Market report: IAG enjoys rare lift for aviation sector

Europe’s stock markets summoned up an almighty shrug yesterday as a dearth of major economic news and company reporting left little to shift sentiment.

London’s top indices both made small moves in opposing directions: the FTSE 100, put under pressure by the pound, which rose slightly on Brexit hopes and dollar weakness, slipped 0.6pc to 5,884.7, while the mid-cap FTSE 250 edged 0.2pc higher to 17,866.1.

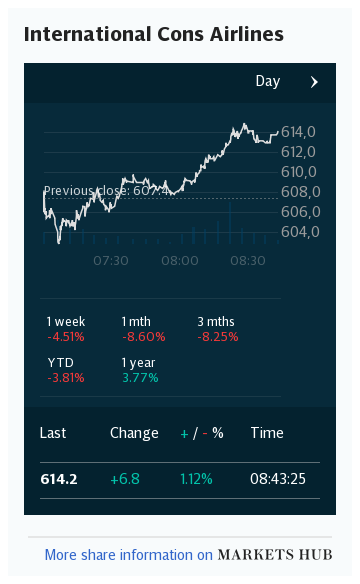

International Consolidated Airlines (IAG), the owner of British Airways, was the biggest FTSE 100 climber following reports over the weekend that the UK flag-carrier will cut flights at Gatwick in response to pandemic-ravaged demand.

Its shares, which rose 4.2p to 100p, may have benefited from some sector glow, as news of Flybe’s plans to return to the air marked a rare positive story for the stricken aviation sector.

Property developer Land Securities rose slightly as it held a virtual capital markets day, guiding analysts and investors through its plans for future growth. The company’s chief executive Mark Allan said the group’s new strategy “will build on existing areas of competitive advantage” and enabled the FTSE 100 group to benefit from “long-term macro trends”.

Centring on the buzzwords optimise, reimagine, realise and grow, its new strategy is pinned on a longer-term gamble: that there’s still life in the London office sector. Shares rose 6.7p to 531.9p.

Consumer goods giants Reckitt Benckiser and Unilever both dipped on currency pressure ahead of results later this week.

Deutsche Bank said the latter group’s plans to unify its corporate structure under a single London-based parent company would produce more positives than negatives.

Analyst Tom Sykes said that Unilever, whose shares fell 64p to £48.02, could benefit by lowering the taxable base for investors, but warned it could face a hefty exit tax bill as it abandons the Netherlands.

Reckitt, meanwhile, closed down 150p at £72.04.

On the FTSE 250, IWG – the serviced office space provider formerly known as Regus – was among the bigger risers, climbing 13p to 274.6p after analysts at Berenberg yesterday named the group as their top stock pick in the business services category.

Raising their price target on the group to 350p from 260p, the bank’s analysts said IWG had managed the pandemic “exceptionally well”, and said they were confident in its longer-term strategy.

JD Wetherspoon managed only a meagre bounceback from a 19pc plunge on Friday following an update. The group closed up 34p at 807.5p. Rival Mitchells & Butlers managed a strong showing, with an 8p rise to 140p.

In small-cap news, litigation funder Burford Capital made its debut on the New York Stock Exchange.

The joint listing makes it the first legal finance group to be publicly traded in the United States. Chief executive Christopher Bogart said the listing would grow its pool of investors and raise its profile in the US.

Its London-listed shares rose 36.5p to 761.5p.