NatWest returns to profit but warns of 'challenging times ahead'

NatWest Group (NWG.L) has surprised the market by returning to profit in the third quarter.

NatWest, which was known as Royal Bank of Scotland until July, on Friday said it made a pre-tax profit of £355m ($458m) on income of £1.9bn in the third quarter. The bank made a profit attributable to shareholders of £61m.

Analysts had been expecting income of £2.5bn and a pre-tax loss of £75m in the quarter.

Despite missing expectations on income, the bank was helped to return to the black by a much lower than expected credit loss provision. The bank set aside £254m in the quarter to cover future losses, which was well below analysts’ expectations of £628m in provisions.

READ MORE: Lloyds beats forecasts and returns to profit in third quarter

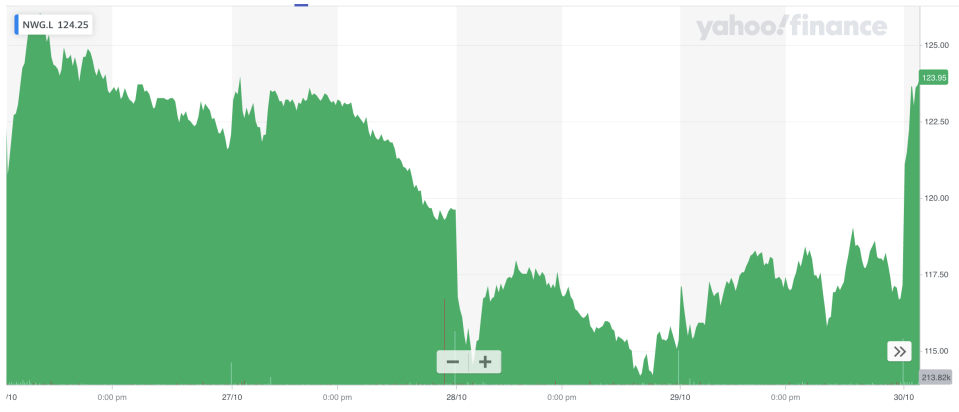

Shares in the bank rose over 5% in London, topping the FTSE 100.

Chief executive Alison Rose said the performance showed the bank’s “resilience” but cautioned that COVID-19 and its impact on the UK economy was still a significant headwind.

“Although impairments were relatively low in the quarter and we have seen some positive trends across our customer base, the full impact of COVID-19 remains very unclear,” she said in a statement.

“Challenging times lie ahead, especially as the current government support schemes come to an end and as new COVID-19 related restrictions are introduced.”

Watch: What is inflation and why is it important?

READ MORE: HSBC plans 'conservative' dividend after better-than-expected quarter

NatWest’s numbers complete the quartet of third quarter earnings from major UK banks. Lloyds (LLOY.L), Barclays (BARC.L), and HSBC (HSBA.L) all beat forecasts with their results. Banks have been boosted by a buoyant mortgage market in the UK, as well as healthy fundraising and trading activity at investment banks.

NatWest did £2.4bn in mortgage lending in the third quarter and lent £2.9bn to businesses under government support schemes. Mortgage applications grew by 91% between the second and third quarter. However, revenues at its retail and consumer businesses were down 12% on the same quarter a year ago.

Activity at NatWest’s investment bank has “eased.” Income at NatWest Markets fell 14% between the second and third quarter but was still much higher than a year ago.

READ MORE: Barclays beats forecasts as it sets aside another £600m for COVID losses

In line with other banks, NatWest said total loss provisions for the year were now likely to be “at the lower end” of the £3.5bn to £4.5bn range guided earlier this year. The bank has so far built up loss absorbing buffers of £3.1bn. The provisioning pushed NatWest to a loss pf £700m in the first half of the year.

Many of the losses banks feared would hit in their loan books have so far failed to materialise, as government support schemes have kept businesses afloat and paid furloughed workers’ wages. NatWest said it had seen a “limited level of defaults across lending portfolios,” it said.

WATCH: What is a V shaped recovery