How Much Does Hammond Manufacturing's (TSE:HMM.A) CEO Make?

Rob Hammond became the CEO of Hammond Manufacturing Company Limited (TSE:HMM.A) in 1978, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Hammond Manufacturing

How Does Total Compensation For Rob Hammond Compare With Other Companies In The Industry?

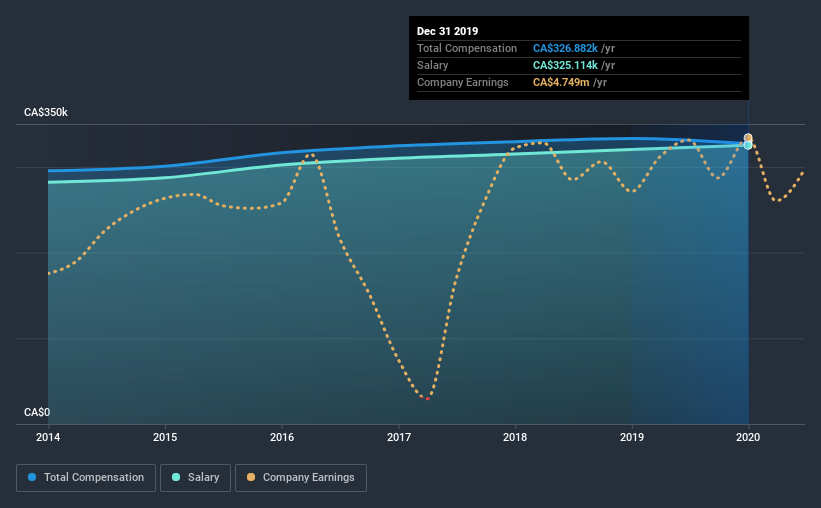

Our data indicates that Hammond Manufacturing Company Limited has a market capitalization of CA$21m, and total annual CEO compensation was reported as CA$327k for the year to December 2019. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at CA$325.1k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under CA$263m, the reported median total CEO compensation was CA$610k. This suggests that Rob Hammond is paid below the industry median. Furthermore, Rob Hammond directly owns CA$8.1m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2019 | 2018 | Proportion (2019) |

Salary | CA$325k | CA$320k | 99% |

Other | CA$1.8k | CA$13k | 1% |

Total Compensation | CA$327k | CA$333k | 100% |

On an industry level, roughly 29% of total compensation represents salary and 71% is other remuneration. Investors will find it interesting that Hammond Manufacturing pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Hammond Manufacturing Company Limited's Growth

Hammond Manufacturing Company Limited's earnings per share (EPS) grew 25% per year over the last three years. It saw its revenue drop 1.3% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Hammond Manufacturing Company Limited Been A Good Investment?

With a total shareholder return of 1.3% over three years, Hammond Manufacturing Company Limited has done okay by shareholders. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Hammond Manufacturing pays its CEO a majority of compensation through a salary. As we touched on above, Hammond Manufacturing Company Limited is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. At the same time, EPS growth has been exceptional over the past three years. However, shareholder returns have failed to show the same level of growth. Shareholder returns could be better but we're pleased with the positive EPS growth. As a result of these considerations, CEO compensation seems quite appropriate.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Hammond Manufacturing that investors should be aware of in a dynamic business environment.

Switching gears from Hammond Manufacturing, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.