Muskrat Falls forensic audit 'raises serious concerns' of initial estimates: Browne

The forensic and investigative audit of Muskrat Falls raises serious concerns about the cost estimates used to justify the project, says the province's consumer advocate, as well as the study of alternate options to provide power for the province.

A longtime critic of the project, Dennis Browne said he doesn't believe the potential alternatives to Muskrat Falls were properly explored before a decision was made. He said if the decision had gone before the Public Utilities Board, things would have unfolded differently.

"Nova Scotia did it right; they put all their matters before their public utilities board. We did it wrong," Browne said.

"The Public Utilities Board should have been engaged from the get-go, and we wouldn't be in the mess we are in today if that step had been taken."

David Vardy of the Muskrat Falls Concerned Citizens Coalition said the audit is "vindication of what many of us have been saying for so long."

"If the PUB had the information that Grant Thornton now has, chances are the PUB would have reached a fairly firm, definitive recommendation, that the better choice was not to go ahead with Muskrat Falls but rather to build according to demand," he said.

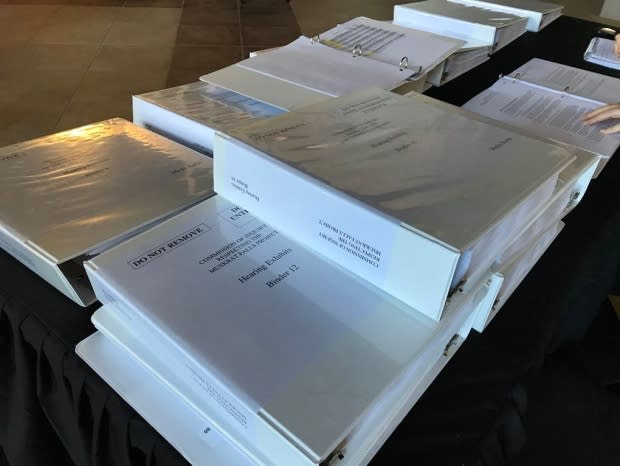

The report, prepared by accounting firm Grant Thornton and released to the Muskrat Falls inquiry Friday morning, found that Nalcor Energy may have underestimated the cost of the project.

'Potential misstatements'

What's more, "potential misstatements" by Nalcor may have resulted in the Muskrat Falls option — also known as the interconnected island option — no longer being considered the least-cost option at the time of sanctioning, auditors found.

Construction costs have soared from $7.4 billion to $12.7 billion — including financing — since Muskrat Falls was sanctioned by the then-Progressive Conservative government in 2012.

The audit also found Nalcor may have overstated the cost of the so-called isolated island option, which included a combination of hydro, thermal, wind and other power generation possibilities.

Grant Thornton also said Nalcor "inappropriately" eliminated the option of importing power from Hydro-Quebec, or deferring the development of the Lower Churchill, until power was available from the Upper Churchill in 2041.

"Further analysis of these options may have led to a different decision," the audit read.

Those findings were no surprise to Vardy, who has long argued that there was no need to invest in Muskrat Falls when vast quantities of power will be available to the province from the Upper Churchill project in just over two decades.

He said it would have made sense to enhance the isolated island power grid as needed, until Upper Churchill power was available.

"There were a lot cheaper options than a $13-billion option," Vardy said.

Probability factor questioned

One of the areas highlighted by the audit was the probability factor used by Nalcor when finalizing its costs estimate.

Nalcor put that probability that there would not be cost overruns at 50 per cent, while the auditor said a factor of 70 to 90 per cent is "more reasonable" for such a project.

Had Nalcor selected a probability factor of 90 per cent in its cost estimates for Muskrat Falls, estimates would have increased by nearly $800M, the audit found.

Those figures seem consistent with the testimony of expert witness, Bent Flyvbjerg, Browne said.

$500-million exclusion

An Oxford professor specializing in megaprojects, Flyvbjerg has studied 300 in his career. He said globally the average cost overrun on hydroelectic projects is 96 per cent above initial estimates.

"As he was speaking I thought that his evidence was relevant, and now we're seeing probably some of that today coming to fruition," Browne said.

Operating and maintenance costs of the project were also low, at $34 million annually. The current estimate is $109 million.

The audit also found Nalcor excluded roughly $500 million of "strategic risk exposure" from the capital cost estimate.

Nalcor's project team told the auditors that exposure was to be funded by the government of Newfoundland and Labrador.

Read more articles from CBC Newfoundland and Labrador