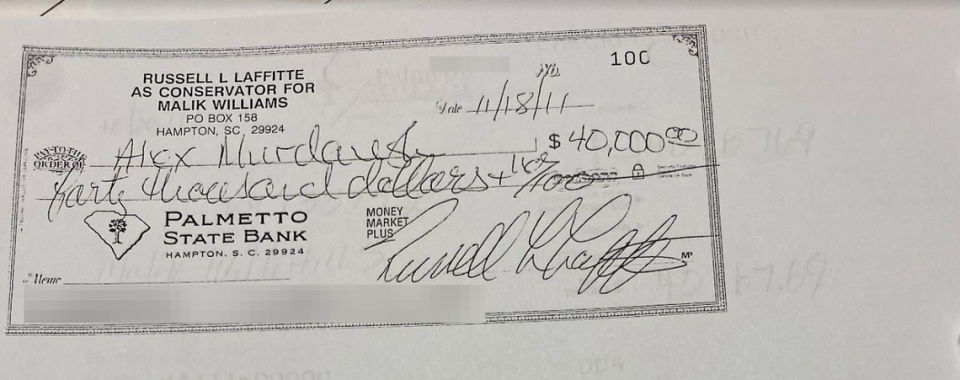

Russell Laffitte, who was fired as CEO of Palmetto State Bank on Jan. 7, signed off on a $40,000 loan from an Estill teenager’s approximately $58,000 in settlement proceeds. Murdaugh requested the loan and was required to pay it back in six weeks with interest, documents show.

“I find that highly unusual,” said Margaret Day, a Bluffton-based estate attorney for the Law Office of Margaret S. Day LLC.

The personal loan was unsecured, meaning there was no collateral to back it up if Murdaugh never paid, and it contained no description about how Murdaugh would use the money, according to the promissory note.

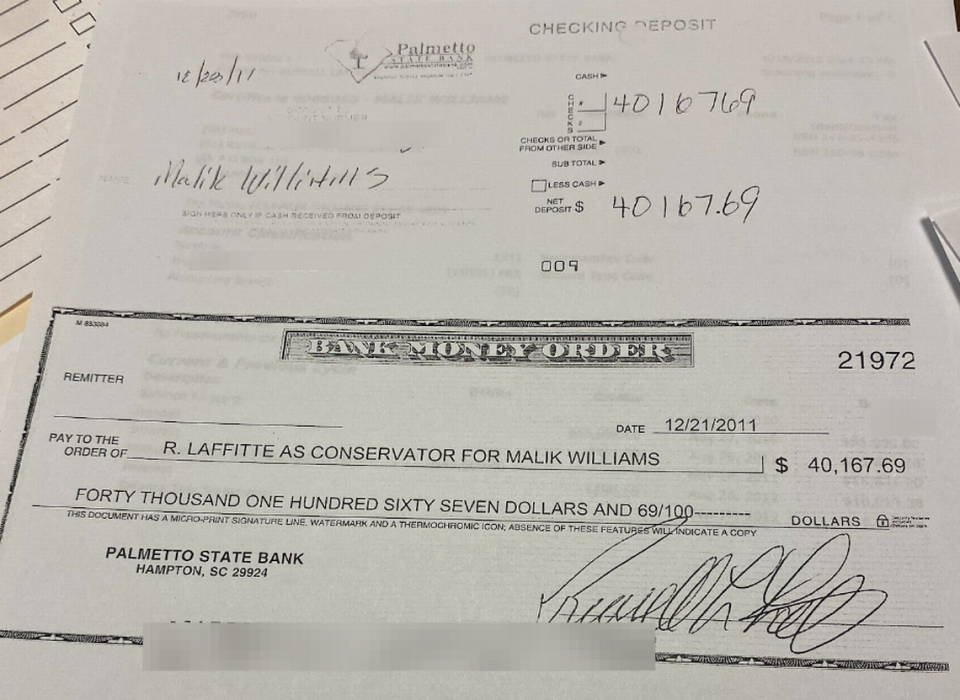

The money, with interest, was returned to the account one month and three days later in the form of a money order from Laffitte, but it’s not clear whether Murdaugh himself paid it back.

The suspicious transaction discovered by The Island Packet and Beaufort Gazette is among the documents requested by the S.C. Supreme Court’s Office of Disciplinary Counsel as part of its investigation into Murdaugh and its inquiry about Laffitte’s involvement. Already, Murdaugh is facing dozens of financial misconduct charges.

Last week, the newspapers learned of Laffitte’s firing after reporters asked Palmetto State Bank officials about a subpoena showing that the S.C. Supreme Court’s disciplinary arm in November had requested records of cases Laffitte and Murdaugh both worked on. The agency, which is investigating Murdaugh’s conduct as a lawyer, sent its subpoena to Hampton County Probate Court.

Laffitte served as conservator and a personal representative for members of a family involved in a 2009 car wreck that left one man a quadriplegic. Murdaugh was their lawyer, and hundreds of thousands of dollars in settlement money went missing, attorney Justin Bamberg said last week.

Asked Friday whether the bank was reviewing cases in which Laffitte was conservator, Palmetto State Bank issued the following statement:

“Palmetto State Bank has taken immediate action to obtain all the facts about the allegations that have been made, including those involving any former officers. It remains committed to taking all the appropriate measures that may be warranted once it has conducted a thorough review of all the pertinent information.” The statement was attributed to G. Trenholm Walker and Thomas P. Gressette Jr., legal counsel for Palmetto State Bank, of Walker Gressette Freeman & Linton LLC.

A message for Laffitte left on Friday afternoon was not returned.

‘Never knew about’ transaction

One of the cases sent to the Supreme Court as a result of its subpoena was that of Malik Williams.

When he was 6 years old, Williams was hit by a car in Estill and badly hurt. His father died a week later in an unrelated incident. Paul Detrick, a lawyer from Murdaugh’s former law firm PMPED, helped secure a settlement for the boy to pay for medical expenses from his injuries.

Williams said they were advised by PMPED that they needed a conservator, and Laffitte was appointed.

Now 27 years old with his own landscaping business, Williams said he didn’t know Laffitte had loaned his money out.

“I never knew about it,” Williams said. “It makes me want to go trace it down, so I guess that’s what I’m going to do.”

The names of Laffitte and Murdaugh, from powerful, decades-old family dynasties in Hampton County, are sprinkled in case files in Hampton County Probate Court.

Probate Court houses records related to the estates of the deceased. It’s also where legal representatives, called “conservators,” file documents and oversee the finances of those who are incapable of overseeing them themselves.

Several probate cases involving Laffitte, reviewed by The Island Packet, show a system in which PMPED lawyers represented injured individuals or families reeling from a death, won a settlement, and directed them to Laffitte to serve as a conservator or personal representative.

It’s not unusual to have a conservator in Williams’ case, as S.C. law requires probate courts to appoint a conservator when minors come into settlements of more than $25,000. Williams was 16 at the time Laffitte was appointed his conservator.

Williams’ account contained about $60,000 when it was first created, and the main job of the conservator, as described to Williams and his family, was to hold the money for him until he turned 18.

Was the loan a wise investment?

According to S.C. law, a conservator “owes a duty to the beneficiaries of the trust .... [to] invest and manage trust assets as a prudent investor would.”

That could be why the $40,000 loan of William’s settlement funds was made to Alex Murdaugh. The account accrued $167.69 in interest in the month it existed.

Day, the Bluffton estate attorney, said one could question whether it was a “prudent” investment.

As conservator, Day said, “I wouldn’t feel comfortable making a loan to a private individual with no security for the bulk of my minor’s funds.”

She also said there’s the issue of PMPED’s involvement in the case and ties to Laffitte.

“By loaning to a partner of the attorney that represents Mr. Williams, is there a conflict of interest?” she said. “That would be a question I would ask.”

The probate court is required to regulate conservators and review their annual reports.

On Dec. 21, 2011, Laffitte paid off the loan with interest to Williams’ account in a money order in Laffitte’s name, according to documents. It’s unclear whether Murdaugh paid him back or Laffitte input the money himself.

Once he turned 18, Williams received the full amount leftover in his account: $58,107.35.

Families of influence

Prosecutors allege that Alex Murdaugh used his prestige and influence as a lawyer to siphon money from clients for years. More than a dozen victims have been included in indictments alleging the suspended lawyer stole from them.

“When we look at who he preyed upon allegedly, they were either people with longstanding family or personal contacts with him, or they were people who were particularly trusting and vulnerable because of their unfamiliarity with the system, or both,” said Creighton Waters with the S.C. Attorney General’s office at a recent bond hearing for Murdaugh.

In total, he is accused of taking more than $6 million. The allegations came to light as a result of sustained attention since the still unsolved murders of Murdaugh’s wife and younger son on June 7, 2021.

The Murdaugh family is known locally for running the five-county prosecutor’s office for over 80 years. The Hampton-based Laffitte family grew alongside them, purchasing Palmetto State Bank in 1955 and helping it expand into multiple branches across the Lowcountry.

Russell Laffitte had worked at the bank since 1997, according to his Linkedin page last week, which has since been taken down. Fired last week, he was also dropped as vice chairman of Independent Community Bankers of America, a national advocacy organization.

Laffitte has not been charged with a crime.