Household wealth surged to a record high during the pandemic — but not all benefited

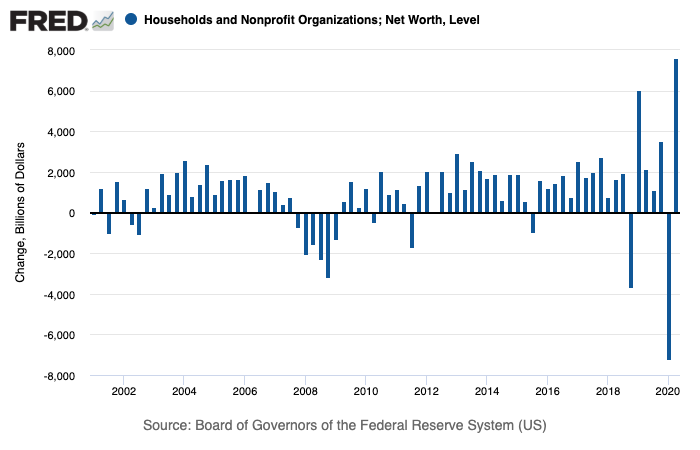

Americans’ net worth hit an all-time high, increasing by the largest amount in almost 70 years, even as the country wrestled with the coronavirus pandemic.

But not everyone saw gains.

The net worth of U.S. households reached $119 trillion in the second quarter, rising by $7.6 trillion from the previous quarter, according to the Federal Reserve. That’s the sharpest increase since 1952 and nearly $380 billion more than the fourth quarter of 2019 when the pandemic had yet to reach U.S. shores.

Stocks fueled much of the increase, with rising home prices contributing to a lesser extent. But those gains largely benefited Americans with higher incomes rather than lower earners.

“Almost all of it went to the top,” Dean Baker, senior economist at the Center for Economic and Policy Research, told Yahoo Money. “The stock markets is a story about the top 10%. Beyond that, stock holdings are pretty small.”

‘Stock market went through the roof’

Stocks added $5.7 trillion to household wealth versus the first quarter, according to the Fed. Following the swoon in March, the Standard & Poor’s 500 index has jumped over 45%, helping Americans with investments in retirement or brokerage accounts.

“The stock market went through the roof,” Baker said. “What that means is the top quintile or top decile did very well. Everyone else has little or nothing in the market, so that's not effective.”

Read more: Coronavirus stimulus checks: What’s stopping a second round of payments?

Around 45% of Americans don’t own stocks, according to an April Gallup survey, with ownership starkly divided by race and ethnicity. White Americans owned 91.2% of stocks in the first quarter of 2020, while Black and Hispanic Americans accounted for just 1.6% each, according to the Fed.

‘Good for more middle-income people’

The value in owner-occupied real estate grew $458 billion from the first quarter, according to the Fed. While much of the housing market stalled in April when states locked down, buyers quickly returned to the market in May and June, boosting prices.

“House prices are rising, so that will be good for more middle-income people,” Baker said. “That should help at least the second quintile a little bit, the third, too. But not the bottom — few of those people are homeowners.”

Read more: Here’s what you need to know about unemployment benefits eligibility

The second and the third quintiles collectively owned 35% of household real estate in the first quarter — the latest data available from the Fed — while the bottom two quintiles accounted for only 10.6%. The top quintile owned 57.7% of all real estate.

‘Very little of this is lower-income households’

Savings also increased in the second quarter by $760 billion, thanks in part to stimulus checks and expanded unemployment benefits, but also because of lower spending by high-income households.

“Very little of this is lower-income households,” Baker said. “This is the pandemic checks coupled with the fact that higher-income people are spending much less on restaurants and travel.”

The top quartile of earners reduced their spending by 36% in mid-April when consumer spending reached its bottom, while low-earners shrunk theirs by just 21%, according to Harvard-based Opportunity Insights.

Low-income and middle-income earners also showed more financial stability — including a record share of Americans reporting they could cover a $400 emergency expense in July. But the one-time stimulus payment and the two rounds of unemployment benefits under the CARES Act and the Lost Wages Assistance (LWA) have now mostly expired, threatening those temporary gains.

“In the absence of relief, there is no reason to expect that the extra financial security that people are telling us about in July — there's no reason to think that lasts,” Claudia Sahm, a former principal economist at the Federal Reserve Board of Governors and now director of macroeconomic policy at the Washington Center for Equitable Growth told Yahoo Money last week.

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova.

Read more:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and Reddit.