Insurance Stock Q3 Earnings Roster for Nov 2: AIZ, CNA & More

Insurance industry players are likely to have benefited from improved pricing, strong retention, new business, favorable renewals, reinsurance agreements, compelling products and service portfolio, and adoption of technologies to curb operational costs in the third quarter. However, catastrophe losses and lower interest rate might have acted as partial offsets.

The third quarter of a year generally bears the brunt of catastrophes as the hurricane season typically starts in June and lasts through November during a year, gathering strength in August and September. Thus, the third-quarter performance of industry players is likely to have been affected by losses stemming from hurricanes Laura, Isaias, Hanna and Sally, wildfires in California and Oregon, Midwest United States Derecho windstorm and the explosion in Beirut. Nonetheless, better pricing, reinsurance arrangements, portfolio repositioning and prudent underwriting practice are likely to have limited the downside.

Frequent natural disasters are likely to have accelerated the policy renewal rate and kept the momentum of increased pricing alive in the third quarter. Most of the commercial insurance lines are likely to have witnessed rate increase in the quarter.

A higher invested asset base might have somewhat limited the adverse impact of sustained low rates for insures. Nonetheless, the impacts of the pandemic are expected to weigh on the results. Given the slowdown in economic growth due to the pandemic, contributions from employers and employees are likely to have declined.

Nonetheless, the adoption of technologies is expected to have aided smooth functionality amid coronavirus-induced challenges and saved costs.

Let’s see how the following insurers are poised prior to their third-quarter earnings releases on Nov 2.

According to the Zacks model, a company needs the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Assurant’s AIZ third-quarter performance is likely to have been impacted by adverse forex, lower investment income and lower mortality risk. The company expects growth in Global Lifestyle and Global Housing net operating income. Higher amortization of deferred acquisition costs and value of business acquired and underwriting, general and administrative expenses are likely to have increased expenses in the third quarter. (Read more: What's in the Cards for Assurant This Earnings Season?)

The Zacks Consensus Estimate for earnings per share of 94 cents indicates 44.8% decline from the year-ago quarter reported figure. It has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell).

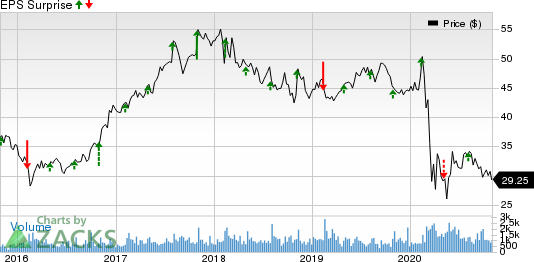

The company surpassed estimates in two of the last four reported quarters, with the average surprise being 6.00%. This is depicted in the chart below:

Assurant, Inc. Price and EPS Surprise

Assurant, Inc. price-eps-surprise | Assurant, Inc. Quote

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CNA Financial CNA: The Zacks Consensus Estimate for earnings per share of 62 cents for the third quarter indicates a decrease of 46.6% year over year. It has an Earnings ESP of 0.00% and a Zacks Rank #4.

The company’s earnings outpaced estimates in two of the last four reported quarters, with the average negative surprise being 2.61%. The same is depicted in the chart below:

CNA Financial Corporation Price and EPS Surprise

CNA Financial Corporation price-eps-surprise | CNA Financial Corporation Quote

Kemper KMPR: The Zacks Consensus Estimate for earnings per share of 91 cents for the third quarter indicates a decrease of 54.7% year over year. It has an Earnings ESP of 0.00% and a Zacks Rank #4.

The company’s earnings outpaced estimates in the last four reported quarters, with the average surprise being 22.80%. The same is depicted in the chart below:

Kemper Corporation Price and EPS Surprise

Kemper Corporation price-eps-surprise | Kemper Corporation Quote

CNO Financial Group CNO: The Zacks Consensus Estimate for earnings per share of 46 cents for the third quarter indicates an increase of 2.2% year over year. The combination of its Earnings ESP of +2.52% and a Zacks Rank #2 makes us confident of a likely earnings beat.

The company’s earnings outpaced estimates in three of the last four reported quarters, with the average surprise being 20.09%. The same is depicted in the chart below:

CNO Financial Group, Inc. Price and EPS Surprise

CNO Financial Group, Inc. price-eps-surprise | CNO Financial Group, Inc. Quote

Horace Mann Educators HMN: The Zacks Consensus Estimate for earnings per share of 72 cents for the third quarter indicates an increase of 12.5% year over year. The combination of its Earnings ESP of 0.00% and a Zacks Rank #2 and makes surprise prediction difficult.

The company’s earnings outpaced estimates in three of the last four reported quarters, with the average surprise being 24.77%. The same is depicted in the chart below:

Horace Mann Educators Corporation Price and EPS Surprise

Horace Mann Educators Corporation price-eps-surprise | Horace Mann Educators Corporation Quote

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Kemper Corporation (KMPR) : Free Stock Analysis Report

Horace Mann Educators Corporation (HMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research