Ontario unveils 'sensible, achievable' plan to address climate change

The Ontario government has launched its latest assault against the federally-imposed carbon tax with a plan of its own.

The Ontario Progressive Conservatives unveiled their own climate change strategy Thursday as it continues its battle with the federal government over carbon pricing. Ontario Environment Minister Rod Phillips said the province will meet its share of the 2030 climate targets in the Paris Agreement.

“There is evolving science behind how much has to be done. What we have benchmarked ourselves against is the international agreements,” Phillips told reporters in Nobleton, Ont. He said the Paris Agreement called for emissions to be reduced 30 per cent from 2005 levels and Ontario has already reduced emissions by 22 per cent.

“We will hit those targets with that plan and we will do it without a carbon tax.” Phillips added. “The plan that we have presented today is a sensible, achievable approach to do that.”

The province will spend $400 million over four years on the taxpayer-funded Ontario Carbon Trust to partner with the private sector on green technologies.

Phillips stressed the need for the provincial government to work with industries to ensure Ontario-based companies can compete in global markets with a “made-in-Ontario solution.” The Ontario government is trying to balance accountability with “competitive realities,” the minister explained.

The minister added regulations will be set following consultations with industry leaders to establish standards for large polluters.

Phillips was asked how exactly the government would set these environmental standards in a bid to reduce greenhouse gas (GHG) emissions.

“We have a long history in Ontario of regulating these industries effectively,” Phillips said. “Typically it’s done on a per unit basis, so how much does a tonne of cement cost in terms of GHGs. And so the standards are established and then those standards gradually improve so that emissions are reduced.”

The minister acknowledged the PCs and the federal Liberals have their own approaches.

“They have a different vision about the role of government,” Phillips said. “Ontario industry wants to work with the Ontario government because they have confidence that we’ll have sensitivities.”

LIVE: Minister Phillips announces new Made-in-Ontario environment plan. https://t.co/H318eAO8Zl

— Rod Phillips (@RodPhillips01) November 29, 2018

Federal Environment Minister Catherine McKenna told CBC News “Ontario wants to go back in time” with its climate plan.

“I think Canadians understand that it shouldn’t be free to pollute,” she told the news outlet.

Scheer links GM closure with carbon tax

The Ontario’s announcement comes days after General Motors announced it was closing its manufacturing plant in Oshawa, Ont, which will affect nearly 3,000 workers and auto parts makers in the Greater Toronto Area.

Federal Conservative Leader Andrew Scheer blamed future job losses on the carbon tax during question period Wednesday.

“The carbon tax is bad for all Canadian workers,” Scheer said. “Now that we’ve seen the impact of this policy chasing future jobs and investment away, will he do the right thing and cancel his carbon tax?”

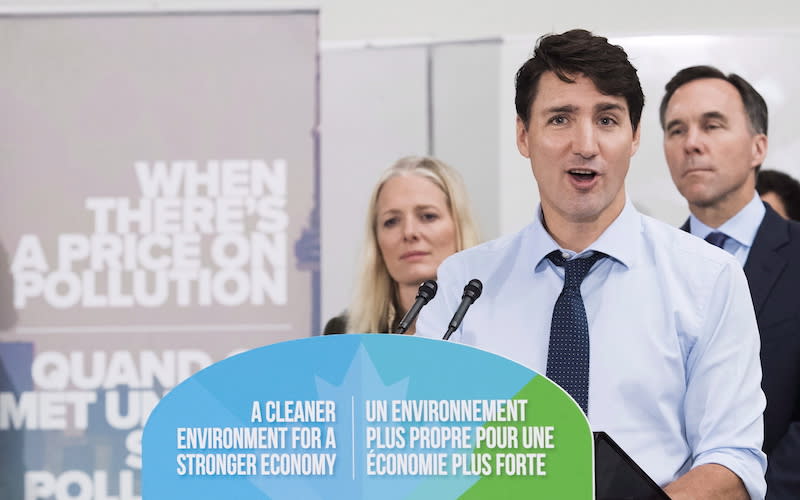

Prime Minister Justin Trudeau responded to multiple questions about the carbon tax in the House.

“We know that making sure that pollution is not free is how we’re going to move forward on protecting jobs, on protecting our future and protecting the environment for future generations,” Trudeau said.

Ontario, Saskatchewan, New Brunswick and Manitoba have all refused to put carbon pricing in place for 2019, as mandated by the federal government.

Ontario Premier Doug Ford has said the province will join Saskatchewan in their court battle against the carbon tax, and he’s already eliminated the provincial cap-and-trade program. Ontario was able to generate nearly $3 billion from the cap-and-trade system established in 2015 under former premier Kathleen Wynne’s Liberals.

Trudeau pushing merits of carbon tax

Trudeau has been trying to sell Canadians on the importance of a carbon tax since running on an election platform in 2015 that pledged to penalize carbon emitters.

“There is an imperative to put a price on pollution,” Trudeau told a crowd in Toronto on Oct. 23. “The time is now to take real action.”

Provinces and territories were given two choices to adopt by January 2019: a direct price on carbon pollution that starts at $20 per tonne, rising $10 each year to $50 in 2022; or, a cap-and-trade system that puts a direct price on emissions.

“Starting next year, it will no longer be free to pollute anywhere in Canada,” the prime minister said last month. “And if there are costs associated for average families, we will more than compensate those families for those costs.”

This tax will likely be passed on by corporations to consumers, which means Canadians can expect to pay more for gasoline, natural gas, diesel, air travel and more starting in January.

Trudeau says 90 per cent of what Ottawa makes from the tax will be given back to Canadians as an annual rebate with their taxes. The other 10 per cent will go to small businesses, schools and hospitals.

The prime minister has insisted this plan benefits both Canadians and the economy by putting a price on pollution, but his critics haven’t been convinced.

Liberal plan attracting several critics

Ontario Premier Doug Ford has called the plan “another Trudeau Liberal tax grab” that has been rammed “down the throats” of Ontarians.

“This massive tax hike from the federal government will jack up the cost-of-living for each and every Ontario family and business,” Ford tweeted in late October.

Never trust a politician who tells you he will save you money by hiking your taxes. Plain and simple, the Trudeau carbon tax will make life harder and more expensive for everyone in Ontario. pic.twitter.com/KQ2zWHx0XU

— Doug Ford (@fordnation) October 23, 2018

Saskatchewan Premier Scott Moe has referred to the carbon tax as a “financial shell game.”

“We see it as a cynical vote-buying scheme using your money to buy your vote,” Moe said in October.

In Ottawa, Scheer has insisted Canadians won’t be “tricked” by the plan.

“Conservatives, like Canadians, see through this cynical election gimmick and we will hold Justin Trudeau to account,” Scheer said last month.

People’s Party of Canada Leader Maxime Bernier tweeted on Oct. 24 that the Liberals could only sell the tax if they lied to Canadians.

“Selling a carbon tax as a way to fight ‘pollution’ is simply manipulation and propaganda.”

We can debate the effects of too much CO2 in the atmosphere on climate. That doesn’t make CO2 a form of “pollution.”

CO2 is essential for life.

Selling a carbon tax as a way to fight “pollution” is simply manipulation and propaganda.

Typical Liberal lie. https://t.co/JZlniO7GHs

— Maxime Bernier (@MaximeBernier) October 24, 2018

Former Saskatchewan premier Brad Wall, the first premier to publicly oppose the carbon tax, said last month that he was stepping out of retirement to voice his opposition against the plan, which he compared to a “Nigerian prince” scam.

“The Trudeau carbon tax disproportionately impacts western Canadian industries which can be carbon intense and trade exposed,” he wrote on Twitter.

Meanwhile, leaders on the other side of the political spectrum have also chimed in with their own critiques of the carbon tax mandate. Federal NDP Leader Jagmeet Singh has said his party believes there should be a price on carbon, but he’s not sold on the Liberal plan.

“Will this make a difference? Well no, for a couple of reasons … the targets of this current government, the Liberal government are using, those targets are not going to get us anywhere near where we need to go,” Singh said.

Climate change is the single greatest threat we face – and with Trudeau spending billions on pipelines & Scheer promising to revive #EnergyEast – Canada is failing to do its part. We don't have to accept this. We can invest in clean, renewable energy & increase emission targets: pic.twitter.com/gxOjmc9aSW

— Jagmeet Singh (@theJagmeetSingh) October 22, 2018

Elizabeth May, the leader of the federal Greens, has said the tax is a “very fundamental first step,” but “it’s approximately half of what must be done.”

Good first step.. but like JFK committing to put a man on the moon, Trudeau committed to Paris. This step-ladder puts us closer…1/2 #gpc

— Elizabeth May (@ElizabethMay) October 24, 2018

What do you think of Ottawa’s plan to impose a carbon tax on Canadians? Do you think it’s the right thing to do for the environment in the face of climate change? Or is this a plan that will hurt Canadians by increasing the cost of living? Share your thoughts in the comment section below!

With files from The Canadian Press