Marriott (MAR) Q4 Earnings Beat Estimates, Revenues Miss

Marriott International, Inc. MAR reported mixed fourth-quarter 2019 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same. Following the quarterly results, not much movement was witnessed in the company’s share price in the after-hour trading session on Feb 26.

Adjusted earnings of $1.57 per share beat the Zacks Consensus Estimate of $1.46 and improved 9% year over year. The company’s earnings in the quarter included a gain of 32 cents from an asset sale, which was partially offset by 26 cents thanks to asset impairments.

Total revenues of $5,371 million lagged the consensus mark of $5,515 million. However, the top line also improved 1.6% on a year-over-year basis.

At the end of 2019, Marriott's development pipeline totaled roughly 3,050 hotels, with approximately 515,000 rooms. Further, nearly 220,000 pipeline rooms were under construction.

RevPAR & Margins

In the quarter under review, revenue per available room (RevPAR) for worldwide comparable system-wide properties increased 1.1% in constant dollars (up 0.8% in actual dollars), driven by 0.8% increase in occupancy. However, average daily rate (ADR) declined 0.1%.

Comparable system-wide RevPAR in North America grew 0.9% in constant dollars (up 0.9% in actual dollars) owing to a 0.3% gain in ADR and 0.4% increase in occupancy.

On a constant-dollar basis, international comparable system-wide RevPAR rose 1.5% (down 1% in actual dollars), owing to a 1.3% rise in occupancy. The metric was partially offset by a 0.3% decline in ADR.

Meanwhile, worldwide comparable company-operated house profit margins increased 20 basis points (bps) on robust cost control and synergies from the Starwood acquisition, negated by marginal growth in RevPAR and increase in wages.

North American comparable company-operated house profit margins expanded 10 bps. Moreover, house profit margins for international comparable company-operated house profit margins increased 30 bps.

Total expenses were down 5% year over year to $5,097 million, primarily due to a decline in Reimbursed expenses.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to $901 million, up 4% with the year-ago figure.

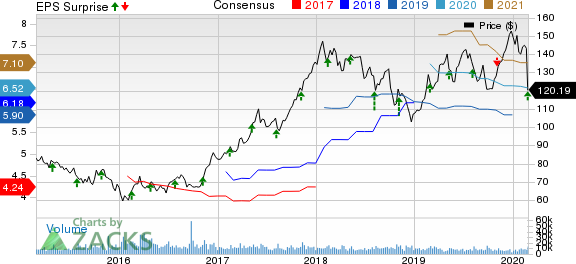

Marriott International, Inc. Price, Consensus and EPS Surprise

Marriott International, Inc. price-consensus-eps-surprise-chart | Marriott International, Inc. Quote

Coronavirus Impact

The coronavirus outbreak will hurt the company’s first quarter and 2020 results. However, the company is unable to estimate any financial impact of the coronavirus outbreak at the moment as the duration and extent of the outbreak cannot be ascertained.

First-quarter 2020 Base Case Outlook (Excluding the Coronavirus Impact)

For first-quarter 2020, the company expects comparable system-wide RevPAR to increase in the range of 1 to 2% (in constant currency) in North America and worldwide.

Furthermore, gross fee revenues are projected between $940 million and $950 million, indicating an improvement of 5-6% on a year-over-year basis. Operating income is anticipated between $685 million and $699 million.

General, administrative and other expenses are expected within $230-$234 million. Adjusted EBITDA is anticipated in the range of $853-$867 million, suggesting year-over-year growth of 4-6%. Earnings per share are envisioned between $1.47 and $1.50. Notably, the Zacks Consensus Estimate for first-quarter earnings is pegged at $1.48 per share.

2020 Guidance Base Case Outlook (Excluding the Coronavirus Impact)

For 2020, Marriott anticipates earnings within $6.30-$6.53 per share, compared with $6.00 reported in the 2019. The Zacks Consensus Estimate for full-year earnings is pegged at $6.52 per share, which is above mid-point of the company’s guidance of $6.41 per share. Gross fee revenues are expected between $3,960 million and $4,040 million, suggesting growth of 4-6% from the year-ago period.

Comparable system-wide RevPAR is expected to be in the range of flat to up 2% worldwide, with RevPAR growth in North America around the middle of that range. Marriot now anticipates room additions to be nearly 5-5.25% in 2020.

Operating income is envisioned within $2,995-$3,095 million. General, administrative and other expenses are anticipated in the range of $950-$960 million. Adjusted EBITDA is projected in the band of $3,700-$3,800 million, indicating an improvement of 3-6% from the prior year.

Zacks Rank & Peer Releases

Marriott currently carries a Zacks Rank #4 (Sell).

Hyatt Hotels Corporation H reported better-than-expected fourth-quarter 2019 results. Notably, the company’s bottom line has surpassed the Zacks Consensus Estimate for the 16th straight quarter, while the top line has outpaced the same for the fourth consecutive quarter. Adjusted earnings came in at 47 cents per share, which outpaced the Zacks Consensus Estimate of 20 cents. In the prior-year quarter, the company reported earnings of 62 cents per share. Total revenues were $1,275 million, beat the Zacks Consensus Estimate of $1,182 million and improved 12% from the prior-year quarter.

Choice Hotels International, Inc. CHH reported better-than-expected fourth-quarter 2019 results. The lodging franchisor reported adjusted earnings of 92 cents per share, which beat the consensus mark of 84 cents and rose 4.5% year over year. Notably, this marked the eighth straight quarter of earnings beat. In the quarter under review, total revenues came in at $268.1 million. The figure increased 9% from the year-ago quarter’s level and beat the consensus mark of $258 million.

Hilton Worldwide Holdings Inc. HLT reported fourth-quarter 2019 results, wherein both earnings and revenues came ahead of the Zacks Consensus Estimate. Hilton’s adjusted earnings of $1.00 per share surpassed the consensus mark of 95 cents and improved 6.4% on a year-over-year basis. Further, it came above management’s forecasted range of 91-96 cents per share. Revenues totaled $2,369 million, which surpassed the consensus mark of $2,337 million.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research