Imagine Owning IRC (HKG:1029) And Trying To Stomach The 77% Share Price Drop

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding IRC Limited (HKG:1029) during the five years that saw its share price drop a whopping 77%. And some of the more recent buyers are probably worried, too, with the stock falling 31% in the last year. Even worse, it's down 15% in about a month, which isn't fun at all.

See our latest analysis for IRC

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

IRC became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

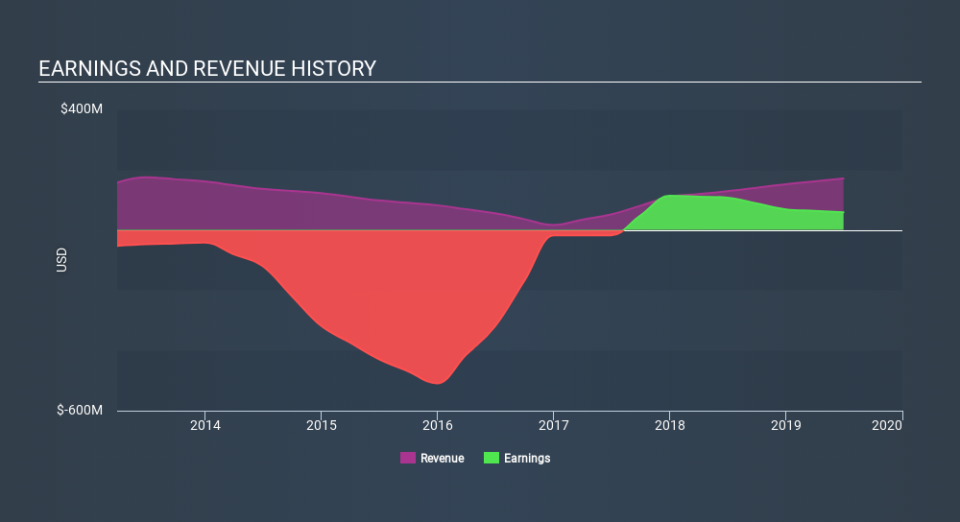

In contrast to the share price, revenue has actually increased by 8.0% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that IRC has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at IRC's financial health with this free report on its balance sheet.

A Different Perspective

IRC shareholders are down 31% for the year, but the market itself is up 0.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 26% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for IRC (1 doesn't sit too well with us!) that you should be aware of before investing here.

But note: IRC may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.