HSBC Q3 Pre-Tax Profit Decreases Y/Y on Decline in Revenues

HSBC Holdings’ HSBC third-quarter 2020 pre-tax profit of $3.1 billion represents a decline of 36.4% from the prior-year quarter’s reported number.

Shares of the company gained 6.8% in pre-market trading. However, a full day’s trading session will depict a better picture.

The company recorded lower revenues in the quarter along with a decline in expenses. Capital ratios were decent.

Revenues & Expenses Decline

Adjusted total revenues of $12.1 billion decreased 9.6% year over year. Reported revenues were down 10.7% year over year to $11.9 billion.

Adjusted operating expenses declined 2.6% from the prior-year quarter to $7.4 billion.

Common equity Tier 1 ratio as of Sep 30, 2020, was 15.6%, up from 14.7% as of Dec 31, 2019. Leverage ratio was 5.4%, up from 5.3% at the end of December 2019.

Performance by Business Lines

Wealth and Personal Banking: The segment reported $1.2 billion in pre-tax profit, down 13.9% year over year. The decline was due to a fall in revenues, partly offset by lower costs.

Commercial Banking: The segment reported pre-tax profit of $1.2 billion, down 23.8% from the prior-year quarter. The segment recorded a decline in revenues and expenses.

Global Banking and Markets: Pre-tax profit of $998 million for the segment declined 18.3% from the prior-year quarter end. The decrease primarily resulted from higher operating expenses.

Corporate Centre: The segment reported pre-tax loss of $336 million against pre-tax profit of $633 million recorded in the prior-year quarter.

Guidance

The company projects expected credit losses and other credit impairment charges in the lower end of $8-$13 billion for 2020.

It expects to reduce 2022 annual expense base by more than the previously mentioned $31 billion.

HSBC expects to exceed its $100 billion gross risk-weighted asset (“RWA”) reduction target by the end of 2022.

Lower global interest rates are projected to continue to hurt net interest income in 2020.

Our Viewpoint

Global economic slowdown, low interest rate environment across the globe and weak loan demand are expected to continue to hamper HSBC’s revenue growth to some extent in the near term. Moreover, the continued coronavirus outbreak-induced ambiguity is likely to hurt its financials.

Also, while the company’s initiatives to improve market share in the U.K. and China are likely to support financials over the long term, these efforts might lead to a rise in expenses in the near term, which might hurt the bottom line to some extent.

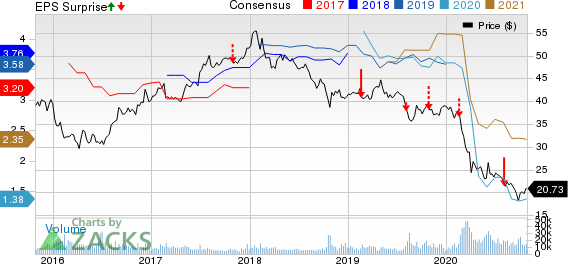

HSBC Holdings plc Price, Consensus and EPS Surprise

HSBC Holdings plc price-consensus-eps-surprise-chart | HSBC Holdings plc Quote

Currently, HSBC carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Upcoming Release Date of Other Foreign Banks

Barclays BCS reported third-quarter 2020 net income attributable to ordinary equity holders of £611 million ($789 million) against a net loss recorded in the prior-year quarter. Results were primarily hurt by an increase in credit impairment charges as well as lower revenues. Moreover, an increase in operating expenses was a major headwind.

UBS Group AG UBS reported third-quarter 2020 net profit attributable to shareholders of $2.09 billion, up significantly from $1.05 billion in the prior-year quarter. The company’s performance was supported by a rise in net fee and commission income (up 8% year over year) along with a rise in net interest income (up 39%). However, higher expenses posed as a headwind.

Itau Unibanco Holding S.A. ITUB is scheduled to report quarterly numbers on Nov 2.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UBS Group AG (UBS) : Free Stock Analysis Report

Barclays PLC (BCS) : Free Stock Analysis Report

Itau Unibanco Holding S.A. (ITUB) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research