Here's what the stock market is facing down this week, from Fed moves to earnings that will set the tone for the rest of 2023

Good morning, team. I'm your host, Phil Rosen.

My colleagues and I have had some good fun over recent weeks with the viral language tool ChatGPT. The bot can convincingly write articles, balance a portfolio, and even respond to dating app messages.

So I wanted to see how it fared against the inimitable Warren Buffett.

ChatGPT took all of 30 seconds to spit out an analysis of Buffett's value-investing strategy, best-ever investment, and two stock picks that align with the billionaire's portfolio.

You can read the full story here.

Now, with the Federal Reserve kicking off a critical two-day meeting today, let's see what's on investors' radars.

If this was forwarded to you, sign up here. Download Insider's app here.

1. This is a make-or-break week for the stock market.

That's according to Fairlead Strategies' Katie Stockton, who cautioned investors that the strong rally so far this year is about to contend with some highly important technical indicators, Fed moves, and key earnings from mega-cap tech.

In a note Monday, Stockton explained that the S&P 500's recent breakout above 4,020 won't hold unless the index finishes the week above 4,050.

"A short-term overbought downturn cautions against positioning for upside follow-through prematurely. If a breakout is confirmed, next resistance is [about] 4,225," Stockton said. That marks about a 5% upside from current levels.

On Wednesday, Fed Chair Jerome Powell is expected to hike interest rates by 25 basis points, which could rattle markets.

Not only that, but a slate of mega-cap earnings from Apple, Amazon, and Alphabet are also due later this week. Any negative surprises could derail the January rally, Stockton said, and negate much of the recent recovery from 2022's vicious bear market.

"We believe the rally rests on the shoulders of heavyweights Apple, Amazon, and Alphabet, which are showing softness today as the market anticipates their earnings," Stockton wrote.

Mike Wilson, Morgan Stanley's top stock strategist, echoed Stockton's sentiment. The upbeat trajectory could fizzle out once the Fed announces the latest rate hike and reaffirms its commitment to combating high inflation, he explained.

"While there have been several positive developments, we think the good news is now priced, and reality is likely to return with month end and the Fed's resolve to tame inflation," Wilson wrote in a note to clients.

The upbeat start to the year for stocks can be chalked up to the seasonal January effect, as well as short covering and "FOMO," Wilson said.

"The reality is that earnings are proving to be even worse than feared based on the data, especially as it relates to margins," he added. "Secondly, investors seem to have forgotten the cardinal rule of 'Don't Fight the Fed'. Perhaps this week will serve as a reminder."

What stocks will you be watching this week to outperform or crash? Tweet me (@philrosenn) or email me (prosen@insider.com) to let me know.

In other news:

2. US stock futures fall early Tuesday, ahead of a number of central bank decisions. The Fed's interest rates decision Wednesday will be followed by the European Central Bank and Bank of England Thursday. Here are the latest market moves.

3. Earnings on deck: ExxonMobil, Samsung, Pfizer, and McDonald's, all reporting.

4. Evercore recommended investors buy these 20 stocks. This batch of oversold value names are due for a turnaround that will see them outperform in 2023 and beyond, strategists said. See the list.

5. Natural gas prices hit their lowest level in 21 months. Some parts of the East Coast have had near-record stretches of zero snowfall, even as freezing temperatures and winter storms blow through the southern states. Get the full details.

6. Russia and Iran are integrating their banking systems to get around being banned from SWIFT. Financial institutions in both countries have been cut off from the critical payments messaging system. A recent report said the two nations plan to use the new system to increase trade to $10 billion a year.

7. ChatGPT's soaring popularity has added $5 billion to the wealth of Nvidia's founder. Wall Street is betting on chip companies to lead the way in the AI boom, and so far Nvidia has emerged as a favorite. Cofounder Jensen Huang is now worth nearly $19 billion.

8. This 29-year-old entrepreneur used YouTube to create financial independence. Vanessa Ideh Adekoya said there are two key ways to earn passive income — and she shared what to focus on instead of side hustles.

9. Make these 10 trades right now for a guaranteed profit. That's according to Goldman Sachs, which said returns can follow whether one of these stocks soars or crashes after it reports earnings. Take a look at the names.

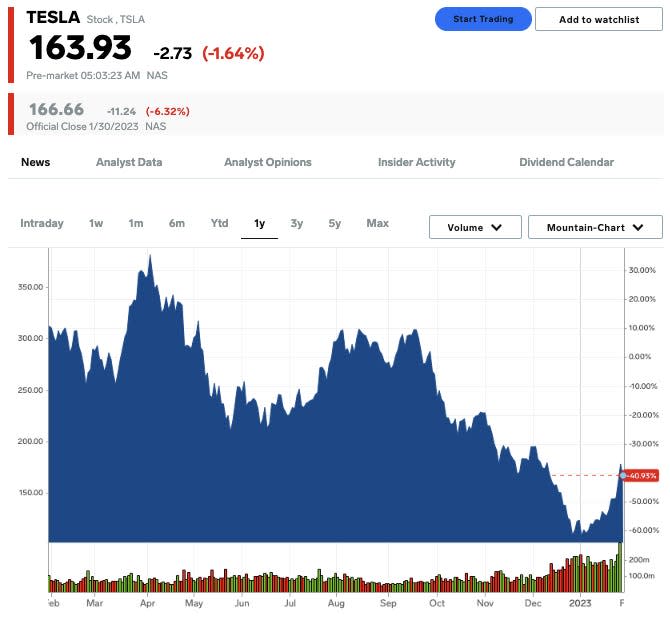

10. Tesla's market fortunes are turning around this month. Better-than-expected earnings and the potential for a Fed pivot have fueled a sharp rebound in the stock. After a dismal 2022, Elon Musk's car company is on track for its best month in two years.

Curated by Phil Rosen in Los Angeles. Feedback or tips? Tweet @philrosenn or email prosen@insider.com

Edited by Max Adams (@maxradams) in New York and Hallam Bullock (@hallam_bullock) in London.

Read the original article on Business Insider