What we can learn from China and Sweden about post-lockdown traffic and travel

Predicting future behaviour is often fraught with risk and doubly so when the world is turned upside down by a pandemic.

Trying to forecast what life will be like a few years, months or even weeks from now isn't straightforward, even when examining some simple human behaviours — like how many people will be dining at restaurants or using public transit again.

But some early data is emerging available from two noteworthy countries — China and Sweden.

China has the most post-lockdown experience because it's believed that's where the novel coronavirus originated. Sweden, meanwhile, decided not to shut down its economy like most developed countries and can offer a glimpse of how people could act when the economy in Canada and other countries is fully open again even though the threat of COVID-19 still exists.

Travel data from the two countries provides some insight into what to expect in terms of how many people will continue to work from home, traffic patterns on city streets, the eagerness of shoppers to return to stores and how long until travellers will have the confidence to catch a flight, among many other observations.

Peoples' new travel habits will have broad implications for the economy, especially the oil sector, which saw demand plummet for fuel during the pandemic.

Will rush hour traffic return?

City drivers have no doubt already noticed streets beginning to slowly fill up again as lockdown restrictions are eased, but data suggests it will take a while before rush hour becomes as painful as it was pre-COVID.

In China, a similar number of vehicles are already back on the road, but figures analysed by Sproule, an energy consultancy, show how people in that country are still choosing not to drive as much as in the past. Trips are still mainly for essentials, such as going to work and getting groceries.

A similar pattern is seen in Sweden. Looking at mobility data from Google COVID-19 community mobility reports for all types of transportation, people are visiting retail shops and attractions like movie theatres 21 per cent less, going to subway, bus and transit stations 42 per cent less and commuting to work 72 per cent less.

"What stands out the most is, if given the choice, people are electing to adjust their habits," said Liam O'Brien, a Calgary-based analyst with Sproule, which recently published a report looking at the early data from China and Sweden related to post-lockdown activity.

"It's probably reasonable to assume that we're going to see similar behaviour in most major centres globally with increased work-from-home solutions and less willingness to travel for unnecessary purposes," O'Brien said.

When will air travel take off?

The rebound in air travel at Chinese airports indicates there are better times ahead for airlines, but likely several years of turbulence ahead.

Just like at airports around the world, the runways in China saw a sharp drop in activity as COVID-19 struck. However, figures show airports across the Asian country are seeing passenger volumes begin to rebound. The total daily number of flight departures has climbed back to roughly 50 per cent of pre-virus levels, according to Sproule's report.

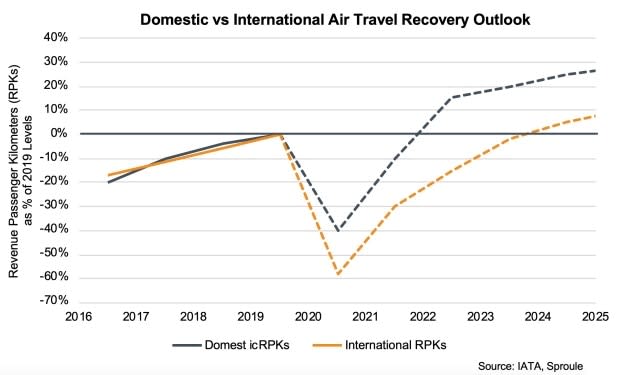

Virtually all the flights are domestic and experts say that market will return much more quickly than international flights.

Still, the air travel recovery will likely be slow.

In a report by DBRS Morningstar this week, the ratings agency forecasts it could take up to four years to recover in its worst-case scenario.

"We think it is likely that the initial recovery in air passenger traffic will be led by domestic travel (similar to China) as international travel is subject to the effectiveness of each country's containment measures and fiscal and monetary policies," DBRS stated.

There are several reasons for the long recovery for air travel, including a change in some people's willingness to fly and apprehension about airports, the expected hike in ticket prices as the number of available seats is reduced and ongoing border restrictions that will continue to curtail travel.

"it's going to take some time, probably the 2023-2025 timeframe, before we get back to pre-virus air travel levels," said O'Brien, with Sproule.

How eager are people to travel?

The reduced appetite to fly likely extends to driving, too.

Overall travel intentions by Canadians have declined this summer, according to a recent survey of 2,000 adults by the Conference Board of Canada.

About 47 per cent of respondents still plan to take a trip by any mode of transportation, but many are still trying to figure out what they'll do.

"The vast majority of what we would call tourist activity is actually people going and doing things in their own cities, going out to restaurants or events at home or close by," said Robyn Gibbard, a senior economist in charge of tourism research at the Conference Board of Canada.

"We saw a big uptick in the share of people who were saying they're planning to do activities that kind of jive with social distancing," he said, such as camping or hiking.

Conversely, there was a drop in interest in the share of people planning to see concerts or sporting events.

What's the impact on fuel use?

Refineries around the globe are beginning to ramp up activity and produce more gasoline and diesel as countries loosen up lockdown measures. Still, fuel demand will take a while to rebound to pre-COVID levels, based on the data from China and Sweden.

Gasoline consumption is still down 15 per cent in China, while diesel use is 10 per cent lower in Sweden, according to Sproule, compared to normal levels.

Assuming similar behaviour around the globe in the months ahead, an impact on global oil demand is expected.

Even calculating a seven per cent drop in gasoline and five per cent decrease in diesel use, that equates to a three million barrel per day hit to global oil demand, according to O'Brien, the Sproule analyst.

"For an industry that rides very much on the margin, that's material."

Further, the aviation sector's struggles are causing about a 3.5 million barrel-a-day disruption, said O'Brien. An average decrease of about two million barrels a day from pre-COVID levels is expected over the next few years as the sector slowly recovers.