OPINION | Alberta's plan to balance its books is already off the rails

Barely four months since its last budget, Alberta's plan to balance the books is already off the rails. The province's upcoming budget — due next week — will face difficult choices to fill a new multibillion-dollar hole.

The problem, as usual for Alberta, is low oil prices. The province was previously counting on oil prices rising from $57 US per barrel in 2019/20 to $63 US by 2022/23. But after the coronavirus shocked the world's second-largest economy, this looks a lot less likely.

Oil demand in China is down by roughly 20 per cent, and global prices are down more than $10 per barrel as a result. Lasting implications for global supply chains combined with trade wars, Brexit fears and rising global uncertainty means low prices might continue for some time.

No one can predict the future with certainty, especially when it comes to oil prices. But the current futures market — where investors make deals for oil tomorrow, at prices agreed to today — suggests many expect oil to remain barely over over $51 per barrel for some time to come.

That's a full $12 per barrel less than Alberta's government was counting on.

This is going to hurt.

Each dollar-per-barrel drop in oil prices costs Alberta's budget $800,000 to $900,000 per day. A weaker Canadian dollar will cushion some of that blow, but not all.

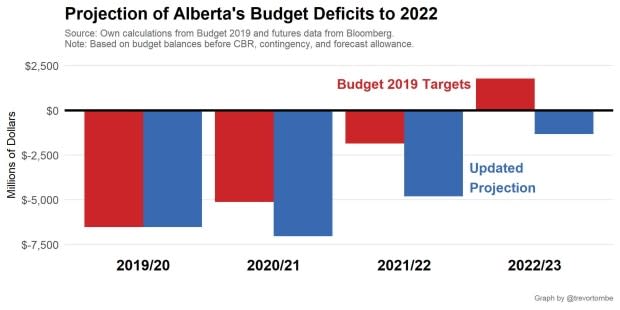

Updating my own estimate of the provincial budget, I find that we're now on track for a deficit of well over $1 billion by 2022/23, instead of the planned $1.8-billion surplus.

To make matters worse, Alberta's entire economy is slowing down.

The government was hoping the economy would grow rapidly, at 2.7 per cent this year and 2.9 per cent next.

Today, most forecasters anticipate growth to be a full one-per-cent lower.

This also hurts the budget. And while it is hard to say precisely, this may shave a few hundred million more off government revenues and increase pressure on already strained income-support programs.

Tough choices ahead

Alberta's Budget 2020 will have to make some tough new choices. None will be easy, and some may be unwise.

The government could ignore the problem and present a budget with optimistic growth and oil price targets. This would be a big gamble, and merely paper over the problem hoping it goes away on its own.

Or it could distract from the real issues and shift blame to Ottawa — a regular (and often successful) tactic of many Alberta governments. From equalization to climate policies to pipeline delays, there's no shortage of potential targets to blame an enlarged deficit on. Given the sudden and intense interest on the Teck Frontier approval and growing demands for reforms to federal transfers, the seeds may already have been planted.

But while we may see some of this, the province's commitment to balance by 2022/23 is unlikely to budge. This means further spending cuts, and (perhaps) tax increases.

To their credit, the government was providing itself a reasonable cushion in the last budget — enough that it could lose almost $1.8 billion in revenue by 2022 yet still balance on time. But today's shock, if fully priced in, will require they find roughly $1.3 billion in new cuts.

This would mean program spending would have to fall by 1.8 per cent per year over the next three years, compared to the one per cent per year the government previously planned for. This would make program spending more than 5.3-per-cent lower by 2022/23, compared to when they first took office, rather than the 2.8 per cent they were hoping for.

While there may be some low-hanging fruit — the province's "war room," which burns through $30 million per year in tax dollars on what is, to date, a sloppy public relations campaign, comes to mind — most new spending cuts won't be easy.

Alberta's real budget problem

Of course, none of this should come as a surprise. Wild swings in provincial revenue is the rule, not the exception.

The recent MacKinnon Report was clear on this. In a section entitled Alberta: We have a problem, they note "since 2000, Alberta's actual annual revenues have been roughly 10 per cent higher or lower than forecast … [which] represents $5 billion to $6 billion of revenues in any given year and underscores how volatile Alberta's revenues are."

The panel recommended that Alberta deal with its revenue problem, saying "steps need to be taken to increase stable sources of revenue and decrease the reliance on the volatile non-renewable resource revenues."

This means tax increases.

And though they didn't recommend it explicitly, the most stable and efficient source of tax revenue is a sales tax. The revenue from one could allow resource revenues to be saved, rather than spent.

That's not in the cards, of course. But other tax increases might be.

There were some hikes in Budget 2019, after all, but they were minor changes to credits and indexing rules that added only a few hundred million to revenues. There's little scope for further hidden increases in Budget 2020 — unless the government wants to be more transparent about it.

But unless we get serious about Alberta's fiscal roller-coaster and ease our reliance on resource revenues, Budget 2020 will just be another short-term reaction to the latest avoidable shock.

It will present yet another plan to balance the books. But in Alberta, such plans never last long.

This column is an opinion. For more information about our commentary section, please read this editor's blog and our FAQ.