Hollywood Bowl Group's (LON:BOWL) Shareholders Are Down 32% On Their Shares

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Hollywood Bowl Group plc (LON:BOWL) share price is down 32% in the last year. That's well below the market decline of 11%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 4.1% in three years. Even worse, it's down 16% in about a month, which isn't fun at all.

Check out our latest analysis for Hollywood Bowl Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Hollywood Bowl Group share price fell, it actually saw its earnings per share (EPS) improve by 0.1%. Of course, the situation might betray previous over-optimism about growth.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

Hollywood Bowl Group managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

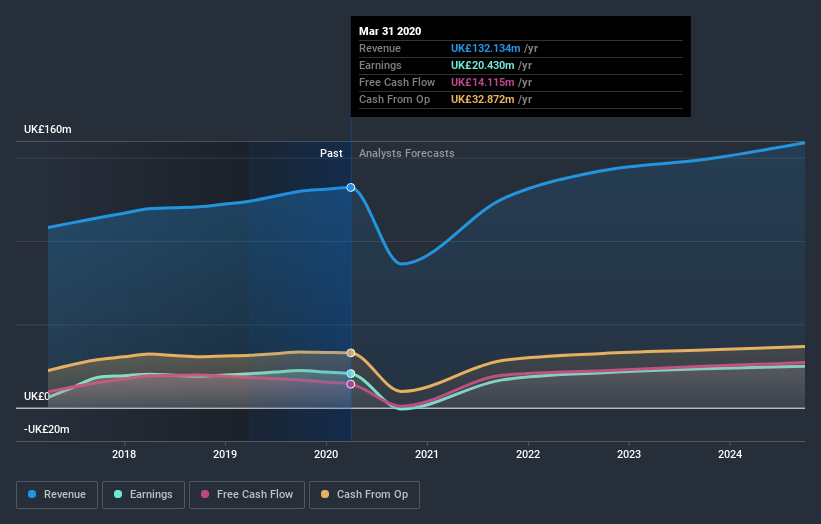

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Hollywood Bowl Group will earn in the future (free profit forecasts).

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Hollywood Bowl Group's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Hollywood Bowl Group's TSR, which was a 29% drop over the last year, was not as bad as the share price return.

A Different Perspective

Hollywood Bowl Group shareholders are down 29% for the year, falling short of the market return. Meanwhile, the broader market slid about 11%, likely weighing on the stock. Fortunately the longer term story is brighter, with total returns averaging about 2.8% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Hollywood Bowl Group that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.