Homeless housing investor plans London debut

A company which will invest in housing for homeless people has announced plans for a London stock market debut, citing growing demand.

Home REIT is seeking to raise £250m in the float, with the cash to be invested in accommodation across the UK.

The company is planning to lease properties to registered charities and housing associations which have a "proven track record" and receive government support. The aim is to offer them long leases terms of between 20 and 30 years.

The company said it had already identified £350m worth of assets which fit its criteria. It is expecting to have spent the cash raised from its debut within nine months of listing.

Home REIT is managed by Alvarium Investments, the London-based firm which has around $7bn (£5.3bn) of real estate assets under management.

Chairman Lynne Fennah said: "We believe a significant investment opportunity now exists in the UK homeless accommodation asset market."

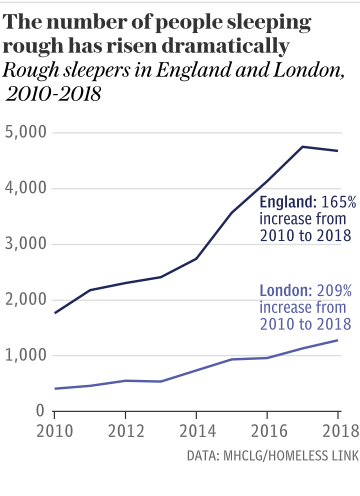

The number of people sleeping rough in the UK has surged over the past decade, rising by 165pc between 2010 and 2018 across England. In London, numbers of homeless people have risen by more than 200pc.

Earlier this year, the Government announced it was allocating an extra £236m to tackle rough sleeping, with cash going towards housing 6,000 of the most at-risk people.

There are fears homelessness would worsen when a ban on evictions, introduced in March as an emergency Covid-19 measure, comes to an end. This is expected to take place later this month.